AL Form 204/205 2008 free printable template

Show details

Application/Redetermination for Elderly and Disabled Programs Alabama Medicaid Agency Important: Answer all questions on this form. An original signature in ink is required. You may have someone help

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AL Form 204205

Edit your AL Form 204205 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AL Form 204205 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AL Form 204205 online

To use the services of a skilled PDF editor, follow these steps below:

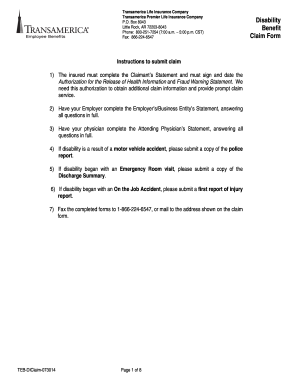

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit AL Form 204205. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AL Form 204/205 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AL Form 204205

How to fill out AL Form 204/205

01

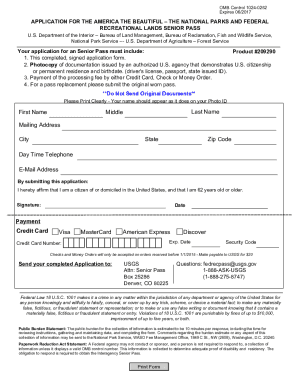

Obtain AL Form 204/205 from the appropriate authority or website.

02

Fill in your personal information, including name, address, and contact details.

03

Provide any necessary identification information as required.

04

Complete sections related to the purpose of the form, detailing the specific information requested.

05

Review the form for accuracy and completeness.

06

Sign and date the form as required.

07

Submit the form through the specified method (mail, online, in-person) according to the guidelines.

Who needs AL Form 204/205?

01

Individuals or entities applying for specific licenses, permits, or services that require AL Form 204/205.

02

Professionals who are mandated by law to submit this form for regulatory compliance.

03

Anyone seeking to document a transaction or verify compliance with state regulations.

Fill

form

: Try Risk Free

People Also Ask about

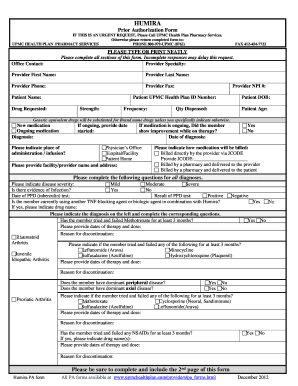

What is the maximum income to qualify for Medicaid in Alabama?

Income after deductions cannot exceed $2,400 per month for a family of 2. Income after deductions cannot exceed $3,025 per month for a family of 3. Income after deductions cannot exceed $3,650 per month for a family of 4. Parent and Caretaker Relatives.

How long does it take to get approved for Alabama Medicaid?

It may take several weeks to receive a letter telling you whether you were approved or not. However, if you applied online, you can use the number that was assigned to your application to open a My Medicaid account where you can check to see if the number has been activated.

Who can receive Medicaid in Alabama?

Who is eligible for Alabama Medicaid? To be eligible for this benefit program, you must be a resident of the state of Alabama, a U.S. national, citizen, permanent resident, or legal alien, in need of health care/insurance assistance, whose financial situation would be characterized as low income or very low income.

How do you get Alabama Medicaid?

To qualify for Medicaid, applicants must meet income, age or other requirements; provide proof of income and other information, fill out forms correctly and turn in a completed application to the correct office or worker. For more help, applicants should contact 1-800-362-1504.

What is the income limit for Medicaid in Alabama?

Income after deductions cannot exceed $2,400 per month for a family of 2. Income after deductions cannot exceed $3,025 per month for a family of 3. Income after deductions cannot exceed $3,650 per month for a family of 4. Parent and Caretaker Relatives.

Does Alabama Medicaid have an app?

Alabama Medicaid recipients and Alabama patients can view their health information from their smartphone or mobile device through a health application (app) of their choice.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my AL Form 204205 directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your AL Form 204205 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I execute AL Form 204205 online?

Completing and signing AL Form 204205 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an eSignature for the AL Form 204205 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your AL Form 204205 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

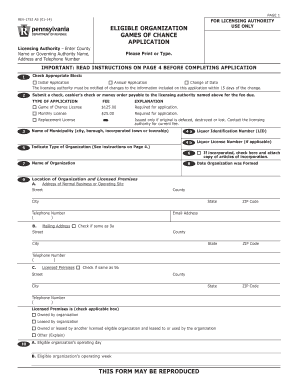

What is AL Form 204/205?

AL Form 204/205 is a tax form used in the state of Alabama for reporting business or entity information, typically related to business licenses or tax obligations.

Who is required to file AL Form 204/205?

Businesses operating in Alabama, including corporations, partnerships, and sole proprietorships, are required to file AL Form 204/205 if they have certain tax obligations or are applying for a business license.

How to fill out AL Form 204/205?

To fill out AL Form 204/205, individuals must provide details such as the business name, address, tax identification number, business type, and specific information relevant to their tax situation or license requirements.

What is the purpose of AL Form 204/205?

The purpose of AL Form 204/205 is to ensure compliance with Alabama's tax regulations and to facilitate the collection of taxes from businesses operating within the state.

What information must be reported on AL Form 204/205?

The information that must be reported on AL Form 204/205 includes the legal name of the business, address, federal employer identification number (FEIN), type of business entity, and details regarding the nature of the business activities.

Fill out your AL Form 204205 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AL Form 204205 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.