Get the free 2008 Reciprocity Guidelines with App - abohn

Show details

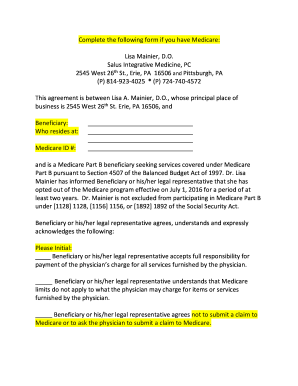

This document provides guidelines for occupational health nurses seeking board certification by reciprocity from the American Board for Occupational Health Nurses (ABOHN), detailing eligibility requirements,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2008 reciprocity guidelines with

Edit your 2008 reciprocity guidelines with form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2008 reciprocity guidelines with form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2008 reciprocity guidelines with online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2008 reciprocity guidelines with. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2008 reciprocity guidelines with

How to fill out 2008 Reciprocity Guidelines with App

01

Begin by reading the 2008 Reciprocity Guidelines thoroughly to understand the requirements.

02

Gather all necessary documentation that supports your application.

03

Open the application form provided by the relevant authority.

04

Fill out your personal information accurately, including name, contact details, and any identification numbers required.

05

Follow the guidelines step-by-step, providing all requested information regarding reciprocity.

06

Attach any required supporting documents, such as proof of previous mutual agreements.

07

Review your application for completeness and accuracy before submission.

08

Submit your application through the designated method (online, by mail, etc.) as instructed.

Who needs 2008 Reciprocity Guidelines with App?

01

Individuals or organizations seeking recognition or acceptance in a different state or region based on prior mutual agreements.

02

Professionals in regulated fields who need to establish qualifications for practice in a new jurisdiction.

03

Anyone looking to facilitate interstate or international transactions that involve mutual recognition of credentials.

Fill

form

: Try Risk Free

People Also Ask about

How does reciprocity work between states?

For states with reciprocity agreements, workers only pay taxes in the state where they live, not the state where they perform the work. For example, a person who lives in Arizona but works in California wouldn't have to pay state taxes in California because the two states have a tax reciprocity agreement.

What is a reciprocity agreement in the US?

Under a reciprocal agreement, employees only pay income taxes to their home state (i.e., the state where they live), and are exempt from income taxes in their work state. Without a reciprocal agreement, an employee pays income tax to their work state but must file a tax return in both.

What does reciprocity mean for visas?

These fees are based on the principle of reciprocity: when a foreign government imposes fees on U.S. citizens for certain types of visas, the United States will impose a reciprocal fee on citizens of that country*/area of authority for similar types of visas.

How much is the reciprocity fee for Chile?

Effective immediately, US citizens are no longer required to pay the $160 reciprocity fee upon entering Chile through any border. US citizens can enter Chile for up to 90 days on a tourist visa with a valid passport.

What is the visa reciprocity schedule?

The U.S. Department of State uses the reciprocity schedule to advise people on obtaining supporting documents for their green card or U.S. visa applications. It shows whether a document is available, where and how much it costs to get an official copy, and other details based on the country that issued the document.

What is reciprocity in the United States?

State reciprocity agreements refer to pacts between two or more states that allow employees who live in one state and work in one of the others to only pay state income tax in their home state.

What states have reciprocity for?

States with Reciprocal Tax Agreements and No State Taxes. Wisconsin, Michigan, Pennsylvania, Kentucky, and Ohio. Pennsylvania, Indiana, West Virginia, Kentucky, and Michigan. Virginia, Kentucky, Pennsylvania, Ohio, and Maryland. Oregon, California, Virginia, and Indiana.

What does it mean to be eligible for reciprocity?

Reciprocity is an agreement among certain California public retirement systems allowing members to move from one public employer to another. The move must be made within six months of leaving one agency to another participating reciprocal agency. This allows for some portability of retirement benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2008 Reciprocity Guidelines with App?

The 2008 Reciprocity Guidelines with App refers to a set of regulations and procedures established in 2008 that outline how states interact in terms of tax reciprocity, specifically regarding the reporting and application process for individuals working in states other than their residence.

Who is required to file 2008 Reciprocity Guidelines with App?

Individuals who earn income in a state other than their residence and wish to claim tax reciprocity benefits are generally required to file the 2008 Reciprocity Guidelines with App. This often includes employees who work across state lines.

How to fill out 2008 Reciprocity Guidelines with App?

To fill out the 2008 Reciprocity Guidelines with App, individuals should accurately complete the application form by providing personal information, including residency details, income sources, and any relevant tax identification numbers. Additionally, they should ensure they adhere to the specific instructions provided with the form.

What is the purpose of 2008 Reciprocity Guidelines with App?

The purpose of the 2008 Reciprocity Guidelines with App is to clarify the processes for taxpayers regarding the reciprocity of income tax between states, thereby preventing double taxation for individuals who work in a different state than where they reside.

What information must be reported on 2008 Reciprocity Guidelines with App?

The information that must be reported on the 2008 Reciprocity Guidelines with App includes the taxpayer's name, address, residency state, the state where they are working, income details, and any other pertinent financial information required for accurate processing of mutual tax agreements.

Fill out your 2008 reciprocity guidelines with online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2008 Reciprocity Guidelines With is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.