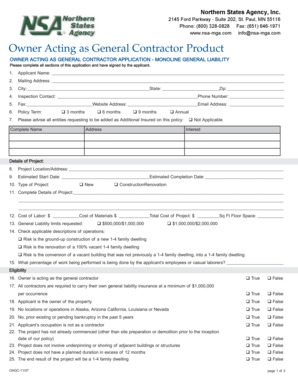

Get the free AGLA 91008 R Critical Illness Policy - insurance arkansas

Show details

This document outlines the terms and provisions of the AGLA 91008 R Critical Illness Policy, including coverage for specific critical illnesses, exclusions, benefits, and application details.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign agla 91008 r critical

Edit your agla 91008 r critical form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your agla 91008 r critical form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit agla 91008 r critical online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit agla 91008 r critical. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out agla 91008 r critical

How to fill out AGLA 91008 R Critical Illness Policy

01

Obtain the AGLA 91008 R Critical Illness Policy application form.

02

Read the instructions carefully to understand the required information.

03

Fill in your personal details, including name, address, date of birth, and contact information.

04

Provide any previous medical history or current health status as required.

05

Specify the types and amounts of coverage you wish to apply for.

06

Review the policy terms and conditions thoroughly.

07

Sign and date the application form.

08

Submit the completed application to the appropriate insurance representative or agency.

Who needs AGLA 91008 R Critical Illness Policy?

01

Individuals seeking financial protection in the event of a critical illness.

02

Families who want to ensure that their loved ones are financially secure during health crises.

03

Workers in high-risk occupations that may be more prone to critical health issues.

04

People with a family history of critical illnesses who want to mitigate potential financial burdens.

Fill

form

: Try Risk Free

People Also Ask about

What is the average payout for critical illness?

Critical illness insurance is a supplemental health insurance plan that typically offers a lump sum, such as $25,000 or $50,000, if you're diagnosed with a critical illness.

How much is critical illness worth?

The benefit is usually half the amount of the full specified illness cover or capped at around €25,000, whichever is lower. Partial specified illness payments are also halved or capped at around €7,500.

What is the average critical illness payout?

Yvonne Braun, Director of Policy, Long Term Savings, Health and Protection at the ABI, said: ProductsNew Claims PaidAverage value of claims paid** Critical Illness 19,876 £68,354 Life 48,782 £80,403 Total Permanent Disability 454 £73,921 Whole of Life 211,088 £5,7602 more rows • Sep 2, 2024

What is covered by AIG critical illness?

It can be used to help pay off a mortgage, provide a legacy or financial protection for a family member or friend. Critical illness conditions covered are: • Cancer - excluding less advanced cases; • Heart attack - of specified severity; and • Stroke - of specified severity.

How much do you get paid for critical illness?

The payout can help you pay for costs like expensive treatments and everyday expenses while you recover. While each policy is unique, many come with lump sum payments like $25,000 or $50,000.

Is critical illness cover worth buying?

Deciding whether critical illness cover is a worthwhile investment is a highly personal decision. It depends on your individual circumstances, lifestyle, and financial situation. Things to consider before taking out cover include: Your financial situation: What expenses would you need to cover if you couldn't work?

What is covered in a critical illness policy?

Critical illness insurance can provide financial protection in the event of a major health emergency, such as a heart attack, stroke, or organ failure.

What is the maximum benefit for critical illness?

What is covered by Critical Illness insurance? It's simple. You choose 1 of 5 Maximum Lifetime Benefit amounts: $10,000, $20,000, $30,000, $40,000 or $50,000. Your benefit pays out upon first diagnosis of a qualifying illness experienced at least 30 days after the plan becomes effective.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is AGLA 91008 R Critical Illness Policy?

AGLA 91008 R Critical Illness Policy is an insurance policy designed to provide financial protection to policyholders in the event of a critical illness diagnosis. It typically offers a lump-sum benefit that can be used to cover medical expenses, lost income, or other financial needs arising from the critical illness.

Who is required to file AGLA 91008 R Critical Illness Policy?

Policyholders or their designated representatives are required to file AGLA 91008 R Critical Illness Policy to ensure the coverage is activated and claims can be processed in the event of a critical illness.

How to fill out AGLA 91008 R Critical Illness Policy?

To fill out the AGLA 91008 R Critical Illness Policy, individuals must complete the application form with accurate personal information, including name, address, age, health history, and any other relevant details as outlined in the form. It is also important to review the terms and conditions before submission.

What is the purpose of AGLA 91008 R Critical Illness Policy?

The purpose of AGLA 91008 R Critical Illness Policy is to provide financial security to individuals diagnosed with critical illnesses. It helps alleviate the financial burden related to medical treatments, recovery costs, and everyday expenses during a critical health crisis.

What information must be reported on AGLA 91008 R Critical Illness Policy?

The information that must be reported on AGLA 91008 R Critical Illness Policy includes the policyholder's personal details, medical history, specific critical illnesses covered under the policy, and any relevant financial information required for processing claims.

Fill out your agla 91008 r critical online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Agla 91008 R Critical is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.