Get the free Petition to the Clallam County Board of Equalization - clallam

Show details

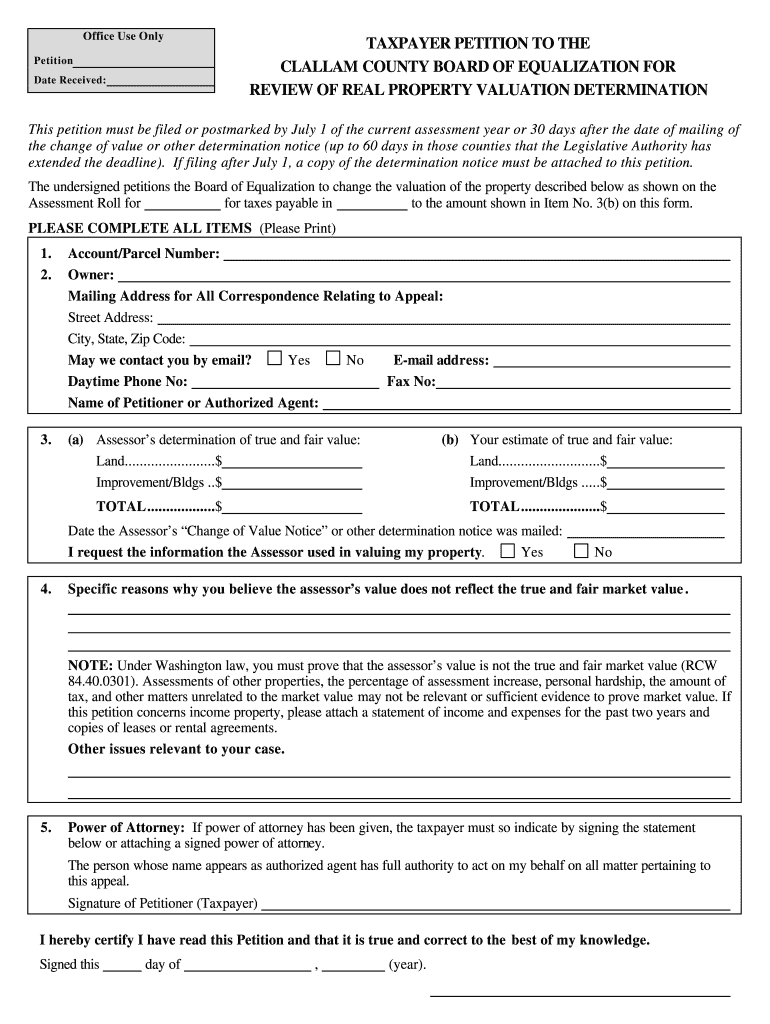

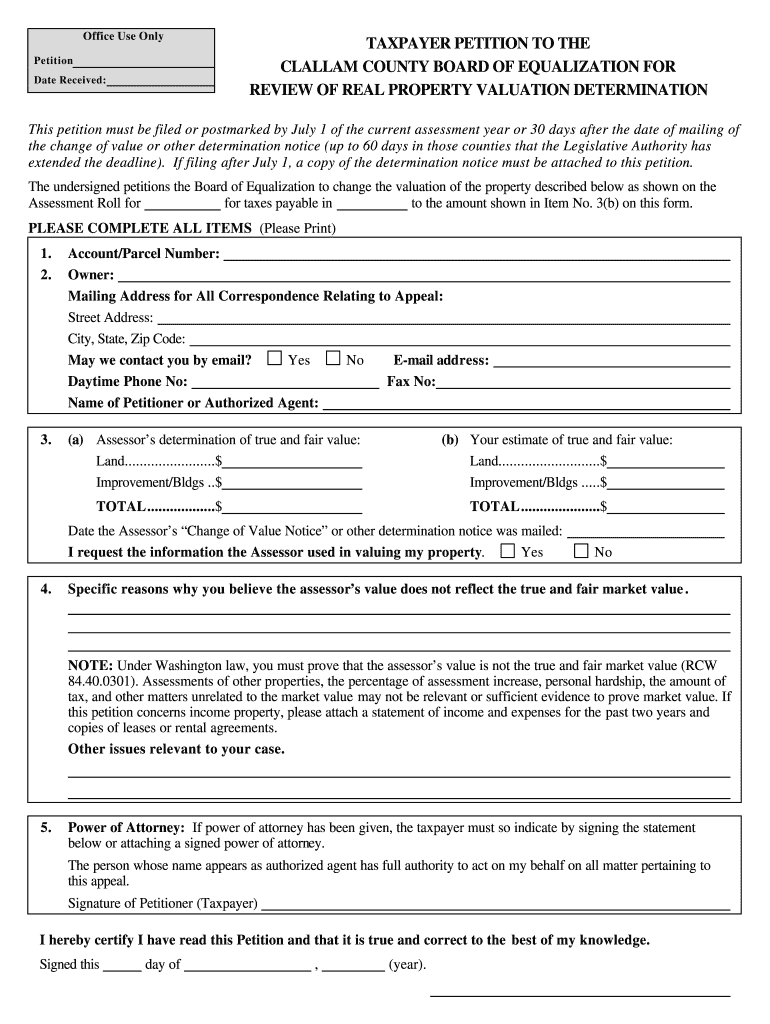

This document serves as a formal petition for taxpayers seeking a review of the assessed valuation of their property by the Clallam County Board of Equalization.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign petition to form clallam

Edit your petition to form clallam form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your petition to form clallam form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit petition to form clallam online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit petition to form clallam. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out petition to form clallam

How to fill out Petition to the Clallam County Board of Equalization

01

Obtain the Petition form from the Clallam County Board of Equalization website or office.

02

Clearly identify the property in question by providing the parcel number and address.

03

Fill out the property owner's information, including name, address, and contact information.

04

State the reason for contesting the property assessment in detail, including supporting evidence if applicable.

05

Include any relevant documentation such as property tax statements or appraisal reports.

06

Review the completed form for accuracy and completeness.

07

Sign and date the petition.

08

Submit the petition by the designated deadline to the Clallam County Board of Equalization via mail, email, or in person.

Who needs Petition to the Clallam County Board of Equalization?

01

Property owners in Clallam County who disagree with their property tax assessment.

02

Individuals seeking a reduction in assessed property values for tax purposes.

03

Anyone who feels their property has been unfairly assessed based on market conditions or property characteristics.

Fill

form

: Try Risk Free

People Also Ask about

What does it mean if your property assessment goes up?

The change could be due to a complete revaluation of an assessment unit, adjustments for certain types of residences due to trends in the market, or additions/deletions of buildings.

What is the equalization process in real estate?

How are equalization rates used? At tax time, officials use the equalization rate to adjust property values so that all properties within a district are at market value. This ensures that all taxpayers within all municipalities pay the same tax rate based on the full value (not the assessed value) of their properties.

What does a county equalization department do?

