Get the free Aplicación del Condado de Spartanburg para la Evaluación Especial - spartanburgcounty

Show details

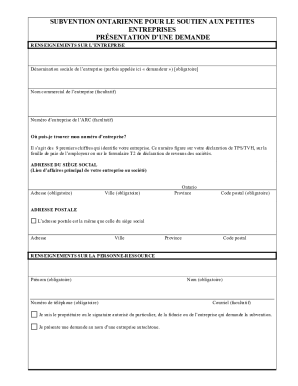

Formulario para solicitar la evaluación especial de propiedades residenciales legales en el Condado de Spartanburg, Carolina del Sur, que permite a los propietarios obtener una reducción en la tasa

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign aplicacin del condado de

Edit your aplicacin del condado de form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aplicacin del condado de form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit aplicacin del condado de online

To use the services of a skilled PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit aplicacin del condado de. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out aplicacin del condado de

How to fill out Aplicación del Condado de Spartanburg para la Evaluación Especial

01

Obtain the Aplicación del Condado de Spartanburg para la Evaluación Especial form from the county's official website or local office.

02

Read the instructions carefully before filling out the form.

03

Provide your personal information, including your name, address, and contact details.

04

Indicate the reasons for requesting a special evaluation in the designated section.

05

Attach any required supporting documents, such as medical records or educational assessments.

06

Review the application to ensure all information is accurate and complete.

07

Sign and date the application at the designated area.

08

Submit the completed application to the appropriate office, either in person or by mail.

Who needs Aplicación del Condado de Spartanburg para la Evaluación Especial?

01

Families or guardians of children who may have special educational needs.

02

Individuals seeking special assessments for disability accommodations.

03

Residents of Spartanburg County who require access to special evaluation services.

Fill

form

: Try Risk Free

People Also Ask about

What is proof of residency for SC property tax?

SC Driver's License/Identification card for all owner-occupants and spouse. SC Motor Vehicle Registration showing current address for all owner occupants and spouse. *For company cars-provide registration showing business address. Social Security Card (both spouses).

What is the special assessment for legal residence in SC?

These residences are taxed on an assessment equal to 4% of the fair market value of the property. To this value, a local rate is applied to determine taxes due. In addition to the special assessment ratio of 4%, the legal residence is also exempt from payment of taxes for school operating purposes.

What is proof of primary state of residence?

Primary state of residency does not pertain to owning property but rather it refers to your legal status of residency. Proof of residence includes obtaining a driver's license, voting/registering to vote or filing federal taxes with an address in that state. These legal documents must be issued by the same state.

What is proof of residency tax form?

Form 8802, Application for United States Residency Certification is used to request a certificate of residency, Form 6166, that residents of the United States may need to claim income tax treaty benefits and certain other tax benefits in foreign countries.

How to apply for primary residence in SC?

Property owners must apply for the primary residence rate with the county assessor's office and provide documentation showing that the property is the owner's legal primary residence.

How much is property tax in Spartanburg, SC?

Median Spartanburg, SC effective property tax rate: 0.74%, slightly lower than the national median of 1.02%, but higher than the South Carolina state median of 0.72%.

What is the residency requirement for property tax in SC?

For property tax purposes the term "Legal Residence" shall mean the permanent home or dwelling place owned by a person and occupied by the owner thereof. It shall be the place where he intends to remain permanently for an indefinite time even though he may temporarily be living at another location.

What is considered proof of residency in SC?

Statement of full-time employment in South Carolina; Designating South Carolina as state of legal residence on military record; Possession of a valid South Carolina driver's license, or if a non-driver, a South Carolina identification card.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Aplicación del Condado de Spartanburg para la Evaluación Especial?

The Aplicación del Condado de Spartanburg para la Evaluación Especial is a form used to apply for special property tax assessments in Spartanburg County, designed to assist property owners by potentially reducing their tax burden based on specific criteria.

Who is required to file Aplicación del Condado de Spartanburg para la Evaluación Especial?

Property owners who believe they qualify for a special assessment due to specific eligibility criteria are required to file this application.

How to fill out Aplicación del Condado de Spartanburg para la Evaluación Especial?

To fill out the application, property owners must provide necessary personal information, details about the property, and any relevant documentation that supports their eligibility for special assessment.

What is the purpose of Aplicación del Condado de Spartanburg para la Evaluación Especial?

The purpose of the application is to determine whether a property qualifies for a special assessment, which can lower property taxes for eligible owners based on certain qualifications.

What information must be reported on Aplicación del Condado de Spartanburg para la Evaluación Especial?

The application must report information such as the property owner's name, property address, details of the property, eligibility criteria being claimed, and any pertinent documentation that supports the application.

Fill out your aplicacin del condado de online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aplicacin Del Condado De is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.