Get the free DEFAULT AND FORECLOSURE REPORT

Show details

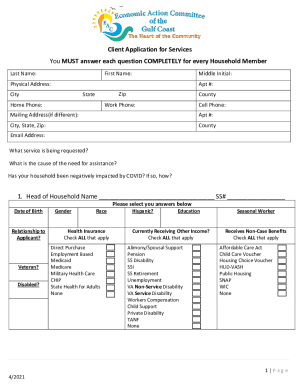

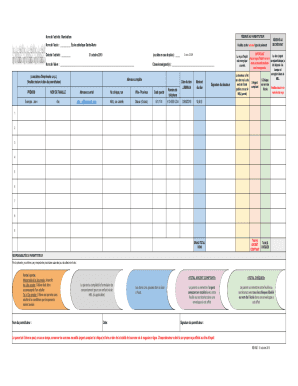

This report is used by institutions to disclose information related to conventional 1-4 family mortgage loans, defaults, and foreclosures for the period ending December 31, 2004, as required by the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign default and foreclosure report

Edit your default and foreclosure report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your default and foreclosure report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit default and foreclosure report online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit default and foreclosure report. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out default and foreclosure report

How to fill out DEFAULT AND FORECLOSURE REPORT

01

Gather necessary financial documents related to the mortgage, including loan agreements and payment history.

02

Access the DEFAULT AND FORECLOSURE REPORT form, which can typically be found on the appropriate government or financial institution's website.

03

Fill in the property details, such as address, owner's name, and loan number.

04

Provide accurate information on missed payments, including dates and amounts.

05

Detail any communication with the lender regarding the default situation.

06

Include supporting documentation, such as notices from the lender and proof of income.

07

Review the completed report for accuracy and completeness.

08

Submit the report according to the specified instructions, ensuring all required attachments are included.

Who needs DEFAULT AND FORECLOSURE REPORT?

01

Individuals who are facing financial difficulties and at risk of foreclosure.

02

Lenders and financial institutions to assess the status of loans in default.

03

Real estate professionals to understand the market impact of foreclosures.

04

Government agencies responsible for monitoring housing and foreclosure trends.

05

Investors interested in purchasing properties in distress situations.

Fill

form

: Try Risk Free

People Also Ask about

What comes after a notice of default?

If you pay the amount on the Notice of Default, the lender cannot sell your home. Notice of Trustee Sale – If you don't pay within 90 days, a Notice of Trustee Sale will be recorded against your property. This Notice tells you the date, time, and place your home will be sold.

What happens if you get a default letter?

After a default judgment, the Plaintiff will try to collect the money you owe. The Plaintiff may be able to take money from your paycheck or bank account and put a lien on your property. If you don't have any assets to pay the debt, you can let the Plaintiff. They may give up or try to collect in the future.

What are the stages of foreclosure?

Foreclosure is a legal proceeding that occurs when a borrower misses a certain number of payments. The lender moves forward with taking ownership of a home to recoup the money lent. Foreclosure has six typical phases: payment default, notice of default, notice of trustee's sale, trustee's sale, REO, and eviction.

Does default mean foreclosure?

A Notice of Default is your mortgage lender's way of telling you that you have one last chance to address overdue mortgage payments before your lender will foreclose on your home.

What does default mean in foreclosure?

The Notice of Default tells you the total amount you owe including missed payments and foreclosure fees. A declaration must be attached to the notice stating the lender has spoken to you or tried to reach you to discuss your situation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is DEFAULT AND FORECLOSURE REPORT?

The DEFAULT AND FORECLOSURE REPORT is a document that provides information about properties that are in default or have undergone foreclosure. It typically outlines details such as the status of the loan, the reasons for default, and ownership changes.

Who is required to file DEFAULT AND FORECLOSURE REPORT?

Lenders, mortgage servicers, and financial institutions managing loans that are in default or have gone through foreclosure are typically required to file the DEFAULT AND FORECLOSURE REPORT.

How to fill out DEFAULT AND FORECLOSURE REPORT?

To fill out the DEFAULT AND FORECLOSURE REPORT, one must provide accurate details about the loan, property, borrower, default status, and any relevant legal proceedings, following the guidelines laid out by regulatory bodies.

What is the purpose of DEFAULT AND FORECLOSURE REPORT?

The purpose of the DEFAULT AND FORECLOSURE REPORT is to ensure transparency in the mortgage lending process, facilitate the tracking of defaults and foreclosures, and assist regulatory authorities in monitoring the financial health of the housing market.

What information must be reported on DEFAULT AND FORECLOSURE REPORT?

Information that must be reported includes the property address, borrower's details, loan amount, current status of the loan, the date of default, foreclosure proceedings, and any loss mitigation efforts taken.

Fill out your default and foreclosure report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Default And Foreclosure Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.