Get the free McLennan County Clerk Recording Fee Schedule

Show details

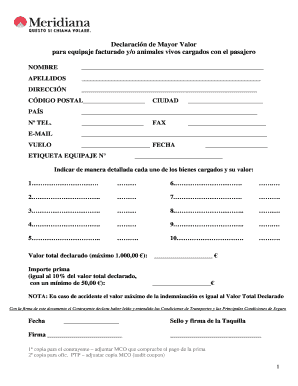

This document outlines the fees associated with various filings and services provided by the McLennan County Clerk's office, including recording fees for documents, certified copies, and specific

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mclennan county clerk recording

Edit your mclennan county clerk recording form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mclennan county clerk recording form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mclennan county clerk recording online

Follow the steps below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mclennan county clerk recording. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mclennan county clerk recording

How to fill out McLennan County Clerk Recording Fee Schedule

01

Visit the McLennan County Clerk website to download the Recording Fee Schedule.

02

Review the fee schedule to understand the different types of fees for various documents.

03

Gather all necessary documents that you wish to record.

04

Complete the required information for each document as specified in the recording fee schedule.

05

Calculate the total recording fee based on the number of documents and applicable fees outlined.

06

Prepare your payment method as specified (check, money order, etc.).

07

Submit the completed documents along with the payment to the McLennan County Clerk's office either in person or by mail.

Who needs McLennan County Clerk Recording Fee Schedule?

01

Individuals or entities looking to record legal documents, such as property deeds, liens, or other official documents.

02

Real estate agents and attorneys who are managing property transactions.

03

Business owners needing to file official documents related to their business.

04

Anyone seeking to ensure their legal documents are recognized and accessible in public records.

Fill

form

: Try Risk Free

People Also Ask about

How much is the recording fee for the McLennan County Clerk?

The McLennan County Clerk's recording fee is $16.00 for the first page and $4.00 for each additional page.

What is an UCC recording fee?

However, in general, most charge a nominal fee in the range of $10 to $25 per filing. Many states and counties assess a separate filing fee for each debtor on a filing as well. In other words, you may have one filing, but five different debtors listed on the form.

What is an UCC fee for?

This form is used by creditors, typically financial institutions, or lenders, to file an initial security interest as part of a secured transaction. The fee for this filing is $20 or $120 if Transmitting Utility or Manufactured Home is selected. The fees for UCC filings are nonrefundable.

Who will pay the required fees for recording the deed?

0:23 2:06 In most cases the buyer is responsible for paying the fees associated with recording the deed. ThisMoreIn most cases the buyer is responsible for paying the fees associated with recording the deed. This is because recording the deed is a crucial step in transferring ownership of the property from the

What is an UCC recording?

A UCC financing statement — also called a UCC-1 financing statement or a UCC-1 filing — is a legal form that allows a lender to announce a lien on an asset to secure a loan. By filing the UCC financing statement, the lender is giving notice that it has an interest in the property listed in the filing.

How much is the recording fee for the UCC?

It is $10 for the first page and $8.50/page for each additional page.

What is the county recording fee?

A recording fee is charged by a government agency to register or record the purchase or sale of real estate and ensures that the transaction becomes public.

Why would someone have an UCC filing?

A Uniform Commercial Code filing — or UCC filing — is a form of notice that lenders use when securing a borrower's loan with an asset or group of assets. This enables lenders to seize the listed property as a way of recouping loan funds in the case of borrower default.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is McLennan County Clerk Recording Fee Schedule?

The McLennan County Clerk Recording Fee Schedule outlines the fees associated with recording documents with the County Clerk's office, including various types of filings such as real estate transactions, legal documents, and other public records.

Who is required to file McLennan County Clerk Recording Fee Schedule?

Anyone who wishes to record a document with the McLennan County Clerk's office is required to complete the Recording Fee Schedule, which is typically filed by property owners, real estate agents, or legal representatives.

How to fill out McLennan County Clerk Recording Fee Schedule?

To fill out the McLennan County Clerk Recording Fee Schedule, one must provide details such as the document title, number of pages, applicable fees based on the fee structure, and any other required information as specified in the schedule.

What is the purpose of McLennan County Clerk Recording Fee Schedule?

The purpose of the McLennan County Clerk Recording Fee Schedule is to provide a standardized method for calculating fees associated with recording documents, ensuring transparency and compliance with local regulations.

What information must be reported on McLennan County Clerk Recording Fee Schedule?

The information that must be reported on the McLennan County Clerk Recording Fee Schedule includes the name and address of the filer, the type of document being recorded, the number of pages, and the corresponding fees based on the schedule.

Fill out your mclennan county clerk recording online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mclennan County Clerk Recording is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.