Get the free Application for Life Insurance, et al - insurance arkansas

Show details

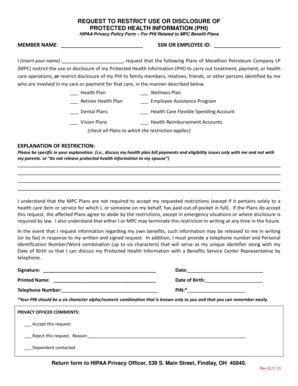

This document serves as the application form for life insurance, detailing the necessary information required for the underwriting process and illustrating the changes to various existing forms.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for life insurance

Edit your application for life insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for life insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for life insurance online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit application for life insurance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for life insurance

How to fill out Application for Life Insurance, et al

01

Read the instructions carefully before starting.

02

Gather all necessary documents and information, such as identification, financial information, and health history.

03

Complete personal information section, including name, address, and date of birth.

04

Provide details about your health, including any pre-existing conditions and medications.

05

Select the type and amount of coverage you need.

06

Fill out any beneficiary information, specifying who will receive the benefits.

07

Review the completed application for accuracy.

08

Sign and date the application.

09

Submit the application according to the insurer's instructions.

Who needs Application for Life Insurance, et al?

01

Individuals seeking financial protection for their dependents after their death.

02

Parents or guardians wanting to secure their children's future.

03

People with financial obligations, such as a mortgage or loans.

04

Anyone looking to cover funeral and burial expenses.

05

Individuals aiming to leave a legacy or inheritance.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to hear back from a life insurance claim?

As long as the required paperwork is in order and the policy isn't being contested, a life insurance claim can often be paid within 30 days of the death of the insured. However, each claim is different and there may be state regulations that require additional processing time.

How long does it take for a life insurance application to be approved?

How long does the underwriting process take for life insurance? Once the application and medical exam are completed, it can take as little as 24 hours. But the life insurance company will commonly set an expectation of 4 to 6 weeks.

How long does it take for insurance to approve an application?

Insurance Company Review (4-8 Weeks) Once verification is complete, the insurance company reviews the application in detail. This includes checking compliance with their internal standards. The time frame is usually 4-8 weeks but can vary based on the thoroughness of their review process.

What not to say when applying for life insurance?

There are numerous ways in which people will intentionally provide incorrect information on life insurance applications. For example, applicants might lie about their age, income, weight, medical conditions, family medical history, hobbies or occupation.

What is required on a life insurance application?

Your first step is applying for life insurance coverage with a broker, agent, or directly with an insurance company. The application will ask for basic information such as your name, address, occupation, and employer. It will also typically ask for the following personal information: Height.

What are the 4 types of life insurance?

There are four primary types of life insurance: term, whole, endowment, and Unit-Linked Insurance Plans (ULIPs).

How long does it take to get approved for life insurance?

The average time from the receipt of your application to receipt of your insurance certificate is six to eight weeks. This depends on how quickly the insurance company's underwriter can obtain the necessary medical information and, if needed, financial documents to assess your application.

What life insurance takes effect immediately?

Instant life insurance is a type of guaranteed issue policy that allows you to get approved shortly after you apply. You can apply with no medical exam. You won't have to wait days, weeks, or months for a decision and your coverage typically begins almost immediately if there is no waiting period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Life Insurance, et al?

An Application for Life Insurance is a formal request to an insurance company for coverage and includes personal information, health history, and other relevant details to assess eligibility and risk.

Who is required to file Application for Life Insurance, et al?

Individuals seeking life insurance coverage are required to file an Application for Life Insurance. This typically includes the policyholder and may also require information from family members depending on the policy.

How to fill out Application for Life Insurance, et al?

To fill out the Application for Life Insurance, complete all required sections truthfully, including personal information, health history, lifestyle choices, and beneficiaries. Be thorough and ensure all information is accurate.

What is the purpose of Application for Life Insurance, et al?

The purpose of the Application for Life Insurance is to gather necessary information that helps insurers assess risk, determine the premium, and decide whether to issue the policy.

What information must be reported on Application for Life Insurance, et al?

The information required typically includes personal identification details, medical history, lifestyle habits (such as smoking or alcohol use), existing insurance coverage, and beneficiary information.

Fill out your application for life insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Life Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.