Get the free Direct Payment Authorization

Show details

This form allows taxpayers to authorize the Ross County Treasurer to automatically debit their bank accounts for tax payments. It includes instructions for providing taxpayer and financial institution

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign direct payment authorization

Edit your direct payment authorization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your direct payment authorization form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing direct payment authorization online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit direct payment authorization. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

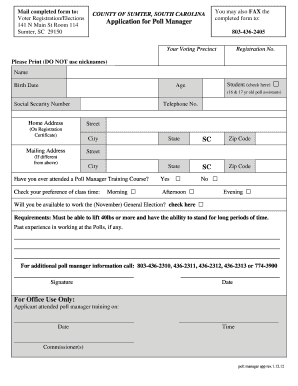

How to fill out direct payment authorization

How to fill out Direct Payment Authorization

01

Obtain the Direct Payment Authorization form from your financial institution or service provider.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide your bank account information, including account number and routing number.

04

Specify the type of payment (one-time or recurring) and the amount if applicable.

05

Sign and date the authorization form to confirm your consent.

06

Submit the completed form according to the instructions provided, either in person, by mail, or electronically.

Who needs Direct Payment Authorization?

01

Individuals who wish to set up automatic payments for bills or services.

02

Businesses needing to facilitate regular payments to vendors or contractors.

03

Those applying for government benefits or services that require bank information for direct payment.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between direct debit authorization and autopay?

A direct debit is a regular payment that's approved by you but set up and controlled by the business you are paying. The amount can change with each payment. An automatic payment is a regular payment that's set up and controlled by you. You pay the same amount every time.

What does payment authorization mean?

Payment Authorization is a process through which the amount to be paid on a payment method is verified. In case of credit cards, authorization specifically involves contacting the payment system and blocking the required amount of funds against the credit card.

What does direct deposit authorization mean?

Direct deposit authorization forms authorize employers to send money directly into an individual's bank account. In times past, employers would print out and distribute physical checks on pay day for each employee to deposit into their bank accounts themselves.

What is the script for ACH authorization?

I (we) agree that ACH transactions I (we) authorize comply with all applicable law. Amount of debit(s) or method of determining amount of debit(s) [or specify range of acceptable dollar amounts authorized]: _.

What is direct payment authorization?

0:20 2:33 Account. This is usually done through a form that you fill out which includes your bank's. Name yourMoreAccount. This is usually done through a form that you fill out which includes your bank's. Name your account number and the bank's routing.

What is an example of authorization for direct deposit?

I hereby authorize [Company Name] to directly deposit my pay in the bank account(s) listed below in the percentages specified. (If two accounts are designated, deposits are to be made in whole percentages of pay to total 100%.)

What is a ACH transfer in English?

An ACH transaction is an electronic money transfer made between banks and credit unions across a network called the Automated Clearing House (ACH).

What is the meaning of direct payment?

So what is meant by the term, direct payment? Well, direct payment is a way for consumers to pay their bills automatically and electronically. In other words, it is a way to transfer money from a consumer's bank account to the company they wish to pay.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Direct Payment Authorization?

Direct Payment Authorization is a process that allows taxpayers to authorize the withdrawal of funds directly from their bank accounts to pay taxes owed to the government.

Who is required to file Direct Payment Authorization?

Taxpayers who wish to set up automatic payments for their tax obligations or those who prefer direct bank transfers for their payments are required to file Direct Payment Authorization.

How to fill out Direct Payment Authorization?

To fill out a Direct Payment Authorization, taxpayers must complete the relevant form by providing their personal information, bank details, and the specific tax payment information needed for authorization.

What is the purpose of Direct Payment Authorization?

The purpose of Direct Payment Authorization is to streamline the payment process for taxpayers, ensuring timely payments while reducing the risk of late fees and penalties.

What information must be reported on Direct Payment Authorization?

The information that must be reported on Direct Payment Authorization includes the taxpayer's name, address, social security number or taxpayer identification number, bank account number, and routing number, along with the specific amount and date for the payment.

Fill out your direct payment authorization online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Direct Payment Authorization is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.