Get the free BPT-E - ador state al

Show details

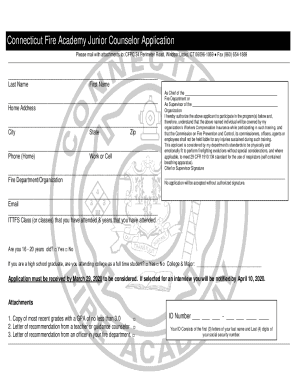

This form is used for electing a Family Limited Liability Entity in the state of Alabama for the tax year 2007, requiring information about ownership and income sources.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bpt-e - ador state

Edit your bpt-e - ador state form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bpt-e - ador state form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bpt-e - ador state online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit bpt-e - ador state. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bpt-e - ador state

How to fill out BPT-E

01

Obtain the BPT-E form from your local tax office or download it from the official website.

02

Fill in your personal information, including your name, address, and identification number.

03

Accurately report your income from all sources for the specified tax year.

04

Include any allowable deductions and credits you are eligible for.

05

Double-check all information for accuracy and completeness.

06

Sign and date the form where required.

07

Submit the completed form by the designated deadline, either online or via mail.

Who needs BPT-E?

01

Individuals and businesses who have earned income and are subject to local taxes.

02

People who wish to receive tax refunds or are required to report their earnings.

03

Taxpayers who are self-employed and need to report their income and expenses.

Fill

form

: Try Risk Free

People Also Ask about

What is the name of the first settlement in Alabama?

1702 - The first settlement, Fort Louis, is established by the French. 1763 - The British take over from the French. 1813 - The United States takes over after the War of 1812. 1817 - The Alabama Territory is established by the U.S. Congress.

What is the initial BPT return in Alabama?

The Initial Business Privilege Tax Return (Form BPT-IN) is the first tax filing a new business must submit to the Alabama Department of Revenue. Applied to all entities obliged to register with the state, this return must be filed two and a half months from the date of business incorporation.

What is a BPT account number in Alabama?

BPT Account Number – Enter the taxpayer's BPT (Business Privilege Tax) account number only if the taxpayer does not have an FEIN (Federal Employer Identification Number). The account number is issued when the account is opened and is provided in the notice advising the taxpayer of the Business Privilege Tax liability.

What is the due date for Alabama business privilege tax?

For C-corporations with a fiscal year of June 30, the Alabama business privilege tax return is due no later than two and a half months after the beginning of a taxpayer's taxable year. Taxable year 2021 Form CPT would be due on September 15, 2021, for C-corporations with a fiscal year of June 30.

What is an example of a business privilege tax?

Tax Basis: The business privilege tax in Los Angeles is generally calculated based on a business's gross receipts. Example: For a child care provider, the tax is $23.65 per year for the first $20,000 or less in gross receipts, plus $1.18 per year for each additional $1,000 of gross receipts over $20,000.

What is the initial BPT in Alabama?

The Initial Business Privilege Tax Return (Form BPT-IN) is the first tax filing a new business must submit to the Alabama Department of Revenue. Applied to all entities obliged to register with the state, this return must be filed two and a half months from the date of business incorporation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is BPT-E?

BPT-E is a business privilege tax return form used by entities operating within specific jurisdictions to report their gross receipts and calculate their tax liability.

Who is required to file BPT-E?

Any business entity engaged in business activities within the jurisdiction that generates gross receipts above a certain threshold is required to file BPT-E.

How to fill out BPT-E?

To fill out BPT-E, businesses must gather necessary information regarding gross receipts, deductions, and other financial details, and accurately complete the form as per the instructions provided by the tax authority.

What is the purpose of BPT-E?

The purpose of BPT-E is to ensure compliance with local business privilege tax regulations and to determine the amount of tax owed to the jurisdiction based on a business's gross revenue.

What information must be reported on BPT-E?

BPT-E requires reporting of total gross receipts, applicable deductions, credits, the tax rate, and any other relevant financial information as stipulated by the tax regulations.

Fill out your bpt-e - ador state online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bpt-E - Ador State is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.