Get the free Judicial Tax Foreclosure Auction Registration Form

Show details

This document is for the registration of bidders at a judicial tax foreclosure auction, requiring personal information and deed instructions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign judicial tax foreclosure auction

Edit your judicial tax foreclosure auction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your judicial tax foreclosure auction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing judicial tax foreclosure auction online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit judicial tax foreclosure auction. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

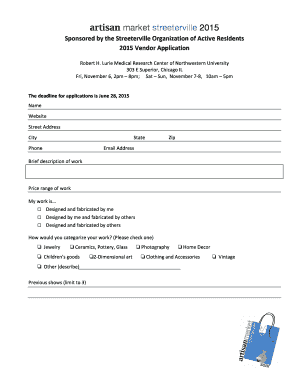

How to fill out judicial tax foreclosure auction

How to fill out Judicial Tax Foreclosure Auction Registration Form

01

Obtain the Judicial Tax Foreclosure Auction Registration Form from the appropriate website or office.

02

Read the instructions on the form carefully to understand the requirements.

03

Fill in your personal information, including your name, address, and contact details.

04

Provide information about the property you're interested in, including its tax identification number and location.

05

Indicate your preferred method of payment for the auction fee, if applicable.

06

Review all entered information for accuracy before submitting the form.

07

Submit the completed form by the deadline specified in the auction announcement.

Who needs Judicial Tax Foreclosure Auction Registration Form?

01

Individuals or entities interested in purchasing property at a judicial tax foreclosure auction.

02

Real estate investors looking to acquire properties due to unpaid taxes.

03

Homeowners wishing to bid on their own properties in foreclosure.

Fill

form

: Try Risk Free

People Also Ask about

Can you buy a house by paying the back taxes in North Carolina?

Prepare for the Foreclosure Auction Be sure to have your funds ready before bidding. It's also a good idea to attend a couple of foreclosure auctions in advance of the one for the property you're interested in bidding on. You can learn the procedures, observe the bidders, and find out the process requirements.

How do I prepare for a foreclosure auction?

Once a NTFL is filed, it makes the government a secured creditor in the event that the debtor files bankruptcy. This means that the lien continues even after a bankruptcy filing. A tax lien is a significant hit on a taxpayer's credit. If you are in this situation, it does not only impact your ability to get credit.

What is the disadvantage of a tax lien?

Tax sales are held in the lobby of the Justice Center. FORECLOSURE BIDS: Our tax sales are auction style and move very quickly. A deposit of 20% of the highest bid is required immediately upon conclusion of the sale at the courthouse. Only cash or a certified check, made to Zacchaeus Legal Services, will be accepted.

How does tax foreclosure work in NC?

Properties with delinquent real estate taxes are subject to tax foreclosure. When a tax foreclosure action is adjudicated, the ownership of the property is transferred from the delinquent taxpayer to a new owner. The new owner is responsible for all future taxes.

Can you buy a house that owes back taxes?

In theory, yes – you can still buy a house with a tax lien in place. But it's much harder, and much less likely. If you have an existing IRS payment plan agreement and a good history of meeting the payments, and if all your other finances stack up, it is possible to be approved for a mortgage with a tax lien in place.

How long can property taxes go unpaid in North Carolina?

How long do I have until my delinquent taxes become subject to foreclosure? In North Carolina, real property taxes become due on September 1 of each year, and become delinquent if not paid before January 6 of the following year. Any taxes which become delinquent are subject to potential tax foreclosure.

Does paying property taxes give you ownership in NC?

Paying someone else's taxes will not entitle you to any legal ownership to the property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Judicial Tax Foreclosure Auction Registration Form?

The Judicial Tax Foreclosure Auction Registration Form is a legal document that allows individuals or entities to register to participate in foreclosure auctions conducted by the judicial system for properties with outstanding tax debts.

Who is required to file Judicial Tax Foreclosure Auction Registration Form?

Anyone interested in bidding at a judicial tax foreclosure auction must file the Judicial Tax Foreclosure Auction Registration Form, which includes real estate investors, individuals, and organizations looking to acquire properties through the auction process.

How to fill out Judicial Tax Foreclosure Auction Registration Form?

To fill out the Judicial Tax Foreclosure Auction Registration Form, registrants must provide personal identification information, contact details, as well as any relevant financial information and comply with the specific requirements outlined by the auction authority.

What is the purpose of Judicial Tax Foreclosure Auction Registration Form?

The purpose of the Judicial Tax Foreclosure Auction Registration Form is to ensure that all bidders are formally registered and meet the necessary legal requirements to participate in the auction process, thereby maintaining transparency and order in the bidding process.

What information must be reported on Judicial Tax Foreclosure Auction Registration Form?

The Judicial Tax Foreclosure Auction Registration Form typically requires information such as the bidder's name, address, contact information, taxpayer identification number, proof of funds, and any other documentation as specified by the auction authority.

Fill out your judicial tax foreclosure auction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Judicial Tax Foreclosure Auction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.