Get the free Standard Insurance Company Group Life Amendment - insurance arkansas

Show details

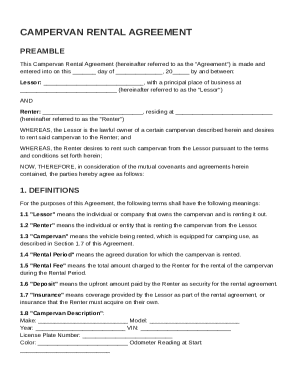

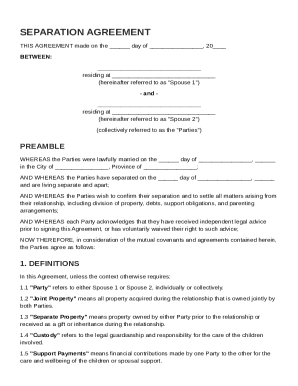

This document is a filing for the amendment of the Group Life Insurance product, specifically the Group Term Life insurance policy and certificate, including updates to the language regarding the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign standard insurance company group

Edit your standard insurance company group form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your standard insurance company group form via URL. You can also download, print, or export forms to your preferred cloud storage service.

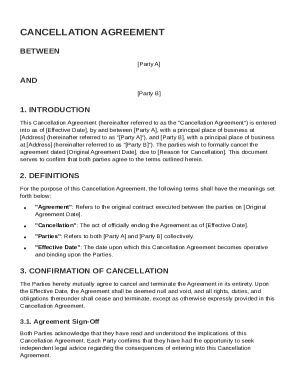

Editing standard insurance company group online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit standard insurance company group. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

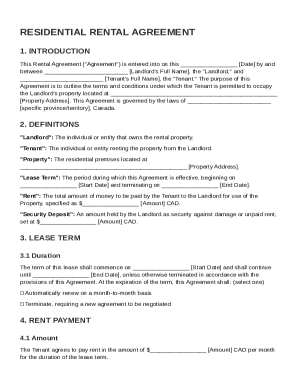

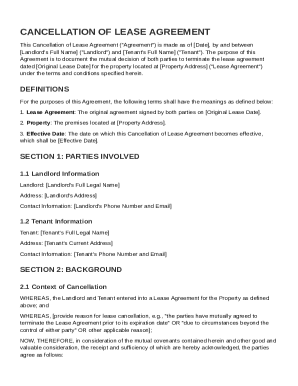

How to fill out standard insurance company group

How to fill out Standard Insurance Company Group Life Amendment

01

Begin by obtaining the Standard Insurance Company Group Life Amendment form.

02

Read the instructions accompanying the form carefully.

03

Fill in your personal information in the designated sections (name, address, date of birth, etc.).

04

Provide details regarding your existing insurance coverage, if applicable.

05

Indicate any changes you wish to make to your current insurance policy.

06

Review the amendment for accuracy to ensure all information is correct.

07

Sign and date the form where indicated.

08

Submit the completed form to your insurance provider as instructed.

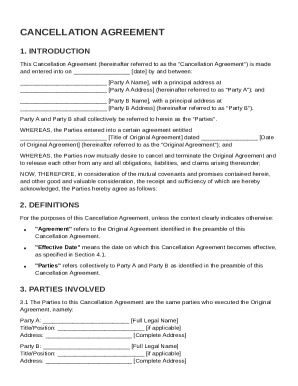

Who needs Standard Insurance Company Group Life Amendment?

01

Employees covered by a group insurance plan who wish to update or amend their life insurance coverage.

02

Individuals who have experienced changes in circumstances that affect their insurance needs.

03

Dependents who might need to be added or removed from the existing policy.

Fill

form

: Try Risk Free

People Also Ask about

What happens if an employer decides to cancel a group life insurance plan?

In summary, if your employer terminates the group life insurance policy, your coverage will end. You may have the option to convert to an individual policy or port your coverage, but these usually come with higher premiums and strict deadlines.

Can you opt out of term life insurance?

