Get the free RESEARCH & DEVELOPMENT TAX CREDIT PROGRAM RULES - sos arkansas

Show details

This document outlines the rules and regulations governing the Research & Development Tax Credit Program in Arkansas, including eligibility criteria, credit limits, application processes, and program

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign research development tax credit

Edit your research development tax credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your research development tax credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit research development tax credit online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit research development tax credit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

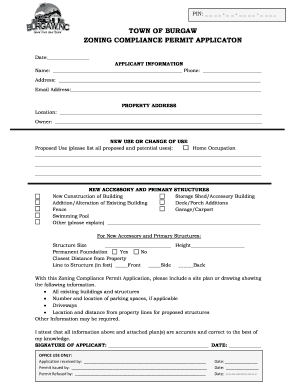

How to fill out research development tax credit

How to fill out RESEARCH & DEVELOPMENT TAX CREDIT PROGRAM RULES

01

Gather all necessary documentation related to your research and development activities.

02

Identify qualifying expenses, including wages, materials, and contract research costs.

03

Review the specific eligibility criteria outlined in the program rules.

04

Complete the required application forms accurately, providing all requested details.

05

Ensure that all calculations for the credit amount are precise and supported by documentation.

06

Submit the application before the deadline specified in the program rules.

07

Keep copies of all submitted materials and correspondence for your records.

Who needs RESEARCH & DEVELOPMENT TAX CREDIT PROGRAM RULES?

01

Businesses engaged in qualifying research activities seeking to reduce their tax liability.

02

Startups and established companies investing in innovation and development of new products or processes.

Fill

form

: Try Risk Free

People Also Ask about

What are the criteria for the research and development tax credit?

For the qualified research RDC, research activities must be: Related to the development of information which is technological in nature. Intended for application to the development of a new or improved business product of the taxpayer — specifically related to function, performance, reliability, or quality.

What are the criteria for R&D?

To provide guidance on what is and what is not an R&D activity, five criteria are provided which require the activity to be novel, creative, uncertain in it outcome, systematic and transferable and/or reproducible.

What qualifies for an R&D claim?

Research and Development ( R&D ) tax relief supports companies that work on innovative projects in science and technology. To qualify for R&D relief, a project must seek an advance in a field of science or technology.

What are the conditions for RDEC?

To be eligible under the RDEC scheme, you need to be classified as a large company, which will be subject to corporation tax in the UK. However, the company must also be carrying out eligible R&D activities in the UK, undertaking R&D that is directly related to the trade.

What is the 80% rule for R&D credit?

What is the 80% rule for R&D credit? The IRS notes that if “substantially all” – that is, at least 80% – of the services performed by an employee fit the criteria of qualified research, then all of the employee's annual wages are eligible as QREs.

What is the 80% rule for R&D credit?

What is the 80% rule for R&D credit? The IRS notes that if “substantially all” – that is, at least 80% – of the services performed by an employee fit the criteria of qualified research, then all of the employee's annual wages are eligible as QREs.

What are the new rules for R&D credit?

Key Changes Impacting R&D Tax Credit Claims for 2024 Businesses electing special tax treatments (such as the reduced credit under Section 280C) must make specific disclosures. Starting in 2025, detailed project-level reporting is mandatory for businesses with over $1.5 million in Qualified Research Expenses (QREs).

What are the new rules for R&D?

Enhanced R&D intensive support regime For periods commencing on or after 1 April 2024, a company would be considered 'R&D intensive' where its R&D expenditure accounted for at least 30% of its total expenditure (plus the expenditure of connected companies) for the period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is RESEARCH & DEVELOPMENT TAX CREDIT PROGRAM RULES?

The Research & Development Tax Credit Program Rules govern the eligibility, application process, and benefits available to businesses engaged in research and development activities, allowing them to claim tax credits for qualified expenses.

Who is required to file RESEARCH & DEVELOPMENT TAX CREDIT PROGRAM RULES?

Businesses that conduct qualified research activities within a specific jurisdiction and wish to claim the tax credit must file under the Research & Development Tax Credit Program Rules.

How to fill out RESEARCH & DEVELOPMENT TAX CREDIT PROGRAM RULES?

To fill out the Research & Development Tax Credit Program Rules, businesses must complete the appropriate application forms provided by the tax authority, detailing their research activities and expenses incurred during the specified tax year.

What is the purpose of RESEARCH & DEVELOPMENT TAX CREDIT PROGRAM RULES?

The purpose of the Research & Development Tax Credit Program Rules is to incentivize innovation and technological advancement by providing tax benefits to businesses that invest in research and development.

What information must be reported on RESEARCH & DEVELOPMENT TAX CREDIT PROGRAM RULES?

Businesses must report detailed information on their research activities, including project descriptions, qualified expenses, employee wages, and any other relevant data that supports their claim for the tax credit.

Fill out your research development tax credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Research Development Tax Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.