Get the free ALABAMA REDEMPTION FROM AD VALOREM TAX SALES

Show details

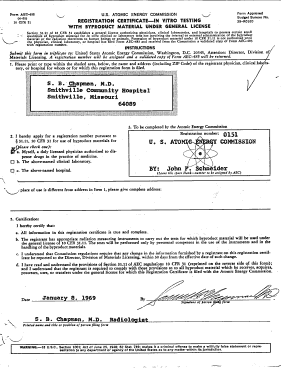

This document outlines the amendments relating to the redemption of property sold for delinquent ad valorem taxes in Alabama, providing guidelines for owners and purchasers regarding tax sales, redemption

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign alabama redemption from ad

Edit your alabama redemption from ad form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your alabama redemption from ad form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing alabama redemption from ad online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit alabama redemption from ad. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out alabama redemption from ad

How to fill out ALABAMA REDEMPTION FROM AD VALOREM TAX SALES

01

Obtain the ALABAMA REDEMPTION FROM AD VALOREM TAX SALES form from the county tax office or the official state website.

02

Fill in the property details, including the parcel number, property address, and the tax sale date.

03

Provide your personal information, including name, address, and contact details.

04

Indicate the amount required for redemption, including any penalties or interest as specified by the tax office.

05

Sign and date the form to certify that the information provided is accurate.

06

Submit the completed form along with the required redemption payment to the appropriate county tax office.

Who needs ALABAMA REDEMPTION FROM AD VALOREM TAX SALES?

01

Property owners in Alabama who have lost their property due to non-payment of ad valorem taxes.

02

Individuals or entities seeking to reclaim property after a tax sale.

03

Buyers or investors looking to understand the process of redeeming property from tax sales.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax redemption period in Alabama?

The property owner is required to pay the buyer interest on the sale amount. The interest rate on tax sale property is 12% annually. After the three year redemption period, the owner of the property is no longer able to redeem his/her property through this office and must communicate with the buyer directly.

What is ad valorem tax in Alabama?

The yearly Ad Valorem, or Property Tax, is based on the values assigned by the State of Alabama Department of Revenue. ing to Act 1999-363 (STARS Act), if back taxes are owed on a motor vehicle, they must be paid before the owner can register the vehicle.

How do I redeem my property after tax sale in Alabama?

You may redeem your property within 3 years of sale by paying all taxes, interest, fees, and penalties at the rate of 12% per annum. Must I pay delinquent taxes if I did not own the property in delinquent years? Yes. The taxes follow the property.

What does ad valorem tax mean?

The Latin phrase ad valorem means "ing to value." Ad valorem taxes are levied based on the determined value of the item being taxed. Municipal property taxes are the most common application of ad valorem taxes.

What is the Alabama ad valorem tax?

Ad valorem tax is a property tax, not a use tax, and follows the property from owner to owner. Therefore, unlike registration fees, taxes accumulate even when a vehicle is not used on the highway.

How much is the tax on a vehicle in Alabama?

State Tax Rates Tax TypeRate TypeRate SALES TAX AUTO 2.000% SALES TAX FARM 1.500% SALES TAX GENERAL \ AMUSEMENT 4.000% SALES TAX FOOD/GROCERY Effective September 1, 2023 3.000%22 more rows

What is the ad valorem tax on my car?

0:06 2:51 In the context of cars. This tax is levied on the vehicle's assessed. Value calculation of assessed.MoreIn the context of cars. This tax is levied on the vehicle's assessed. Value calculation of assessed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ALABAMA REDEMPTION FROM AD VALOREM TAX SALES?

Alabama Redemption from Ad Valorem Tax Sales refers to the process by which property owners can reclaim their property after it has been sold at a tax sale due to unpaid ad valorem taxes. This process allows property owners a set period to pay off the owed taxes, including any associated fees, to regain ownership.

Who is required to file ALABAMA REDEMPTION FROM AD VALOREM TAX SALES?

Property owners who wish to reclaim their property after it has been sold at a tax sale are required to file for Alabama Redemption from Ad Valorem Tax Sales. This includes individuals or entities that hold the title or interest in the property at the time of the tax sale.

How to fill out ALABAMA REDEMPTION FROM AD VALOREM TAX SALES?

To fill out the Alabama Redemption from Ad Valorem Tax Sales form, property owners must provide necessary information such as the property description, the amount of taxes owed, and details about the tax sale. Additionally, they must include personal identification details and any relevant documentation supporting the redemption.

What is the purpose of ALABAMA REDEMPTION FROM AD VALOREM TAX SALES?

The purpose of Alabama Redemption from Ad Valorem Tax Sales is to provide property owners with a legal mechanism to recover their properties after tax sales. This ensures that property owners have a fair opportunity to pay off their debts before permanently losing ownership of their property.

What information must be reported on ALABAMA REDEMPTION FROM AD VALOREM TAX SALES?

The information required on the Alabama Redemption from Ad Valorem Tax Sales form includes property details (such as parcel number and description), the names of the tax sale purchaser, the original tax amount, any interest or penalties accrued, and the total amount due for redemption. It may also require identification details of the property owner.

Fill out your alabama redemption from ad online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Alabama Redemption From Ad is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.