Get the free Pinnacle Private Placement Annuity - insurance arkansas

Show details

This document outlines the terms and conditions of a flexible premium deferred private placement variable annuity certificate, including details on premiums, benefits, ownership, and withdrawal provisions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pinnacle private placement annuity

Edit your pinnacle private placement annuity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pinnacle private placement annuity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pinnacle private placement annuity online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pinnacle private placement annuity. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pinnacle private placement annuity

How to fill out Pinnacle Private Placement Annuity

01

Obtain the Pinnacle Private Placement Annuity application form from a licensed financial advisor or the Pinnacle website.

02

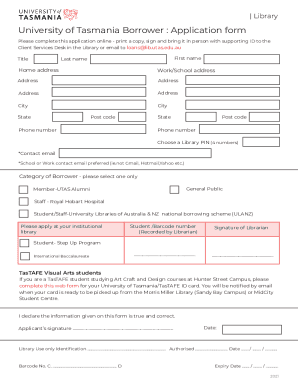

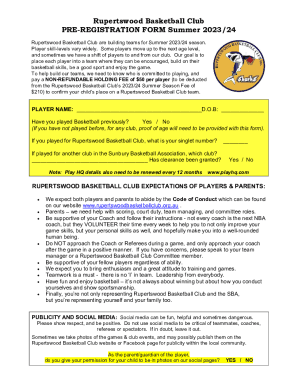

Fill out personal information, including full name, address, and Social Security number.

03

Indicate the amount of investment you wish to allocate to the annuity.

04

Choose the investment options available under the Pinnacle Private Placement Annuity.

05

Specify the beneficiary details for the annuity in case of your passing.

06

Review the terms and conditions of the annuity carefully.

07

Sign the application form to certify that all information is accurate.

08

Submit the completed application form along with any required identification documents to Pinnacle or your financial advisor.

Who needs Pinnacle Private Placement Annuity?

01

Investors looking for tax-efficient investment strategies.

02

Individuals seeking a flexible retirement planning product.

03

High-net-worth individuals wanting to diversify their investment portfolios.

04

Those interested in alternative investments within a structured annuity format.

05

People seeking to create a legacy or provide financial support for beneficiaries.

Fill

form

: Try Risk Free

People Also Ask about

What happens to a variable annuity if the stock market crashes?

Variable annuities carry more risk A variable annuity may give you various investment options to choose from. As such, you could benefit from greater returns. On the other hand, you could also experience losses as well, making this option riskier if there's a market crash.

How much does a $100k annuity pay per month?

The bottom line A $100,000 annuity can provide you with a monthly income of between roughly $525 and just over $1,000, depending on your age, the payout structure and the features you select.

What are private placement annuities?

Private Placement Variable Annuities (PPVAs) and Private Placement Life Insurance (PPLI) are insurance solutions that offer. high net worth investors a way to participate in hedge funds and other alternative investments without incurring current tax. liability each year.

Are life annuities good?

Benefits of an annuity Annuities are the only financial product that can provide you with guaranteed lifetime income and ensure that you are never at risk of outliving your savings. You can choose other types of disbursements, but lifetime income is most commonly chosen.

What is an AXA annuity?

Buying an annuity gives you a regular monthly payment from an insurer. They will look at the value of your Account and your age and then, based on that and the options you choose, will agree to pay you a set amount each month for the rest of your life.

Why would anyone buy a variable annuity?

A variable annuity may be attractive if you want retirement income with the opportunity for higher returns and have a higher risk tolerance. Income in retirement: Like other annuities, variable annuities offer an income stream in retirement and beyond if you choose.

What are the downsides of a variable annuity?

The benefits of a variable annuity include tax-deferred growth, guaranteed income in retirement, and a death benefit for beneficiaries. The downsides are complexity, layered fees, and withdrawal penalties.

Can variable annuities lose money?

Variable annuities have greater potential for earnings growth but they can also lose money. They also tend to be riddled with fees, which cuts into profits. Fixed annuities typically pay out at a lower but stable rate compared to variable annuities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Pinnacle Private Placement Annuity?

Pinnacle Private Placement Annuity is a specialized financial product that combines the benefits of an annuity with private placement investment options, allowing individuals to invest in private securities while enjoying tax-deferred growth.

Who is required to file Pinnacle Private Placement Annuity?

Individuals and entities that invest in Pinnacle Private Placement Annuities may be required to file relevant documentation with tax authorities, particularly if they are subject to specific tax reporting requirements or if there are changes in their investment status.

How to fill out Pinnacle Private Placement Annuity?

To fill out a Pinnacle Private Placement Annuity, investors need to provide personal identification information, investment preferences, and pertinent financial details on the application form, ensuring compliance with industry regulations and guidelines.

What is the purpose of Pinnacle Private Placement Annuity?

The primary purpose of Pinnacle Private Placement Annuity is to provide investors with the ability to access private investment opportunities while benefiting from the tax advantages associated with annuities, thereby enhancing their overall investment strategy.

What information must be reported on Pinnacle Private Placement Annuity?

Information that must be reported on Pinnacle Private Placement Annuity includes details of the annuity contract, investment earnings, beneficiary designations, and any income distributions made during the reporting period, along with compliance with relevant tax laws.

Fill out your pinnacle private placement annuity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pinnacle Private Placement Annuity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.