Get the free FIRST TIME HOMEBUYER’S PROGRAM – 2011/2012

Show details

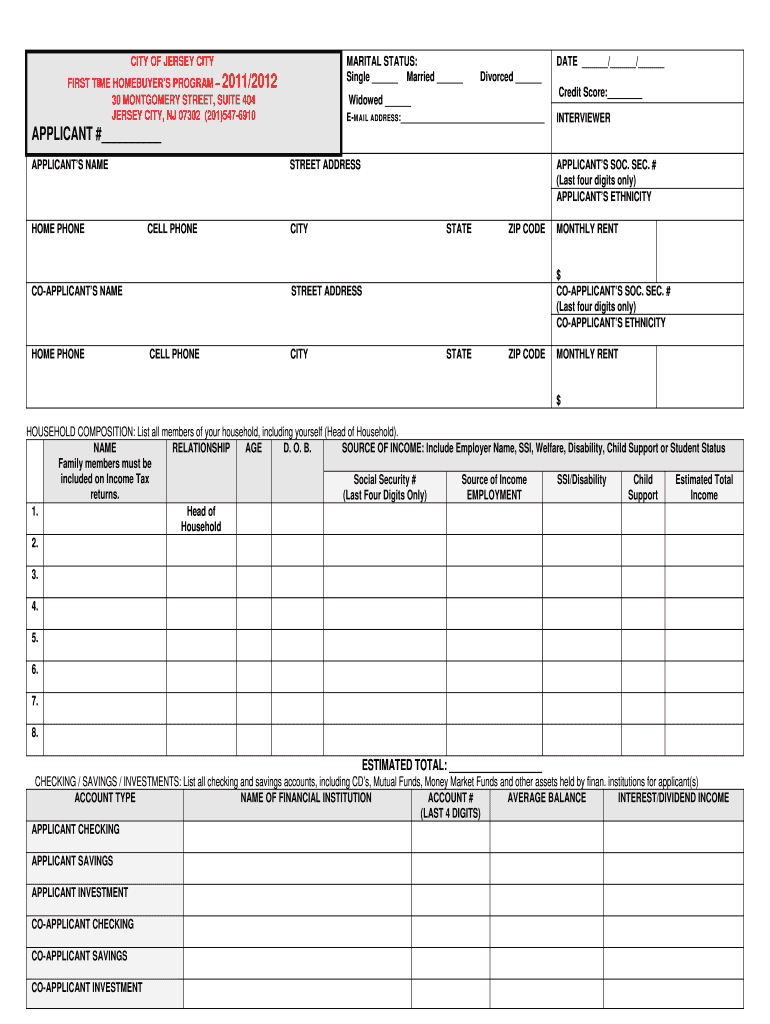

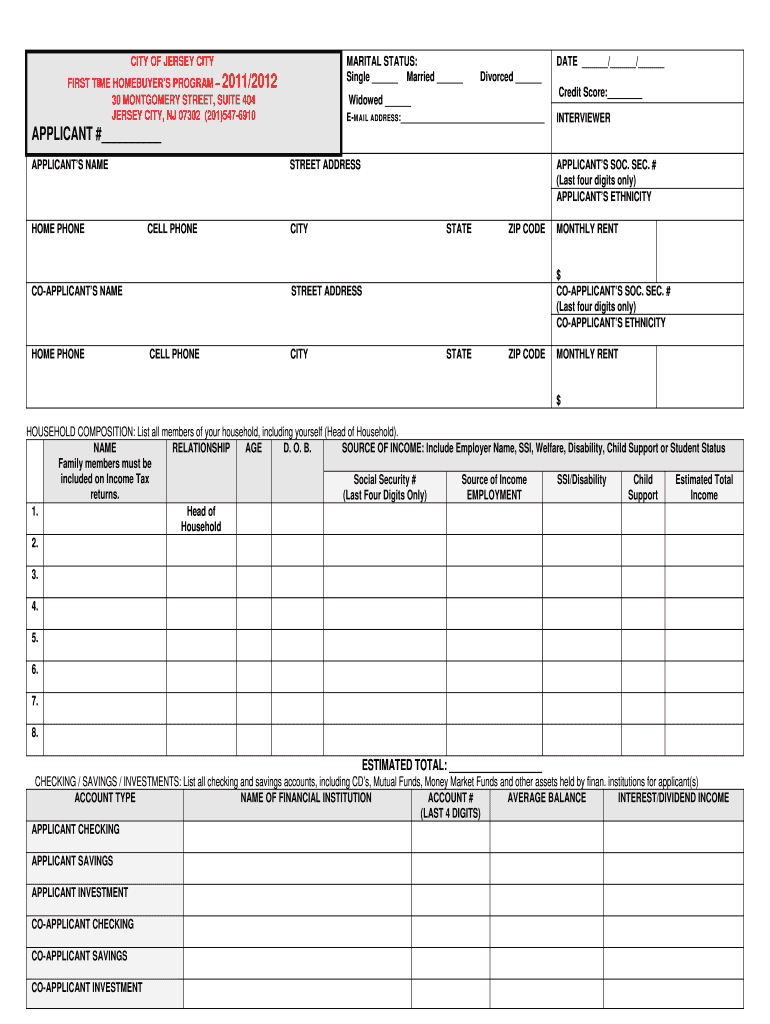

Application form for the First Time Homebuyer’s Program in Jersey City, requiring personal details, financial information, and documentation for qualification.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign first time homebuyers program

