AL Form 40ES 2009 free printable template

Show details

This document is a worksheet used for individuals to estimate their tax payments for the state of Alabama for the year 2009. It provides steps for calculating estimated taxes based on expected income,

pdfFiller is not affiliated with any government organization

Instructions and Help about AL Form 40ES

How to edit AL Form 40ES

How to fill out AL Form 40ES

Instructions and Help about AL Form 40ES

How to edit AL Form 40ES

Edit AL Form 40ES by downloading it from an authorized source, then using software such as pdfFiller to make necessary modifications. Look for editing tools that allow you to enter text, add signatures, or highlight specific areas on the form. Always ensure you save your edits and keep a backup copy for your records.

How to fill out AL Form 40ES

To fill out AL Form 40ES, gather the required information, such as your identification details and payment records. Refer to the instructions included with the form for specific entries. Utilize tools like pdfFiller for seamless completion and to prevent common errors.

About AL Form 40ES 2009 previous version

What is AL Form 40ES?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About AL Form 40ES 2009 previous version

What is AL Form 40ES?

AL Form 40ES is a tax form used in Alabama for estimated tax payments. Filers use this form to report their expected tax liabilities throughout the year. This version was relevant for tax years prior to the most current form.

What is the purpose of this form?

The purpose of AL Form 40ES is to help taxpayers in Alabama make estimated tax payments for state income tax. This proactive approach assists taxpayers in remitting their tax liabilities on a quarterly basis, thereby avoiding penalties at the end of the tax year.

Who needs the form?

Individuals and businesses must use AL Form 40ES if they expect to owe at least $500 in state income tax for the tax year. This includes self-employed individuals, those with additional income sources, or other taxpayers whose withholding is insufficient to meet their tax obligations.

When am I exempt from filling out this form?

You are exempt from filling out AL Form 40ES if your total tax due is less than $500. Additionally, if you have no taxable income or if your tax liability is entirely covered by employer withholding or refundable credits, you may not need to complete this form.

Components of the form

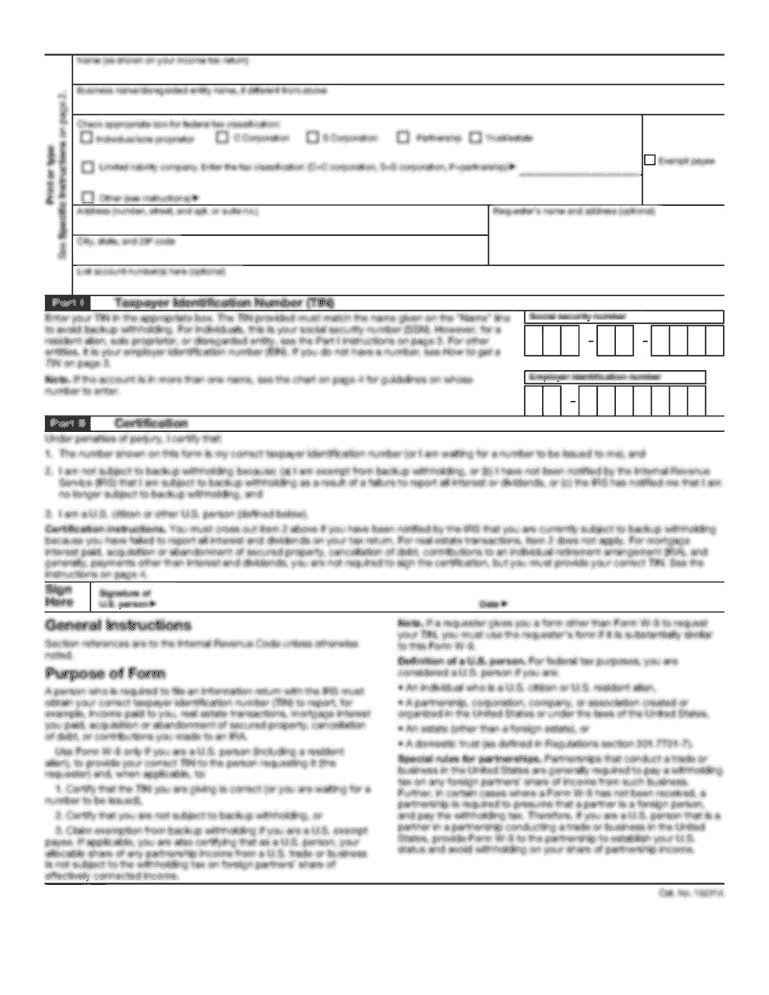

AL Form 40ES typically includes sections for personal information, the calculation of estimated tax due, and payment options. Make sure to complete each section accurately, as discrepancies can lead to penalties or delayed processing.

What are the penalties for not issuing the form?

Failing to file AL Form 40ES when required can result in penalties, including an interest charge on the unpaid tax and potential fines from the Alabama Department of Revenue. These penalties can accumulate quickly, making it crucial to fulfill your obligations.

What information do you need when you file the form?

When filing AL Form 40ES, gather your previous year’s tax return, records of expected income, and any deductions you anticipate. This information is vital for accurately calculating your estimated tax payments and ensuring compliance with Alabama tax laws.

Is the form accompanied by other forms?

AL Form 40ES is often accompanied by supporting documentation, such as income statements or additional forms if you have specific deductions or credits. Check the Alabama Department of Revenue's guidelines to ensure you include all necessary paperwork when filing.

Where do I send the form?

Send the completed AL Form 40ES to the appropriate Alabama Department of Revenue address, which is typically specified in the form's instructions. Ensure it is mailed to the correct location to avoid processing delays.

See what our users say