Get the free Charity Repayment Claim - purecharity org

Show details

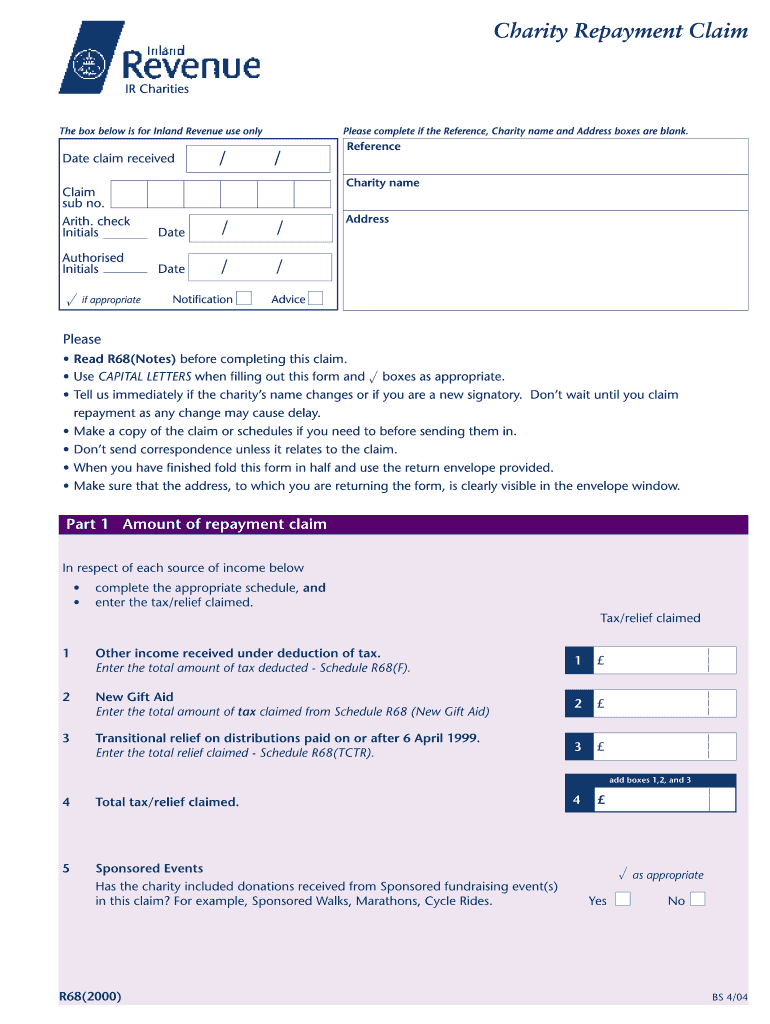

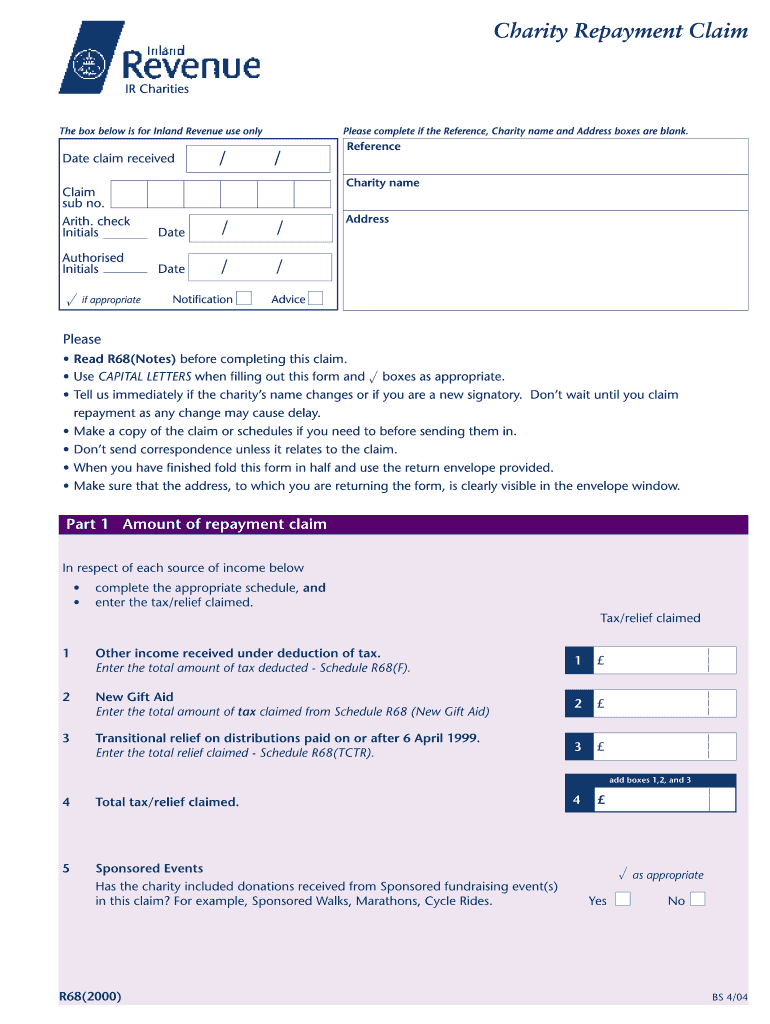

This document is intended for charities to claim tax repayments from the Inland Revenue, detailing the amounts claimed and the associated charity information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charity repayment claim

Edit your charity repayment claim form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charity repayment claim form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing charity repayment claim online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit charity repayment claim. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charity repayment claim

How to fill out Charity Repayment Claim

01

Gather all necessary documentation such as receipts and proof of donations.

02

Visit the official charity or government website to access the Charity Repayment Claim form.

03

Fill out personal information such as your name, address, and contact details.

04

Enter the details of the charity, including the charity's name and registration number.

05

List the amount donated, including individual donation details if applicable.

06

Attach supporting documents, including receipts or confirmation of your donations.

07

Review the completed form for accuracy and completeness.

08

Submit the form either online or via mail as instructed by the charity or governing body.

Who needs Charity Repayment Claim?

01

Individuals or businesses that have made charitable donations and wish to reclaim tax credits.

02

Registered charities that are handling claims on behalf of their donors.

03

Non-profit organizations that want to encourage donors to reclaim their donations.

Fill

form

: Try Risk Free

People Also Ask about

How do you claim charity on your taxes?

To claim charitable donations, you'll need to itemize your deductions on your tax return instead of taking the standard deduction. List your total itemized deductions, including charitable contributions. If that amount exceeds the standard deduction amount for your filing status, you should itemize.

Is it worth claiming charitable donations?

Donating is worth the dollar amount times your marginal tax rate (current bracket for the next dollar) IF, and only IF, you itemize deductions. Most Americans don't, because the standard deduction is far higher.

What proof of charitable donations are needed for IRS?

The record must show the name of the charity and the date and amount of the contribution. Bank records include canceled checks, and bank, credit union and credit card statements. Bank or credit union statements should show the name of the charity, the date, and the amount paid.

