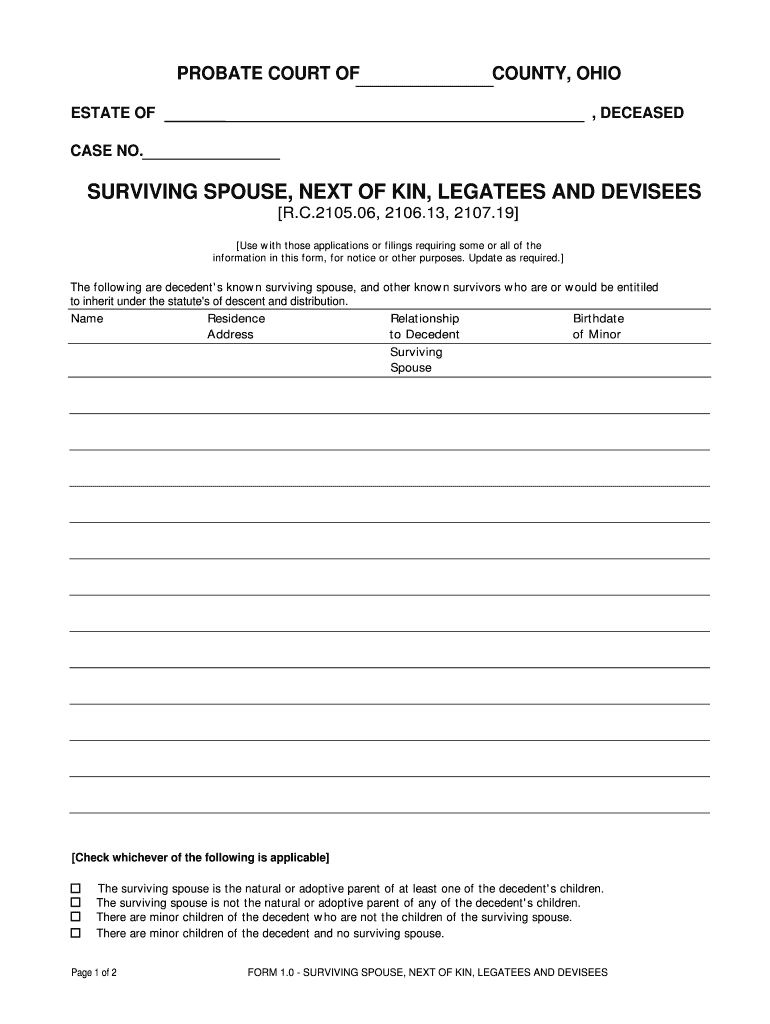

Get the free FORM 1.0 - SURVIVING SPOUSE, NEXT OF KIN, LEGATEES AND DEVISEES

Show details

This form is used to provide information about the decedent's known surviving spouse, next of kin, legatees, and devisees for probate court purposes following the death of an individual.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 10 - surviving

Edit your form 10 - surviving form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 10 - surviving form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 10 - surviving online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 10 - surviving. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 10 - surviving

How to fill out FORM 1.0 - SURVIVING SPOUSE, NEXT OF KIN, LEGATEES AND DEVISEES

01

Begin by downloading the FORM 1.0 - SURVIVING SPOUSE, NEXT OF KIN, LEGATEES AND DEVISEES template from the official website or procuring a hard copy.

02

Fill in your personal information in the designated sections, including your name, address, and contact details.

03

Clearly identify the deceased individual for whom the form is being submitted. Include their full name, date of birth, and date of death.

04

Specify your relationship to the deceased, indicating whether you are the surviving spouse, next of kin, legatee, or devisee.

05

If applicable, provide details of other beneficiaries or legal heirs, including their names and relationships to the deceased.

06

Sign and date the form at the bottom to affirm the information provided is accurate.

07

Review the form for completeness and any required attachments, such as death certificates or proof of relationship.

08

Submit the completed form to the appropriate authority or institution as instructed.

