Get the free Group Annuity Submission - insurance arkansas

Show details

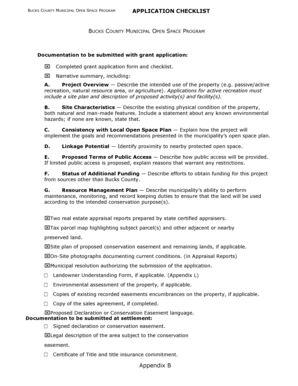

This document consists of various forms related to the submission of a group annuity contract for Great-West Life & Annuity Insurance Company, including details about product types, compliance certifications,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign group annuity submission

Edit your group annuity submission form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your group annuity submission form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing group annuity submission online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit group annuity submission. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out group annuity submission

How to fill out Group Annuity Submission

01

Obtain the Group Annuity Submission form from the relevant financial institution or online portal.

02

Read the instructions carefully to ensure you understand all requirements.

03

Fill in the basic information section, including your name, contact details, and the group's identification number.

04

Provide details regarding the group members, including names, ages, and any relevant identification numbers.

05

Specify the type of annuity product being requested and any special requirements related to it.

06

Attach any necessary documents, such as identification or proof of group membership.

07

Review the submitted form for accuracy and completeness.

08

Sign and date the form where indicated.

09

Submit the form through the specified method (mail, online, etc.).

10

Keep a copy of the submission for your records.

Who needs Group Annuity Submission?

01

Organizations offering retirement plans for employees.

02

Employers looking to secure retirement income for their workforce.

03

Financial advisors assisting clients with group annuity products.

04

Insurance companies providing group annuity products.

Fill

form

: Try Risk Free

People Also Ask about

What is the downside of an annuity?

Group Annuities limit investment choices, focusing on fixed returns. 401(k)s allow self-directed investment in stocks, bonds, and mutual funds.

What is a group annuity policy?

What is a group annuity? An Annuity provides you with a guaranteed income stream for life on the same terms as your pension plan. A Group Annuity is a solution offered to Defined Benefit pension plan sponsors who wish to remove some of the financial risk associated with pension plans.

How does a group annuity work?

A group annuity contract is an annuity that's purchased by a company on behalf of its employees. Many employers include annuities as part of a retirement benefits package to offer their employees a guaranteed stream of income once they stop working.

How much does a $100 000 annuity payout per month?

The bottom line. A $100,000 annuity can provide you with a monthly income of between roughly $525 and just over $1,000, depending on your age, the payout structure and the features you select.

What is an example of a group annuity?

An annual increase of a retirement benefit payment if provided for by the group annuity contract. For example, a $100 monthly retirement benefit with a 3% COLA would subsequently pay $103 per month after the first year, $106.09 per month after the second year, and so forth.

What is the difference between a 401k and a group annuity?

Group Annuities limit investment choices, focusing on fixed returns. 401(k)s allow self-directed investment in stocks, bonds, and mutual funds.

How much does a $100 000 annuity payout per month?

The bottom line. A $100,000 annuity can provide you with a monthly income of between roughly $525 and just over $1,000, depending on your age, the payout structure and the features you select.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Group Annuity Submission?

Group Annuity Submission is a process by which insurance companies submit information regarding group annuity contracts to regulatory authorities for compliance and oversight.

Who is required to file Group Annuity Submission?

Insurance companies that issue group annuity contracts are required to file Group Annuity Submission with the relevant regulatory authorities.

How to fill out Group Annuity Submission?

To fill out Group Annuity Submission, companies must provide accurate and complete information regarding the group annuity contracts, including details about contract holders, payment schedules, and benefits offered.

What is the purpose of Group Annuity Submission?

The purpose of Group Annuity Submission is to ensure that insurance companies comply with regulatory requirements, protecting the interests of contract holders and maintaining the stability of the insurance market.

What information must be reported on Group Annuity Submission?

The information that must be reported includes contract details, financial information, participants' data, premium payments, and any changes to the contract terms.

Fill out your group annuity submission online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Group Annuity Submission is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.