Get the free MARS Disclosure for Offer from Lender (Part II)

Show details

This document is a required disclosure by the FTC regarding short sale terms that should be provided to sellers by brokers. It includes important notices from lenders or servicers about the offer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mars disclosure for offer

Edit your mars disclosure for offer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mars disclosure for offer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mars disclosure for offer online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mars disclosure for offer. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

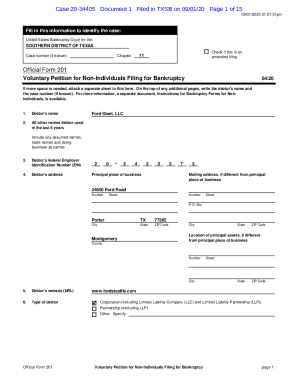

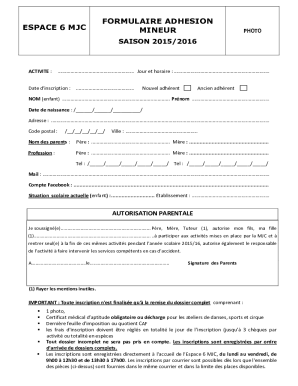

How to fill out mars disclosure for offer

How to fill out MARS Disclosure for Offer from Lender (Part II)

01

Begin by obtaining the MARS Disclosure form from the appropriate lender or regulatory authority.

02

Fill in the borrower's name and address at the top of the form.

03

Provide clear information about the loan terms, including the amount, interest rate, and payment schedule.

04

Explain the purpose of the disclosure, which is to inform the borrower about the implications of the loan offer.

05

Include any fees associated with the loan offer, detailing how they affect the total cost.

06

Highlight any potential risks involved in accepting the offer, such as changes in interest rates or terms.

07

Review the information for accuracy before finalizing the form.

08

Ensure the borrower receives a copy of the completed MARS Disclosure for their records.

Who needs MARS Disclosure for Offer from Lender (Part II)?

01

Borrowers considering an offer from a lender for mortgage assistance.

02

Homeowners seeking loan modifications or refinancing options.

03

Real estate professionals assisting clients with financial options.

04

Lenders providing assistance or offers to borrowers in financial distress.

Fill

form

: Try Risk Free

People Also Ask about

What is Mars in real estate?

National Association Of Realtors - Business / Mortgage Assistance Relief Services (MARS) Page 1.

What is the Mars rule in mortgages?

The Mortgage Assistance Relief Services Rule (MARS Rule) prohibits unfair and deceptive acts or practices with respect to mortgage-loan or foreclosure-relief services.

What does Mars stand for in mortgage?

Regulation O enacts the Mortgage Assistance Relief Services rule, or MARS rule, which is designed to protect consumers by banning potentially deceptive practices in mortgage relief.

What does Mars stand for in mortgage terms?

Mortgage Assistance Relief Services Rule (the MARS Rule, or the Rule) Its provisions sought to protect homeowners from mortgage relief scams by imposing specific requirements and prohibitions on industry professionals in order to regulate their business practices.

What was a common issue with the mortgage relief companies that the Mars rule aimed to regulate?

The FTC's rule will hopefully curb the most abusive practices of MARS providers. The requirement that MARS providers present borrowers with a new payment plan before they can charge fees should stop these companies from taking money without ever contacting lenders — a practice which has been unfortunately common.

What is the 3 7 3 rule in mortgage?

National Association Of Realtors - Business / Mortgage Assistance Relief Services (MARS) Page 1.

What is the Mars rule for mortgages?

prohibits mortgage assistance relief service providers from making false or misleading claims about their services, including claims about the following: The likelihood that the homeowner will get the promised results. The time it will take to obtain results.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MARS Disclosure for Offer from Lender (Part II)?

MARS Disclosure for Offer from Lender (Part II) is a required document that lenders provide to borrowers to disclose certain terms and conditions related to loan modification offers or other foreclosure prevention services.

Who is required to file MARS Disclosure for Offer from Lender (Part II)?

Lenders and mortgage servicers that are making offers to modify loans or provide foreclosure relief are required to file the MARS Disclosure for Offer from Lender (Part II).

How to fill out MARS Disclosure for Offer from Lender (Part II)?

To fill out the MARS Disclosure for Offer from Lender (Part II), lenders must complete specific fields regarding borrower information, terms of the loan modification offer, and any associated fees, ensuring compliance with regulatory requirements.

What is the purpose of MARS Disclosure for Offer from Lender (Part II)?

The purpose of MARS Disclosure for Offer from Lender (Part II) is to inform borrowers about the details of their loan modification offers, including any costs or terms, thus promoting transparency and protecting consumer rights.

What information must be reported on MARS Disclosure for Offer from Lender (Part II)?

The MARS Disclosure for Offer from Lender (Part II) must include borrower identification, loan details, terms of the proposed modification, any fees, and the lender's contact information along with any relevant deadlines.

Fill out your mars disclosure for offer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mars Disclosure For Offer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.