Can I ask for money back from a charity?

However, once you give a legal gift to a charity, it's theirs and you don't have a legal right to get it back. Often organizations will return a donation if asked, but they are not required to unless there's some unusual legal reason.

How much do Brits give to charity?

The British public donated a record £13.9bn to charity in 2023, with people in some of the country's least affluent areas among the most generous, a report reveals. The total marks a 9% increase on the 2022 figure – which stood at £12.7bn – as average monthly donations increased by nearly 40% to reach £65.

How do I deduct charity from my taxes?

As mentioned above, to claim a charitable donation, you need to itemize your deductions using Form 1040, Schedule A as part of your tax preparation. Schedule A reports your itemized deductions, including charitable contributions. Fill out this form carefully to ensure accurate information about your donations.

Can you take money back from charity?

Under charity law, charities are not permitted to refund donations, other than in exceptional circumstances. For more information please see the Charities Act 2011. We will consider a refund of any duplicate donations (but not the original donation) made in error.

Do I get money back from taxes if I donate to charity?

You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Charity Repayment Claim?

A Charity Repayment Claim is a request made by charities to reclaim overpaid taxes or eligible tax refunds from the government, often related to donations received.

Who is required to file Charity Repayment Claim?

Charities and not-for-profit organizations that have paid taxes in excess and are eligible for tax refunds are required to file Charity Repayment Claims.

How to fill out Charity Repayment Claim?

To fill out a Charity Repayment Claim, charities must complete the appropriate form, provide required documentation, and ensure accurate tax information is reported, usually through the relevant tax authority's guidelines.

What is the purpose of Charity Repayment Claim?

The purpose of a Charity Repayment Claim is to allow charities to recover excess tax payments, thereby providing them with additional funds to further their charitable activities.

What information must be reported on Charity Repayment Claim?

Information that must be reported includes the charity's legal name, tax identification number, details of the overpaid taxes, and any supporting documentation necessary to substantiate the claim.

Fill out your charity repayment claim online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charity Repayment Claim is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.