Get the free Group Annuity Contract - insurance arkansas

Show details

This document serves as a contractual agreement for group annuity products offered by John Hancock Life Insurance Company (U.S.A.), including details on various provisions, contribution handling,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign group annuity contract

Edit your group annuity contract form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your group annuity contract form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing group annuity contract online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit group annuity contract. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

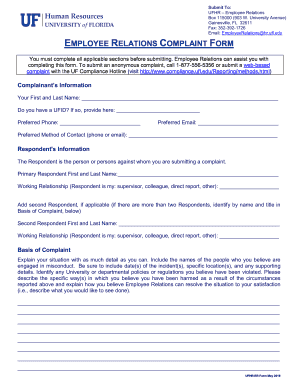

How to fill out group annuity contract

How to fill out Group Annuity Contract

01

Gather all necessary information about the group members, such as names, ages, and beneficiaries.

02

Review the terms and conditions of the annuity contract to understand the coverage and benefits.

03

Complete the application form with accurate details, ensuring all sections are filled out correctly.

04

Specify the desired payout options, including whether payments will be fixed or variable.

05

Indicate the start date for annuity payments.

06

Provide any additional documentation required, such as identification or financial information.

07

Review the completed contract for accuracy before submitting.

08

Submit the contract to the insurance provider along with any required payments.

Who needs Group Annuity Contract?

01

Employers looking to provide retirement benefits to their employees.

02

Organizations or associations that want to offer group retirement savings plans.

03

Groups of individuals seeking a collective investment vehicle for retirement planning.

04

Nonprofit organizations that wish to help their members secure financial stability in retirement.

Fill

form

: Try Risk Free

People Also Ask about

What is the biggest disadvantage of an annuity?

Buying an annuity at age 70 may bring a steady income, but the value depends on your lifespan and the annuity's terms. The decision to buy an annuity at 70 is complex and hinges on an individual's unique financial situation and retirement goals.

Can you cash out a group annuity?

Most annuity companies allow you to cash out, or surrender, the contract for its current value, or withdraw a portion of the accumulated funds before income payments begin. However, surrender charges will be deducted from the amount you receive.

How much income will a 100k annuity generate?

High expenses and commissions Cost is one of the biggest drawbacks of annuities. Expenses erode the owner's payouts, especially on a variable annuity in which the value depends on the investment returns.

What is the difference between a pension and a group annuity?

With a group annuity, you pay a lump sum up front and the insurance company makes the payments to your employees. With a pension, lower-than expected earnings can keep you from being able to save the proper funds needed to pay.

What is the monthly return on a 100k annuity?

The bottom line. A $100,000 annuity can provide you with a monthly income of between roughly $525 and just over $1,000, depending on your age, the payout structure and the features you select.

How much does a $100 000 annuity payout per month?

The bottom line. A $100,000 annuity can provide you with a monthly income of between roughly $525 and just over $1,000, depending on your age, the payout structure and the features you select.

What is the downside of a spia annuity?

Some of the advantages of SPIAs include simplicity, lower fees, and guaranteed income, but the tradeoff is loss of control over the money. Your age and other factors can influence the taxation of your annuity payments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Group Annuity Contract?

A Group Annuity Contract is a financial agreement that provides a stream of payments to a group of individuals, typically employees of an organization, in exchange for a lump sum payment made by the employer or a trust.

Who is required to file Group Annuity Contract?

Employers or plan administrators who offer a group annuity plan to their employees are typically required to file the Group Annuity Contract with the relevant regulatory bodies.

How to fill out Group Annuity Contract?

To fill out a Group Annuity Contract, one must provide details such as the name of the company, the insured group, the amount of premium, the type of annuity, and any specific terms or conditions applicable to the contract.

What is the purpose of Group Annuity Contract?

The purpose of a Group Annuity Contract is to provide a structured retirement income solution for members of a group, ensuring financial security during retirement by converting accumulated assets into regular income payments.

What information must be reported on Group Annuity Contract?

Information that must be reported on a Group Annuity Contract includes participant demographics, funding details, benefit payment terms, insurance company information, and compliance with regulatory requirements.

Fill out your group annuity contract online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Group Annuity Contract is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.