FL Taxpayer Identification Number (TIN) and Certification (Substitute for IRS Form W-9) - County of Volusia 2009-2025 free printable template

Show details

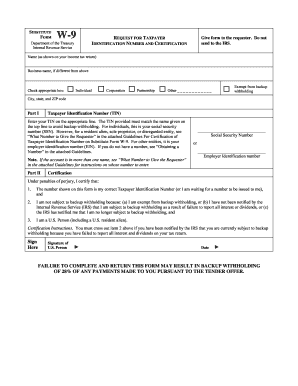

Taxpayer Identification Number (TIN) and Certification (Substitute for IRS Form W-9) COMPLETE BOTH SIDES OF FORM County of Völuspá, Florida Accounting 123 W Indiana Ave, Room 302 Demand, Florida

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign w 9 word document form

Edit your w 9 form download form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w 9 form pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit w9 in word format online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit w 9 form word document. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out w 9 word format

How to fill out FL Taxpayer Identification Number (TIN) and Certification

01

Obtain the FL Taxpayer Identification Number (TIN) application form, also known as Form DR-1.

02

Provide your legal name as it appears on your tax documents.

03

Enter your business name, if applicable.

04

Fill out your address details, including city, state, and zip code.

05

Indicate your business structure (e.g., sole proprietorship, LLC, corporation).

06

Include your Social Security Number (SSN) or Employer Identification Number (EIN) as required.

07

Complete the certification section by verifying the information is accurate.

08

Sign and date the form to certify that the information provided is correct.

09

Submit the completed form to the appropriate Florida tax authority.

Who needs FL Taxpayer Identification Number (TIN) and Certification?

01

Individuals operating a business in Florida that report income.

02

LLCs and corporations registered in Florida for tax purposes.

03

Non-profit organizations seeking exemption status.

04

Foreign entities conducting business in Florida that need to comply with tax regulations.

05

Entities filing for certain tax credits or exemptions.

Video instructions and help with filling out and completing w9 form word document

Instructions and Help about w9 form in word

Click on the link in the description or come to our website www.cpa.psu.edu or

Fill

w9 form word

: Try Risk Free

People Also Ask about w9 word doc

Can I fill out a w9 form online?

If you work as an independent contractor or freelancer, you need to fill out a W-9 form for each of your clients for tax filing purposes. Printing and scanning each form can get a little cumbersome, but filling out the form online can save you time.

Is there a new W9 for every year?

While the form doesn't change that often, it's good practice to request an updated Form W-9 annually, or as you notice a change in vendor information. This process ensures you will have the most up-to-date information.

How do I create a w9 form?

W-9 Form Instructions Line 1 – Name. This should be your full name. Line 2 – Business name. Line 3 – Federal tax classification. Line 4 – Exemptions. Lines 5 & 6 – Address, city, state, and ZIP code. Line 7 – Account number(s) Part I – Taxpayer Identification Number (TIN) Part II – Certification.

Can you fill out a w9 electronically?

The IRS accepts electronic signatures The W4 and W9 forms may be completed via e signatures, and the IRS regulations around them are reasonable. Minimize printing, signing, and mailing your IRS documents by signing them electronically.

When should I ask for a new W9?

Businesses should receive a W9 from vendors when the vendor is new and again whenever the supplier's Form W-9 information changes. Examples of changing information include changes in vendor name (business name or individual legal name, if applicable), address, and taxpayer identification number (TIN).

Where can I download a free W 9 form?

Commonly, the business or financial institutions will give you a blank W-9, and you can complete it directly. Or if you or your business is asked to provide a fillable w 9 form to independent contractors, you can download the w 9 form directly from the IRS website.

Who prepares a W9?

Who needs to fill out a W-9 form? Employers who work with independent contractors must provide them with a W-9 form to fill out before starting work. There are specific criteria for who is classified as an “independent contractor” and will need to fill out a W-9 form.

What is a w9 fillable?

Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS to report, for example: Income paid to you. Real estate transactions.

How do I create a w9?

How to fill out a W-9 Enter your name. Write or type your full legal name as shown on your tax return. Enter your business name. Choose your federal tax classification. Choose your exemptions. Enter your street address. Enter the rest of your address. Enter your requester's information.

What is a W9 for an LLC owner?

The LLC tax classification W9 refers to the IRS form used by LLCs when working with independent contractors and vendors. This form, titled the W-9 form, must be completed by the LLC owner and provided to the vendor or contractor.

Do I put my name or company name on w9?

If you are a sole proprietor or single-member limited liability company (LLC), you should enter your own name on line 1 as well. Partnerships, multiple-member LLCs, C corporations, and S corporations should enter the entity's name as shown on the entity's tax return. The second line is for your business's name, if any.

How do I fill out a w9 on my computer?

0:20 1:34 How to Fill Out a W9 Form Online - YouTube YouTube Start of suggested clip End of suggested clip Or your employer. Identification. Number if you're another type of business. Once all the fields areMoreOr your employer. Identification. Number if you're another type of business. Once all the fields are completed and checked off sign and date your w9 directly in the editor.

Do I need to fill out a W9 if I have an LLC?

Only corporations are exempt from 1099 reporting and Form W-9. This means your LLC must complete a W-9 if it's requested. If you don't comply, any payments your LLC received may be subject to backup withholding.

How do I fill out a w9 for my business?

How to fill out a W9 form Name. Line one requires the full legal name of the taxpayer. Business name. Line two is for a business name. Federal tax classification. Line three indicates the individual or business type. Exemptions. Individuals can skip this section. Address. Account numbers. Tax identification number.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit w9 form word document from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your w9 form word document into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I sign the w9 form word document electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your w9 form word document and you'll be done in minutes.

Can I edit w9 form word document on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign w9 form word document right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is FL Taxpayer Identification Number (TIN) and Certification?

The FL Taxpayer Identification Number (TIN) is a unique number assigned to individuals and businesses for tax-related purposes in Florida. The certification is a declaration stating the accuracy of the provided information.

Who is required to file FL Taxpayer Identification Number (TIN) and Certification?

Individuals and businesses that are subject to Florida taxes, including those that earn income, are required to file the FL Taxpayer Identification Number (TIN) and Certification.

How to fill out FL Taxpayer Identification Number (TIN) and Certification?

To fill out the FL TIN and Certification, provide your personal or business details, including your name, address, and Social Security Number or Employer Identification Number, while ensuring all information is accurate and complete.

What is the purpose of FL Taxpayer Identification Number (TIN) and Certification?

The purpose of the FL Taxpayer Identification Number (TIN) and Certification is to track tax obligations and ensure compliance with state tax laws by identifying entities that owe taxes.

What information must be reported on FL Taxpayer Identification Number (TIN) and Certification?

The information that must be reported includes the taxpayer's name, address, TIN (either SSN or EIN), and a certification that the information provided is accurate.

Fill out your w9 form word document online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

w9 Form Word Document is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.