Get the free ET-1 - ador state al

Show details

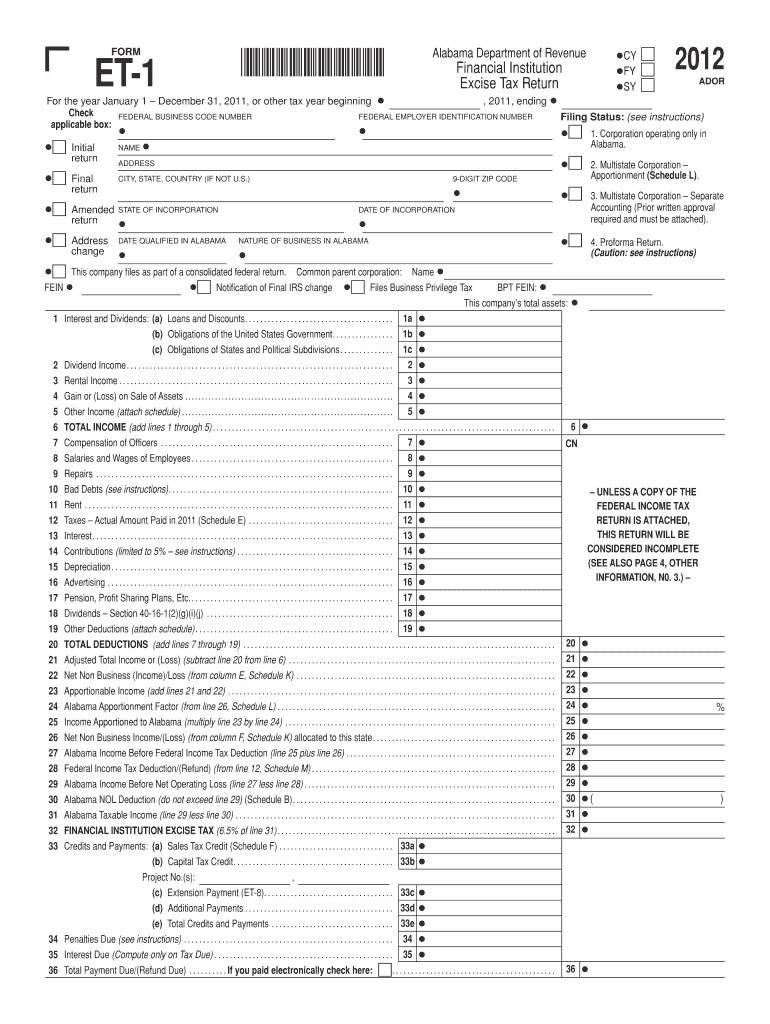

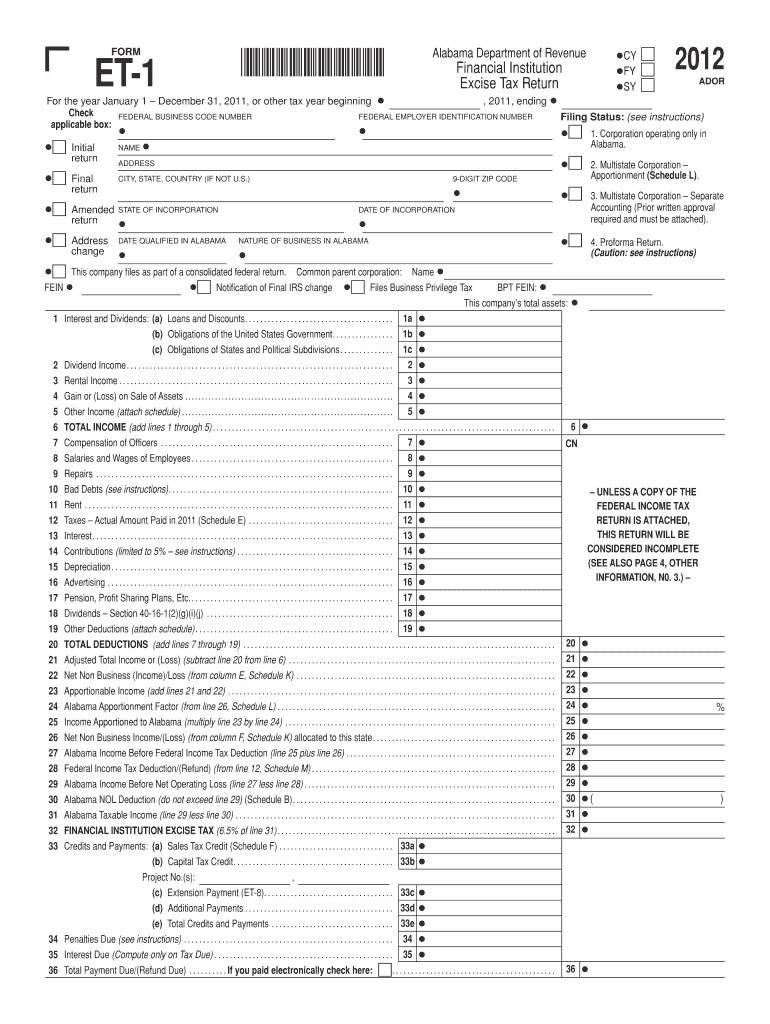

This document is a tax return form for financial institutions in Alabama, detailing income, deductions, and tax calculations for the year 2011.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign et-1 - ador state

Edit your et-1 - ador state form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your et-1 - ador state form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing et-1 - ador state online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit et-1 - ador state. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out et-1 - ador state

How to fill out ET-1

01

Gather all necessary information, including your business details and payroll information.

02

Start filling out the ET-1 form with your business name, address, and identification number.

03

Provide the type of business entity and describe the nature of your business.

04

Enter the employees' information, including names, social security numbers, and wages.

05

Calculate the total taxes owed and any deductions.

06

Review the form for accuracy and completeness.

07

Sign and date the form before submission.

Who needs ET-1?

01

Employers who have employees and are required to report payroll taxes.

02

Businesses that are required to file tax documents for state employment taxes.

03

Any entity that hires employees in the state and accumulates taxable wages.

Fill

form

: Try Risk Free

People Also Ask about

Why did E.T. get sick?

Actor Henry Thomas, who portrayed Elliott in the original movie, expressed in 2022 that a feature-length sequel would not be appropriate. Thus, any claims of a new installment cannot be true. The only official follow-up to "E.T." is a four-minute commercial released in 2019 called "E.T.

How long is E.T. 1?

E.T. the Extra-Terrestrial Release dates May 26, 1982 (Cannes) June 11, 1982 (United States) Running time 114 minutes Country United States Language English11 more rows

Is E.T. too scary for a 5 year old?

In addition to the violent scenes and scary visual images mentioned above, this movie has some scenes that could scare or disturb children under five years.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ET-1?

ET-1 is a tax form used for reporting specific types of business income and expenses related to certain taxes.

Who is required to file ET-1?

Entities engaged in activities subject to the taxes reported on the ET-1 form are required to file it, including businesses that meet specific criteria based on their revenue and operations.

How to fill out ET-1?

To fill out ET-1, businesses must complete the form by providing required information such as income, expenses, and relevant deductions, ensuring accuracy and compliance with tax regulations.

What is the purpose of ET-1?

The purpose of ET-1 is to help state authorities gather information on business operations for tax assessment and compliance purposes.

What information must be reported on ET-1?

ET-1 requires reporting of business income, expenses, employee information, and any other data pertinent to the specific taxes being reported.

Fill out your et-1 - ador state online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Et-1 - Ador State is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.