If you just bought your policy, you can back out during the “free look” period and receive a full refund. Free look periods vary by state but typically last 10 to 30 days. You have term life insurance you no longer want. You can simply stop paying premiums and walk away.

Can you opt out of group term life insurance?

Group term policies are not portable: When you leave your employer, you'll lose your coverage, However, you may have the option to convert your policy into an individual policy as long as you apply with the insurer within 31 days.

How do life insurance companies make money if everyone dies?

How long do I have to convert my group life coverage to an individual life insurance policy? You have 31 days from the date your group life coverage terminated or reduced.

Do I get money back if I cancel my term life insurance?

By law, if you cancel a term life insurance policy within 30 days of purchasing it, the company must refund any money you paid. In addition, if you pay some of your premiums ahead of schedule and then cancel your policy, the company should return those early pre-payments.

What are amendments in life insurance?

Life Insurance Glossary Topic. An official document that applies corrections or revisions to an insurance policy. The amendment is authorized by the insurer/insurance company and the policy owner and becomes part of the policy.

Is group term life insurance optional?

Group term life is often a part of employee benefits packages, and there are a number of payment options employers can use. Typically, an employer pays most, if not all, of the premiums, but the employer can also split the cost with employees, or even make it 100% voluntary (paid by employees) to offset costs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

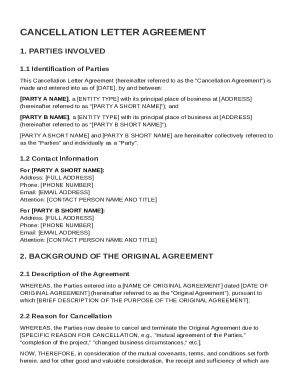

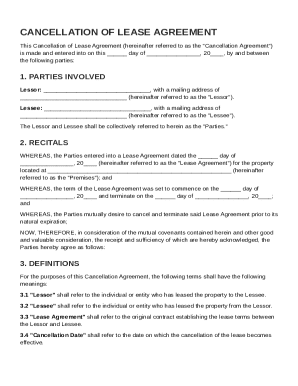

What is Standard Insurance Company Group Life Amendment?

The Standard Insurance Company Group Life Amendment is a legal document that modifies the details of a group life insurance policy, typically to reflect changes in coverage, beneficiaries, or terms of the policy.

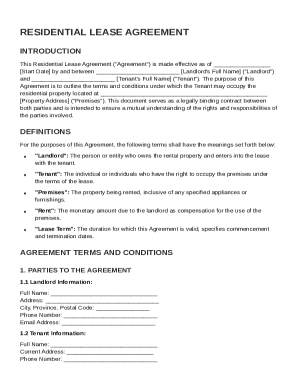

Who is required to file Standard Insurance Company Group Life Amendment?

The insurance policyholder or administrator, usually a business or organization that holds the group life insurance policy, is required to file the Standard Insurance Company Group Life Amendment.

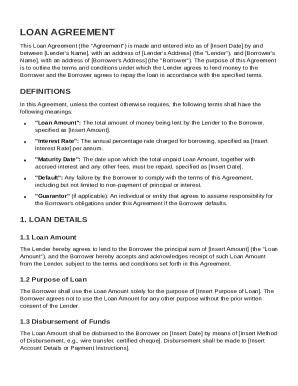

How to fill out Standard Insurance Company Group Life Amendment?

To fill out the Standard Insurance Company Group Life Amendment, you should provide accurate information regarding the policy number, details of the changes being made, signatures from authorized individuals, and date of the amendment.

What is the purpose of Standard Insurance Company Group Life Amendment?

The purpose of the Standard Insurance Company Group Life Amendment is to legally document and implement changes to an existing group life insurance policy, ensuring that all parties are informed and that the coverage remains valid.

What information must be reported on Standard Insurance Company Group Life Amendment?

The information that must be reported on the Standard Insurance Company Group Life Amendment includes the policy number, names of the insured individuals, specific changes being made, dates, and signatures of authorized representatives.

Fill out your standard insurance company group online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Standard Insurance Company Group is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.