Edit your first time homebuyers program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your first time homebuyers program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing first time homebuyers program online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit first time homebuyers program. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out first time homebuyers program

How to fill out FIRST TIME HOMEBUYER’S PROGRAM – 2011/2012

01

Gather necessary documents such as proof of income, employment verification, and credit history.

02

Complete the application form with accurate personal information and financial details.

03

Review eligibility requirements to ensure compliance with the program.

04

Submit the application along with the required documents to the designated agency.

05

Await confirmation and communication about the next steps in the process.

Who needs FIRST TIME HOMEBUYER’S PROGRAM – 2011/2012?

01

Individuals or families who are purchasing their first home.

02

Prospective homebuyers who meet the income eligibility criteria.

03

People looking for financial assistance or incentives to help with down payments.

Fill

form

: Try Risk Free

People Also Ask about

What is the IRS first time home buyer program?

Tax Credit in General For first time homebuyers, there is a refundable credit equal to 10 percent of the purchase price up to a maximum of $8,000 ($4,000 if married filing separately).

Is there a first-time homebuyer credit?

Tax credits for first-time homebuyers The primary tax credit available to first-time homebuyers is the mortgage credit certificate (MCC). This federal tax credit allows you to deduct a portion of your mortgage interest each tax year. MCCs are limited to low- and moderate-income homeowners.

What happened to the first-time homebuyer credit?

The federal first-time homebuyer tax credit was an incentive program that ended in 2010. The goal of the program was to spur homebuying and help individuals during the Great Recession. The program provided a tax credit for those who were eligible. The credit needs to be repaid.

How do I qualify for first-time homebuyer tax credit in the IRS?

A first- time homebuyer is an individual who, with his or her spouse if married, has not owned any other principal residence for three years prior to the date of purchase of the new principal residence for which the credit is being claimed. š The taxpayer exceeds the income limits.

Do you have to pay back first-time homebuyer credit?

The credit is similar to a no-interest loan and must be repaid in 15 equal, annual installments that began in the 2010 income tax year. For example, if you bought a home in 2008 and claimed the maximum credit of $7,500, the repayment amount is $500 per year.

What is the $8,000 homebuyer tax credit?

The $8000 IRS Tax Credit was part of the Housing and Economic Recovery Act of 2008 and was expanded under the American Recovery and Reinvestment Act of 2009. It provided first-time home buyers with a refundable tax credit of up to $8000, helping them offset the costs associated with purchasing a home.

Did the first-time homebuyer tax credit bill pass?

Did The First-Time Homebuyer Act Pass Yet? As of March 5, 2025, Congress has not introduced the First-Time Homebuyer Tax Credit Act as a bill. A bill must be introduced before it can become law.

What is the $8,000 homebuyer tax credit?

The $8000 IRS Tax Credit was part of the Housing and Economic Recovery Act of 2008 and was expanded under the American Recovery and Reinvestment Act of 2009. It provided first-time home buyers with a refundable tax credit of up to $8000, helping them offset the costs associated with purchasing a home.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FIRST TIME HOMEBUYER’S PROGRAM – 2011/2012?

The FIRST TIME HOMEBUYER’S PROGRAM – 2011/2012 is a government initiative designed to assist first-time homebuyers with incentives such as tax credits, down payment assistance, or favorable loan terms to encourage homeownership.

Who is required to file FIRST TIME HOMEBUYER’S PROGRAM – 2011/2012?

First-time homebuyers who are claiming benefits under the program and who meet the specific eligibility criteria set by the government are required to file for the FIRST TIME HOMEBUYER’S PROGRAM – 2011/2012.

How to fill out FIRST TIME HOMEBUYER’S PROGRAM – 2011/2012?

To fill out the FIRST TIME HOMEBUYER’S PROGRAM – 2011/2012, individuals need to complete the designated application form, providing details such as personal information, home purchase details, and any supporting documentation requested by the program.

What is the purpose of FIRST TIME HOMEBUYER’S PROGRAM – 2011/2012?

The purpose of the FIRST TIME HOMEBUYER’S PROGRAM – 2011/2012 is to promote homeownership among first-time buyers, making it more affordable for them to purchase a home and stimulate the housing market.

What information must be reported on FIRST TIME HOMEBUYER’S PROGRAM – 2011/2012?

Information that must be reported includes buyer's personal details, property address, purchase price, mortgage information, and any prior homeownership history to verify eligibility for the program.

Fill out your first time homebuyers program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

First Time Homebuyers Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.