Who needs FORM 1.0 - SURVIVING SPOUSE, NEXT OF KIN, LEGATEES AND DEVISEES?

01

Individuals who are the surviving spouse, next of kin, legatees, or devisees of a deceased person require FORM 1.0 to claim their rights to inheritances or manage estate affairs.

02

Legal representatives or executors managing the estate of the deceased may also need this form to facilitate the distribution of assets.

Fill

form

: Try Risk Free

People Also Ask about

How to legally prove next of kin?

There is no form. Find his birth certificate and/or his death certificate. You can be stated on that death certificate as his next of kin.

What is surviving spouse payment?

Surviving spouse, age 60 or older, but younger than full retirement age, gets between 71% and 99% of the worker's basic benefit amount. • Surviving spouse, any age, with a child younger than age 16, gets 75% of the worker's benefit amount. • Child gets 75% of the worker's benefit amount.

What rights does a wife have after her husband dies?

Upon the death of a spouse, the surviving spouse is entitled to retain their half of the community property. The deceased spouse's half is typically distributed ing to their will or, if there is no will, ing to California's intestate succession laws.

Do I have to pay my husband's medical bills after he dies in Ohio?

If the spouse refuses to pay the outstanding bill, the nursing home or other medical provider may file a lawsuit against the surviving spouse. Although Ohio law requires spouses to provide for each other, there is no further familial duty.

How does probate find the next of kin?

Typically a surviving spouse or child is considered next of kin. If your loved one died without a will, a probate court judge will use state law to determine next of kin, and all other heirs who stand to inherit a part of the estate.

What is a surviving spouse entitled to in Ohio?

3) The “statutory share”. This generally allows the surviving spouse to keep one-half (1/2) of the net estate. However, if two (2) two or more of the deceased spouse's children (or their lineal descendants) survive the deceased spouse, then the surviving spouse would receive one-third (1/3) of the net estate.

What is the surviving spouse allowance in Ohio?

Regardless of the choices detailed directly above, Ohio law dictates that $40,000.00 is set aside from the assets of an estate if the deceased died leaving a surviving spouse and/or minor children. This is commonly known as a “spousal allowance” or “family allowance”, and is considered a priority claim.

How is the next of kin determined in Ohio?

When determining the next of kin, generally the probate court is going to look to the person's nearest relative or relatives. Not all kin or relatives of a decedent are “next of kin.” Rather, the relatives nearest to the decedent are next of kin.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FORM 1.0 - SURVIVING SPOUSE, NEXT OF KIN, LEGATEES AND DEVISEES?

FORM 1.0 - SURVIVING SPOUSE, NEXT OF KIN, LEGATEES AND DEVISEES is a legal document used to designate individuals who are entitled to inherit or receive assets from a deceased person's estate.

Who is required to file FORM 1.0 - SURVIVING SPOUSE, NEXT OF KIN, LEGATEES AND DEVISEES?

The personal representative of the deceased's estate, typically the executor or administrator, is required to file FORM 1.0 to disclose the surviving spouse, next of kin, legatees, and devisees.

How to fill out FORM 1.0 - SURVIVING SPOUSE, NEXT OF KIN, LEGATEES AND DEVISEES?

To fill out FORM 1.0, provide the names, addresses, and relationships of all identified heirs and beneficiaries. Additionally, include the decedent's information and details pertaining to their estate.

What is the purpose of FORM 1.0 - SURVIVING SPOUSE, NEXT OF KIN, LEGATEES AND DEVISEES?

The purpose of FORM 1.0 is to officially identify the individuals entitled to inherit from the estate of the deceased, ensuring that the distribution of assets is executed according to the law.

What information must be reported on FORM 1.0 - SURVIVING SPOUSE, NEXT OF KIN, LEGATEES AND DEVISEES?

FORM 1.0 must report the decedent's name, date of death, information of the surviving spouse, all next of kin, legatees, and devisees, including their names, addresses, and the nature of their relationship to the deceased.

Fill out your form 10 - surviving online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 10 - Surviving is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.