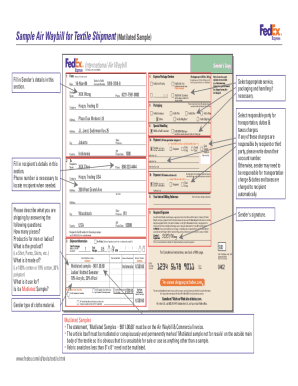

Get the free Muskegon County Exemption Certificate - co muskegon mi

Show details

This document serves as an exemption certificate for purchases made by the County of Muskegon, Michigan, certifying their status as a tax-exempt entity under Michigan law. It includes details about

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign muskegon county exemption certificate

Edit your muskegon county exemption certificate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your muskegon county exemption certificate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

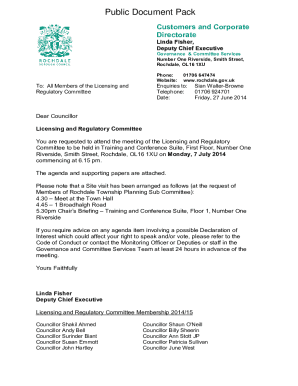

Editing muskegon county exemption certificate online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit muskegon county exemption certificate. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out muskegon county exemption certificate

How to fill out Muskegon County Exemption Certificate

01

Obtain the Muskegon County Exemption Certificate form from the appropriate government office or website.

02

Fill out your name, address, and contact information in the designated fields.

03

Indicate the reason for the exemption by selecting the appropriate category provided on the form.

04

Provide any required identifying information, such as tax identification numbers or business licenses, if applicable.

05

Attach any necessary supporting documents that validate your request for exemption.

06

Review the completed form to ensure all information is accurate and complete.

07

Sign and date the certificate where indicated.

08

Submit the completed exemption certificate to the relevant local authority by the correct method specified (mail, in-person, etc.).

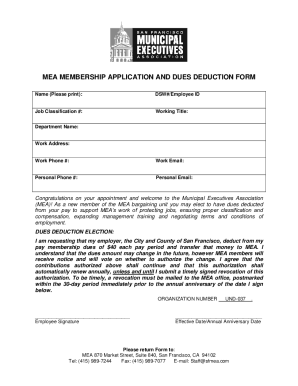

Who needs Muskegon County Exemption Certificate?

01

Individuals or businesses in Muskegon County that qualify for tax exemptions due to their specific circumstances, such as non-profit organizations, veterans, or certain residential applicants.

Fill

form

: Try Risk Free

People Also Ask about

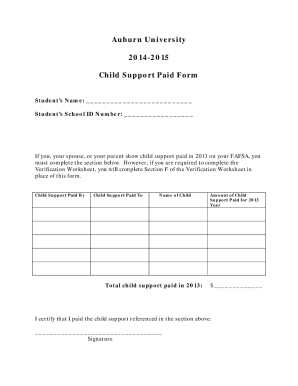

Who qualifies for property tax credit in Michigan?

Who Qualifies? You can claim a property tax credit if all the following apply: You are considered a "natural person" (owner or claimant), and not a living trust, irrevocable trust, or other legal entity, such as a S corporation or LLC, etc. Your homestead is in Michigan (whether you rent or own).

Who is usually exempt from property taxes?

A property tax exemption provides relief from property taxes for eligible individuals and groups, including religious organizations, governmental entities, seniors, veterans and homeowners with disabilities.

How do I become tax exempt in Michigan?

In order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following: Michigan Sales and Use Tax Certificate of Exemption (Form 3372) Multistate Tax Commission's Uniform Sales and Use Tax Certificate.

What is the tax exemption certificate form for Michigan?

Michigan Tax Exempt Form 3372 is a form that must be completed and submitted to the Michigan Department of Treasury in order to receive sales and use tax exemptions. This form is designed for organizations that qualify for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code.

How do I get a tax exemption certificate?

Generally, to obtain a sales tax exemption certificate, an exempt institution must first have a valid sales tax account. That account number is put on a form certificate issued by that state and the certificate can be used to purchase goods tax-free.

Who qualifies for property tax exemption in Michigan?

Property Tax Exemption An eligible person must own and occupy his/her home as a principal residence (homestead) and meet poverty income standards. The local Board of Review may interview the applicant in order to determine eligibility, ing to the local guidelines, and will review all applications.

How do I get Michigan tax-exempt status?

In order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following: Michigan Sales and Use Tax Certificate of Exemption (Form 3372) Multistate Tax Commission's Uniform Sales and Use Tax Certificate.

At what age do you stop paying property taxes in Michigan?

In Michigan, SB 292 would exempt seniors over the age of 70 from paying property taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Muskegon County Exemption Certificate?

The Muskegon County Exemption Certificate is a form that allows certain organizations or individuals to exempt themselves from paying specific local taxes under the jurisdiction of Muskegon County.

Who is required to file Muskegon County Exemption Certificate?

Organizations and individuals that qualify for tax exemptions, such as non-profits, educational institutions, and certain government entities, are required to file the Muskegon County Exemption Certificate.

How to fill out Muskegon County Exemption Certificate?

To fill out the Muskegon County Exemption Certificate, you need to provide the required information, including the name of the organization or individual, the type of exemption being claimed, and any applicable identification numbers. Complete the form accurately and submit it to the designated county office.

What is the purpose of Muskegon County Exemption Certificate?

The purpose of the Muskegon County Exemption Certificate is to formally request an exemption from specified local taxes, ensuring that qualifying parties do not incur tax liabilities that they are legally exempt from.

What information must be reported on Muskegon County Exemption Certificate?

The information that must be reported on the Muskegon County Exemption Certificate includes the name and address of the applicant, the type of entity requesting the exemption, the purpose of the exemption, and details about the specific taxes from which exemption is sought.

Fill out your muskegon county exemption certificate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Muskegon County Exemption Certificate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.