Get the free TDS Certificate for Non-Salary Income

Show details

The extant rules provide an option to persons withholding tax deductors to issue TDS certificate with digital signature only for TDS from salary income in Form 16. CBDT permits issue of TDS certificate for non-salary Form 16A income with digital signature CBDT has recently vide Circular No* 3/2011 F*No* 275/34/2011-IT B Circular dated 13 May 2011 permitted issue of certificate for tax deducted at source TDS certificate Form 16A. Nonsalary TDS certificates in Form 16A are required to be issued...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tds certificate for non-salary

Edit your tds certificate for non-salary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tds certificate for non-salary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tds certificate for non-salary online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tds certificate for non-salary. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tds certificate for non-salary

How to fill out TDS Certificate for Non-Salary Income

01

Start by collecting the necessary information, including the TAN of the deductor and the PAN of the deductee.

02

Choose the appropriate form for TDS Certificate based on the type of payment (such as form 16A for non-salary income).

03

Fill in the deductor's details, including name, address, and TAN.

04

Enter the deductee's details, including name, address, and PAN.

05

Specify the relevant assessment year for which the TDS is being deducted.

06

Enter the details of the payment, including the amount paid, TDS deducted, and the nature of income.

07

Sign and date the certificate to authenticate it before issuing it to the deductee.

08

Provide a copy of the TDS certificate to the deductee.

09

Maintain records for your own reference.

Who needs TDS Certificate for Non-Salary Income?

01

Individuals or entities receiving non-salary income who have had TDS deducted.

02

Freelancers, contractors, and professionals who earn income apart from their regular employment.

03

Businesses that pay out certain types of income like rent, professional fees, or commission.

Fill

form

: Try Risk Free

People Also Ask about

How is TDS calculated for income tax?

Step 3: Divide your payable income tax by the number of months of employment to calculate the monthly TDS amount. For example, if your estimated total taxable income for the current financial year is ₹10,00,000 and you are employed for 12 months, your monthly TDS amount would be ₹10,00,000 X 30% / 12 = ₹25,000.

How to file non-salary TDS return?

Form 26Q - TDS on Non Salary Deductions. During the time of payment to the payee, the payer needs to deduct TDS on particular occasions. This payment is other than the payment of the salary, and the payer needs to file TDS return Form 26Q. Form 26Q needs to be submitted on a quarterly base.

How can I get TDS certificate?

The deductor must log into the TDS Reconciliation Analysis and Correction Enabling System (TRACES) by clicking here. Here, they have to go to the 'downloads' tab. Next, they can select the Form the deductor wishes to download (Form 16/16A).

What is the TDS for income tax?

TDS - Tax Deducted at Source. TDS full form stands for Tax Deducted at Source. It is the tax amount deducted by the employer from the taxpayer which is deposited to the IT Department on behalf of the taxpayer. It is a certain percentage of one's monthly income which is taxed from the point of payment.

How to write a TDS declaration?

I, (state the name of the person signing the declaration), _ (state the designation of the person signing this declaration, like a Director, Partner, Sole Proprietor, Authorized Signatory, etc), acting for and on behalf of __ (state the complete name of the

Do I get a TDS refund?

In case your taxable income is below basic exemption limit, you can avoid TDS deduction from your salary. If the actual tax payable is less than the TDS, you must file Income Tax Return (ITR) to claim TDS refund. While filing the ITR online, you need to provide the details of a bank account and IFSC code.

What is TDS in income tax?

TDS full form stands for Tax Deducted at Source. It is the tax amount deducted by the employer from the taxpayer which is deposited to the IT Department on behalf of the taxpayer. It is a certain percentage of one's monthly income which is taxed from the point of payment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TDS Certificate for Non-Salary Income?

A TDS Certificate for Non-Salary Income is a document issued by deductors to beneficiaries, indicating the amount of tax deducted at source (TDS) on non-salary payments. This certificate serves as proof of the tax that has been withheld and is generated in accordance with the Income Tax Act.

Who is required to file TDS Certificate for Non-Salary Income?

Any individual or entity that deducts TDS on non-salary payments, such as interest, rent, or professional fees, is required to file the TDS Certificate for Non-Salary Income. This usually includes businesses, companies, and institutions that make such payments.

How to fill out TDS Certificate for Non-Salary Income?

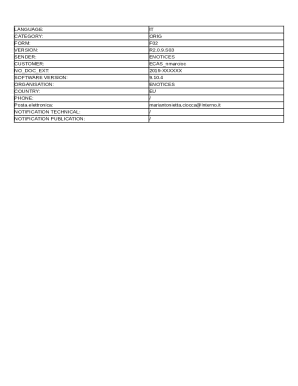

To fill out a TDS Certificate for Non-Salary Income, one must include details such as the deductor's name and TAN (Tax Deduction Account Number), the payee's name and PAN (Permanent Account Number), the amount paid, the TDS amount deducted, and the relevant assessment year. The form must comply with the prescribed format as specified by the Income Tax Department.

What is the purpose of TDS Certificate for Non-Salary Income?

The purpose of the TDS Certificate for Non-Salary Income is to provide documentation of taxes deducted at source from non-salary payments. It ensures transparency in tax deductions and serves as evidence for the payee to claim credit for the deducted TDS against their total tax liability.

What information must be reported on TDS Certificate for Non-Salary Income?

The TDS Certificate for Non-Salary Income must report the following information: the deductor's name, TAN, the payee's name, PAN, the amount paid to the payee, the TDS amount deducted, the nature of the payment, the assessment year, and the date of deduction.

Fill out your tds certificate for non-salary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tds Certificate For Non-Salary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.