Get the free Request For Recapture Tax Reimbursement - arkansas

Show details

This document allows borrowers to request reimbursement for the recapture tax paid following the sale of their home financed through the Arkansas Development Finance Authority's Single Family Mortgage

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request for recapture tax

Edit your request for recapture tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request for recapture tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

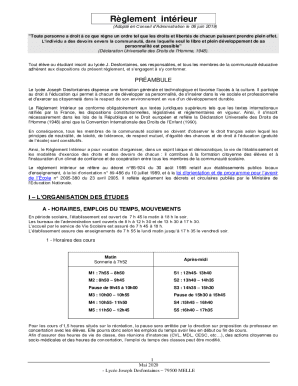

Editing request for recapture tax online

In order to make advantage of the professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit request for recapture tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

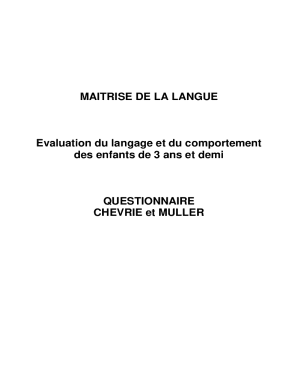

How to fill out request for recapture tax

How to fill out Request For Recapture Tax Reimbursement

01

Gather all necessary documents including tax records and prior reimbursement requests.

02

Obtain the Request For Recapture Tax Reimbursement form from the relevant tax authority's website or office.

03

Fill out the form with accurate personal and financial information as required.

04

Provide detailed information about the tax reimbursement for which you are seeking recapture.

05

Attach any supporting documentation that verifies your claim.

06

Review the completed form for accuracy and completeness.

07

Submit the form to the appropriate tax authority by the specified deadline.

Who needs Request For Recapture Tax Reimbursement?

01

Individuals or businesses that previously received tax reimbursements and believe they are entitled to recapture those funds due to changes in tax regulations or eligibility.

02

Taxpayers who have experienced changes in financial circumstances affecting their tax reimbursement status.

03

Tax advisors and accountants assisting clients with reclaiming tax funds.

Fill

form

: Try Risk Free

People Also Ask about

What is the maximum recapture tax notice?

Calculating Recapture The maximum amount of recapture is 6.25% of the original loan amount or 50% of the gain from the sale, whichever is less. Gain from the home's sale is calculated after deducting future real estate agent's commission, legal fees and closing costs. Here's an example.

How do I stop paying back depreciation recapture?

One of the most popular ways to defer depreciation recapture is to complete a 1031 exchange, also known as a “like-kind exchange”.

Do you always pay depreciation recapture?

Key Takeaways: You can't fully avoid depreciation recapture, but you can delay this and capital gains taxes through 1031 exchanges. You put the money from the sale back into another investment property.

What is the mortgage recapture tax?

What is Recapture Tax? The “potential” repayment of money saved by the Borrower through use of a Mortgage Revenue Bond funded home loan.

How do you know if you owe taxes back?

You can log into your IRS account to check your tax account balance, view tax records, and see any amounts owed for previous years. If you don't already have an account, you can set one up on the IRS website. Call the IRS. You can contact the IRS directly at 800-829-1040 to ask about any back taxes you may owe.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Request For Recapture Tax Reimbursement?

Request For Recapture Tax Reimbursement is a formal request submitted by individuals or businesses to recover certain taxes previously paid that are now eligible for reimbursement under specific regulations or conditions.

Who is required to file Request For Recapture Tax Reimbursement?

Typically, individuals or entities that have overpaid taxes or have claims for reimbursement under applicable tax laws are required to file a Request For Recapture Tax Reimbursement.

How to fill out Request For Recapture Tax Reimbursement?

To fill out the Request For Recapture Tax Reimbursement, individuals must provide detailed information including their personal or business details, the specific tax amounts claimed for reimbursement, supporting documentation, and any required certifications as outlined by tax authorities.

What is the purpose of Request For Recapture Tax Reimbursement?

The purpose of the Request For Recapture Tax Reimbursement is to facilitate the recovery of overpaid taxes, ensuring that taxpayers receive refunds or credits for taxes that should not have been collected or assessed.

What information must be reported on Request For Recapture Tax Reimbursement?

Information that must be reported includes taxpayer identification details, the amount of tax originally paid, the reason for the reimbursement request, relevant dates, and any attached documentation that supports the claim.

Fill out your request for recapture tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request For Recapture Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.