Get the free Form 10-5 - communities qld gov

Show details

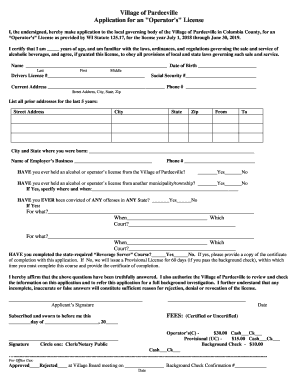

This document is for individuals seeking to have a negative notice or negative exemption notice cancelled under the Disability Services Act 2006, allowing them to apply for a positive notice or positive

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 10-5 - communities

Edit your form 10-5 - communities form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 10-5 - communities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 10-5 - communities online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 10-5 - communities. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 10-5 - communities

How to fill out Form 10-5

01

Obtain Form 10-5 from the relevant agency or official website.

02

Read the instructions provided with the form carefully.

03

Fill out your personal information in the designated fields, including your name, address, and contact details.

04

Provide any required identification information as specified in the form.

05

Complete additional sections pertaining to the purpose of the form, if applicable.

06

Review your entries for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the completed form as instructed, either by mail or electronically.

Who needs Form 10-5?

01

Individuals applying for benefits or services that require this specific form.

02

Organizations or entities needing to report information as defined by the governing body using Form 10-5.

Fill

form

: Try Risk Free

People Also Ask about

Does a 1095-A affect my tax refund?

Yes. In some cases, the information on the corrected Form 1095-A may be in your favor – it may decrease the amount of taxes you owe or increase your refund. Taxpayers have the option of filing an amended return if they choose.

What is the difference between Form 10 and S 1?

Typically, companies choose an S-1 filing when the overall goal is to raise capital and expand operations through taking a company public. Form 10 is used by companies at all stages of business development, not just the startup phase.

Do I need to file a 1095 form with my taxes?

Should I attach Form 1095-A, 1095-B or 1095-C to my tax return? No. Although you may use the information on the forms to help complete your tax return, these forms should not be attached to your return or sent to the IRS. The issuers of the forms are required to send the information to the IRS separately.

Is 1095 needed to file taxes?

However, it is not necessary to wait for Forms 1095-B or 1095-C in order to file. Some taxpayers may not receive a Form 1095-B or Form 1095-C by the time they are ready to file their tax return. While the information on these forms may assist in preparing a return, they are not required.

Is 1095 reporting still required?

The Paperwork Burden Reduction Act (H.R. 3797) (“PBRA”), passed by the 118th Congress on December 11, 2024, aims to ease the strain of this requirement by providing the following: Employers are no longer required to send employees a Form 1095-B or 1095-C, unless the employee requests a copy of the applicable form.

What happens if I don't put my 1095 on my taxes?

Form 1095-B is not required to file your state or federal taxes and you may self‑attest to your health coverage without it. You should get a Form 1095-B in the mail by January 31 following the reported tax year.

What is Form 1095-A used for?

The Form 1095-A will tell you the dates of coverage, total amount of the monthly premiums for your insurance plan, the second lowest cost silver plan premium that you may use to determine the amount of your premium tax credit, and amounts of advance payments of the premium tax credit.

What is the purpose of Form 10?

SEC Form 10, or the General Form for Registration of Securities, is a required regulatory filing for an entity that wishes to sell or issue securities. Form 10 is intended to provide disclosure of all relevant material information for an investor to make an investment decision.

What does Form 10 mean?

The new form 10 IEA can be used to indicate the preference for the old tax regime by Individuals, HUF, AOP (other than co-operative societies), BOI & Artificial Judicial Persons (AJP) having income from business and profession.

What is in a Form 10?

SEC Form 10, or the General Form for Registration of Securities, is a required regulatory filing for an entity that wishes to sell or issue securities. Form 10 is intended to provide disclosure of all relevant material information for an investor to make an investment decision.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 10-5?

Form 10-5 is a regulatory document used by certain organizations or entities to report specific information to government authorities, typically concerning operational compliance and updates.

Who is required to file Form 10-5?

Entities subject to regulatory oversight, such as corporations, partnerships, or other organizations in specific industries, are required to file Form 10-5.

How to fill out Form 10-5?

To fill out Form 10-5, individuals should gather all necessary data, complete each section thoughtfully, ensure accuracy, and submit the form through the designated channels as specified by the governing body.

What is the purpose of Form 10-5?

The purpose of Form 10-5 is to collect essential information necessary for regulatory compliance, ensuring transparency and accountability among organizations operating within a regulatory framework.

What information must be reported on Form 10-5?

Information reported on Form 10-5 typically includes organizational details, financial data, operational updates, compliance information, and any other specifics required by the regulatory authority.

Fill out your form 10-5 - communities online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 10-5 - Communities is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.