The Equalization Department's main purpose is to correct the inequities that may occur between the local units of government as a result of under or over-assessment of a property class.

What does the County Board of Equalization do?

The BOE has a critical role in California's property tax system. The BOE is responsible for assessing property owned or used by railroads and privately-held public utilities and for ensuring statewide uniformity in the assessment of properties by the 58 County Assessors.

What does the County Board of Equalization do?

The BOE has a critical role in California's property tax system. The BOE is responsible for assessing property owned or used by railroads and privately-held public utilities and for ensuring statewide uniformity in the assessment of properties by the 58 County Assessors.

What is the purpose of equalization?

The equalization process sets the property tax base for the county and helps to ensure that property taxes are levied in a fair and equitable manner.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Petition to the Clallam County Board of Equalization?

The Petition to the Clallam County Board of Equalization is a formal request submitted by property owners to contest the assessed value of their property as determined by the county assessor.

Who is required to file Petition to the Clallam County Board of Equalization?

Property owners who believe that their property has been inaccurately assessed or valued by the county assessor are required to file a Petition to the Clallam County Board of Equalization.

How to fill out Petition to the Clallam County Board of Equalization?

To fill out the Petition to the Clallam County Board of Equalization, property owners must provide their name, property address, the assessed value they are contesting, the value they believe is correct, and any supporting evidence or documentation that justifies their claim.

What is the purpose of Petition to the Clallam County Board of Equalization?

The purpose of the Petition to the Clallam County Board of Equalization is to allow property owners an avenue to appeal and challenge the assessed value of their property, ensuring fair taxation based on accurate valuations.

What information must be reported on Petition to the Clallam County Board of Equalization?

The Petition must include the property owner's name, contact information, property address, current assessed value, proposed value, reasons for the appeal, and any evidence or documentation supporting the requested change.

Fill out your petition to form clallam online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Petition To Form Clallam is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.