Get the free Declaration of Tax Status - doa alaska

Show details

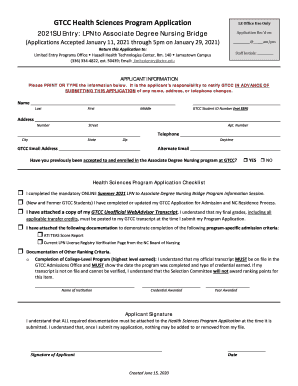

This document is used by the State of Alaska to determine the federal tax status of same-sex partners and their dependents for health coverage purposes. It includes guidelines for completing the form

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign declaration of tax status

Edit your declaration of tax status form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your declaration of tax status form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit declaration of tax status online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit declaration of tax status. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out declaration of tax status

How to fill out Declaration of Tax Status

01

Obtain the Declaration of Tax Status form from the relevant tax authority's website or office.

02

Review the instructions provided with the form carefully.

03

Fill in your personal information, including your name, address, and tax identification number.

04

Indicate your tax residency status by selecting the appropriate option from the choices given.

05

Provide specifics about your income sources and relevant tax treaties if applicable.

06

Sign and date the form to confirm that the information provided is accurate.

07

Submit the completed form according to the guidelines provided, either online or via mail.

Who needs Declaration of Tax Status?

01

Individuals or businesses that earn income in a foreign country and need to clarify their tax residency status.

02

Taxpayers who are claiming benefits under tax treaties to avoid double taxation.

03

Anyone required by the tax authority to provide a declaration of their tax status for compliance purposes.

Fill

form

: Try Risk Free

People Also Ask about

What does my tax status mean?

Filing status determines which tax return form an individual must use, with categories influenced by marital status, dependents, and other factors. The five main filing statuses are single, married filing jointly, married filing separately, head of household, and surviving spouse.

What is tax status 1099 or w2?

A W-2 is a separate form from a 1099. The primary difference is that the W-2 is issued to employees on the company payroll, while the 1099-NEC is given to independent contractors and non-payroll workers. Should a Business File W-2 and 1099 Separately?

What do I put for tax status?

Generally, your filing status is based on your marital status on the last day of the year. You can choose: Single if you're unmarried, divorced or legally separated. Married filing jointly if you're married or if your spouse passed away during the year.

What is a declaration of tax status?

The Declaration of Tax Status Form requires the employee to anticipate the dependency status of their OQA or OQA's child for the upcoming year.

What does declaration of taxes mean?

the income information that someone gives to the tax authorities once a year so that they can calculate how much tax is owed.

What is a declaration of tax status?

The Declaration of Tax Status Form requires the employee to anticipate the dependency status of their OQA or OQA's child for the upcoming year.

What do I put for tax status?

Generally, your filing status is based on your marital status on the last day of the year. You can choose: Single if you're unmarried, divorced or legally separated. Married filing jointly if you're married or if your spouse passed away during the year.

What is a tax status form?

These are commonly referred to as Individual Status Letters (ISL) and may help to obtain a student loan or financing from the California Department of Veterans Affairs. These letters can also show lenders and other interested third parties that the individual has met their California income tax obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Declaration of Tax Status?

The Declaration of Tax Status is a document that individuals or entities submit to affirm their tax filing status and compliance with applicable tax laws.

Who is required to file Declaration of Tax Status?

Individuals or businesses that need to clarify their tax status, including taxpayers who work with foreign entities, may be required to file the Declaration of Tax Status.

How to fill out Declaration of Tax Status?

To fill out the Declaration of Tax Status, individuals or entities must provide personal or business information, outline their tax obligations, and indicate their tax residency status.

What is the purpose of Declaration of Tax Status?

The purpose of the Declaration of Tax Status is to ensure tax compliance and facilitate the correct withholding of taxes, often for cross-border transactions.

What information must be reported on Declaration of Tax Status?

The Declaration of Tax Status generally requires information such as name, address, tax identification number, residency status, and details of any relevant tax treaties.

Fill out your declaration of tax status online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Declaration Of Tax Status is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.