Get the free Form #E-1

Show details

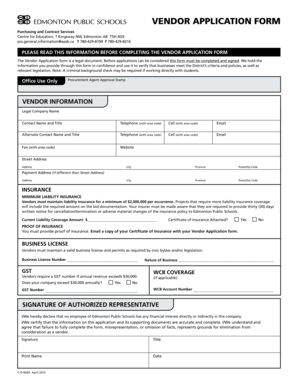

This document is a complaint form intended for the Grievance Committee of the South Dakota Association of REALTORS® regarding alleged violations of the Code of Ethics or membership duties.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form e-1

Edit your form e-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form e-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form e-1 online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form e-1. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form e-1

How to fill out Form #E-1

01

Begin by obtaining Form #E-1 from the relevant authority or website.

02

Fill in your personal information in the designated sections, including full name, address, and contact details.

03

Provide any required identification numbers, such as Social Security or taxpayer ID.

04

Complete the sections that pertain to your specific situation, ensuring you provide accurate and complete information.

05

Double-check all entries to ensure there are no errors or omissions.

06

Sign and date the form at the bottom where indicated.

07

Submit the form by following the instructions, which may include mailing it to a specific address or submitting it online.

Who needs Form #E-1?

01

Individuals or entities required to report specific information to tax authorities.

02

Persons applying for benefits that require documented financial information.

03

Businesses that need to complete specific compliance documentation.

04

Anyone who falls under the category defined by the governing body that instituted Form #E-1.

Fill

form

: Try Risk Free

People Also Ask about

What is an E1 form?

Form E1: Financial statement for a financial remedy (other than a financial order or financial relief after an overseas divorce or dissolution etc) in the family court or High Court.

Can an E1 visa lead to a green card?

Can an E1 visa holder apply directly for a green card? No, the E1 visa does not provide a direct path to a green card. Applicants must qualify under a separate category, such as family sponsorship, employment-based options, or the EB-5 investor program.

What is the form E in English?

Form E, also known as Borang E in Malay, is an annual report that employers in Malaysia must submit to the Inland Revenue Board of Malaysia (LHDN). This form provides a comprehensive summary of employment information, including employee salaries, bonuses, and deductions for the previous year.

What is the E1 form in Greece?

What is? The E1 tax income form is the main income declaration form for Greek residents and residents abroad and includes both informational and quantitative data. This form, along with E2 form (income from leasing real property), refers to taxpayers who own real property and earn income on it.

Who is eligible for an E-1 visa?

Under the immigration law, to qualify for an E1 visa, the treaty businessman investor, or entrepreneur must enter the United States for trade-related activities. To qualify as trade under U.S. law, there must be (a) a meaningful exchange of products, money, or services, and (b) an international scope.

What is an E-1 form?

Form E-1 is a tax return used by a resident individual taxpayer, regardless of the location of their employer, or a non-resident working in the City of St. Louis to file and pay the earnings tax of 1% due and not withheld by the employer.

What is the purpose of E1 form?

The SSS E1 form is an application form used to register as a self-employed individual in the Philippines. The form is used to register for Social Security System (SSS) membership and to apply for SSS benefits, such as sickness, maternity, disability, and death benefits.

What is an E 1 tax form?

0:05 4:44 So schedule E1 is part of the schedule E uh so schedule E1 is used to disclose taxes paid accured orMoreSo schedule E1 is part of the schedule E uh so schedule E1 is used to disclose taxes paid accured or deemed paid on EMP of that foreign corporation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form #E-1?

Form #E-1 is a specific tax form used to report certain financial information to the relevant governmental authority.

Who is required to file Form #E-1?

Individuals or entities that meet specific criteria set by the tax authority are required to file Form #E-1.

How to fill out Form #E-1?

To fill out Form #E-1, you will need to provide personal identification information, financial details, and other relevant data as instructed on the form.

What is the purpose of Form #E-1?

The purpose of Form #E-1 is to ensure compliance with tax regulations and to report specific financial activities.

What information must be reported on Form #E-1?

Information that must be reported on Form #E-1 includes income details, deductions, and other financial transactions as required by the tax authority.

Fill out your form e-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form E-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.