Get the free Application for Property Tax Exemption - co olmsted mn

Show details

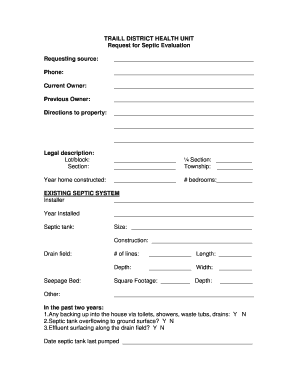

This form is used to apply for a property tax exemption for organizations qualifying under specific categories, including public charities and educational institutions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for property tax

Edit your application for property tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for property tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for property tax online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit application for property tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for property tax

How to fill out Application for Property Tax Exemption

01

Obtain the Application for Property Tax Exemption form from your local tax assessor's office or their website.

02

Carefully read the instructions provided with the application to understand eligibility requirements.

03

Fill in your personal information, including your name, address, and contact details.

04

Indicate the property for which you are seeking the tax exemption by providing its address and parcel number.

05

Specify the type of exemption you are applying for, such as veteran's exemption, senior citizen exemption, or disability exemption.

06

Attach any required documentation, such as proof of age, disability verification, or military service records.

07

Review your application for accuracy and completeness to avoid delays.

08

Sign and date the application form.

09

Submit the completed application to the appropriate tax authority by the specified deadline.

Who needs Application for Property Tax Exemption?

01

Homeowners who qualify for specific exemptions, such as veterans, senior citizens, or persons with disabilities.

02

Individuals who own property and wish to reduce their property tax burden.

03

Non-profit organizations or certain community groups that may be eligible for property tax exemptions.

Fill

form

: Try Risk Free

People Also Ask about

How do I fill out a tax exemption certificate?

The exemption certificate is properly completed and legible: Name and address of the purchaser. Description of the item to be purchased. The reason the purchase is exempt. Signature of purchaser and date; and. Name and address of the seller.

How much is the Colorado senior property tax exemption?

Often referred to as the Senior Homestead Exemption, qualifying individuals receive a 50% discount on the first $200,000 of value of the home, if they have lived in the home for 10 years.

What is the tax deduction for seniors in Colorado?

People 65 and older may deduct up to $24,000 in pension and annuity income from their taxable income. Typically, those ages 55 to 64 may deduct up to $20,000. The Colorado Department of Revenue has more information. Railroad retirement benefits are exempt, and military retired pay is partially exempt.

At what age do seniors stop paying property taxes in TN?

Be 65 years of age or older by the end of the year in which the application is filed.

What is the new property tax law in Colorado?

For property tax year 2025, the valuation is 27% of the actual value of the property; and. For property tax years commencing on or after January 1, 2026, the valuation is 25% of the actual value of the property.

How much is the homestead exemption in Colorado?

Colorado's statutory homestead exemption exempts a portion of a homestead from seizure to satisfy a debt, contract, or civil obligation. Section 2 increases the amount of the homestead exemption: From $75,000 to $250,000 if the homestead is occupied as a home by an owner of the home or an owner's family; and.

How to apply for CA property tax exemption?

Complete form BOE-266, Claim for Homeowners' Property Tax Exemption. Obtain the claim form from the County Assessor's office where the property is located. Submit the completed form to the same office.

At what age do seniors stop paying property taxes in Colorado?

Eligibility Requirements The applicant is at least 65 years old on January 1 of the year in which he/she applies; and.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Property Tax Exemption?

An Application for Property Tax Exemption is a formal request submitted by property owners to seek a reduction or exemption from property taxes based on specific eligibility criteria established by law.

Who is required to file Application for Property Tax Exemption?

Property owners who believe they qualify for a tax exemption due to reasons such as nonprofit status, senior citizen status, or disability, among others, are required to file this application.

How to fill out Application for Property Tax Exemption?

To fill out the application, property owners should complete the designated form by providing detailed information about the property, the owner's status, and any relevant supporting documents that prove eligibility for the exemption.

What is the purpose of Application for Property Tax Exemption?

The purpose of the application is to allow eligible property owners to claim exemptions or reductions in property taxes, thereby providing financial relief and encouraging use of properties for charitable, educational, or other qualifying purposes.

What information must be reported on Application for Property Tax Exemption?

The application typically requires information including property details, owner's identification, the reason for the exemption, and any necessary documentation to support the claim of eligibility.

Fill out your application for property tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Property Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.