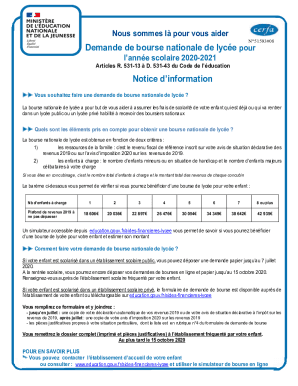

Get the free TAX CREDIT APPLICATION - co saint-marys md

Show details

This document serves as an application form for tax credits related to renovations, restorations, or new constructions on designated local historic landmarks and districts in St. Mary's County.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax credit application

Edit your tax credit application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax credit application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax credit application online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax credit application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax credit application

How to fill out TAX CREDIT APPLICATION

01

Gather all necessary documents, including income statements and tax forms.

02

Obtain the TAX CREDIT APPLICATION form from your local tax authority website or office.

03

Fill out personal information such as name, address, and Social Security number on the form.

04

Report your total income for the year as required on the application.

05

Include any applicable deductions or credits that you qualify for.

06

Attach supporting documentation like proof of income and residency.

07

Review the completed application for accuracy.

08

Submit the application to the appropriate tax authority by the specified deadline.

Who needs TAX CREDIT APPLICATION?

01

Individuals or families with low to moderate income seeking financial relief.

02

Students paying for educational expenses.

03

Homeowners paying property taxes.

04

Business owners eligible for small business credits.

05

Anyone who qualifies based on specific criteria set by the tax authority.

Fill

form

: Try Risk Free

People Also Ask about

What is an example sentence for tax credit?

The money comes from tax credits. Drama, animation and computer game firms will get new tax credits. The Tories voiced alarm that so many were having to pay back tax credit overpayments. He receives 197 a month from the tax credit and disability allowance systems.

Do I have to make $2500 to get a child tax credit?

You have to earn at least $2500 to get the refundable child tax credit. But if you only earned a small amount over $2500, then your credit would be very low. In order to get the full amount of up to $1600 you must earn more than the minimum of $2500. Here is how the refundable amount is calculated:

What is the maximum income to qualify for tax credits?

If you earned less than $66,819 (if Married Filing Jointly) or $59,899 (if filing as Single, Qualifying Surviving Spouse or Head of Household) in tax year 2024, you may qualify for the Earned Income Credit (EIC). These amounts increased from $63,398 and $56,838, respectively, for 2023.

What is the income limit for income tax credit?

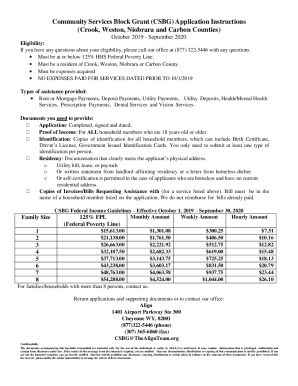

Earned Income Tax Credit table (2024) Number of qualifying childrenMaximum EITC credit amountAGI Limits for Filing Statuses: Single, Head of Household, or Qualifying Surviving Spouse NO CHILDREN $632 $18,591 One $4,213 $49,084 Two $6,960 $55,768 Three or more $7,830 $59,899

What does tax credit mean on a job application?

What is WOTC? The Work Opportunity Tax Credit (WOTC) is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group .

What is the maximum you can earn to get tax credits?

This means, if your household income for tax credit purposes is less than £7,955, you will receive the maximum amount of tax credits. If your household income is above this amount, the maximum tax credits award is reduced by 41p for every £1 of income above the £7,955 threshold.

How much can you make to get the earned income tax credit?

Check if you qualify for CalEITC CalEITC may provide you with cash back or reduce any tax you owe. To qualify for CalEITC you must meet all of the following requirements during the tax year: You're at least 18 years old or have a qualifying child. Have earned income of at least $1 and not more than $31,950.

Should I fill out the work opportunity tax credit questionnaire?

Absolutely, the answer is a resounding YES! Here are several compelling reasons why job applicants should always complete the Work Opportunity Tax Credit (WOTC) screening questionnaire: It has no impact on employment: Completing the WOTC questionnaire will not disqualify you from employment opportunities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TAX CREDIT APPLICATION?

A tax credit application is a formal request submitted by individuals or businesses to claim tax credits, which reduce the amount of tax owed to the government.

Who is required to file TAX CREDIT APPLICATION?

Individuals or businesses that qualify for available tax credits based on their income, expenses, or specific circumstances are required to file a tax credit application.

How to fill out TAX CREDIT APPLICATION?

To fill out a tax credit application, gather necessary documents, provide personal or business information, detail income and expenses, and calculate eligible credits based on the guidelines provided by tax authorities.

What is the purpose of TAX CREDIT APPLICATION?

The purpose of a tax credit application is to formally request tax relief through credits that encourage certain behaviors, support specific demographics, or promote economic development.

What information must be reported on TAX CREDIT APPLICATION?

Information required on a tax credit application typically includes personal identification details, income statements, proof of eligible expenses, and any documentation supporting the claim for specific credits.

Fill out your tax credit application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Credit Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.