Get the free Homeowners Program - insurance arkansas

Show details

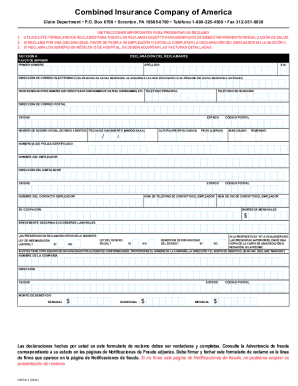

This document outlines the filing for a rate increase for the Homeowners Program by Foremost Insurance Company Grand Rapids, Michigan, including details about the filing, rate adjustments, and coverage

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign homeowners program - insurance

Edit your homeowners program - insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your homeowners program - insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit homeowners program - insurance online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit homeowners program - insurance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out homeowners program - insurance

How to fill out Homeowners Program

01

Gather necessary documents such as proof of ownership, tax records, and property details.

02

Visit the official website or the local authority’s office for the Homeowners Program.

03

Complete the application form provided, ensuring all information is accurate.

04

Attach the required documents to your application.

05

Review your application for completeness and accuracy.

06

Submit the application either online or in person as per instructions.

07

Wait for confirmation or additional requests from the reviewing authority.

Who needs Homeowners Program?

01

First-time homebuyers seeking financial assistance.

02

Low-income families needing help with homeownership costs.

03

Individuals looking to renovate or maintain their homes.

04

Homeowners facing difficulties in keeping their property due to financial strain.

05

Those interested in improving energy efficiency or making accessibility adjustments.

Fill

form

: Try Risk Free

People Also Ask about

How much does a first time home buyer need to put down in Illinois?

For a Fixed-Rate Conventional Mortgage, aim for a minimum of 20% down. If you put down less than 20%, you will be required to pay Private Mortgage Insurance (PMI) premiums monthly until your equity in the home reaches 20%.

Who is eligible for the homeowners assistance fund in Illinois?

To qualify for ILHAF, Illinois homeowners must meet the following criteria: Be past due on one or more of mortgage loan, property tax, property insurance and/or HOA/condo association fee payments. Have a household income at or below 150 percent Area Median Income.

What is the $7500 first-time home buyer grant in Illinois?

The IHDAccess Deferred Mortgage provides payment and closing cost assistance of up to 5% of the purchase price or $7,500, whichever is greater.

How to qualify for a first time home buyer grant in Illinois?

Requirements Buy a primary residence in Illinois. Meet IHDA income and purchase price limits. Minimum 640 credit score. Contribute $1,000 or 1 percent of the purchase price, whichever is greater. Complete a homebuyer education course.

What is the biggest negative when using down payment assistance?

Future costs: While assistance can help you secure your home with a smaller down payment, it might lead to a larger loan amount or higher interest rate. This, in turn, can result in higher monthly mortgage payments and potentially more interest paid over the life of the loan.

What is the 25k grant in New Mexico?

HELP assists income-qualified, first-time homebuyers with down payment assistance and closing costs. Up to $25,000 per homebuyer is available in Texas and New Mexico and up to $20,000 per homebuyer is available in Arkansas, Louisiana and Mississippi.

Is California giving $150,000 to first-time buyers?

How does the shared appreciation loan work? The program will provide a loan of up to 20% of the purchase price of a home or a maximum amount of up to $150,000. The money can be used to help finance a down payment, closing costs or a first-time mortgage.

Do I have to pay back down payment assistance?

The most valuable form of down payment assistance is the grant. That's because grants provide money that homeowners never have to repay since it's considered a gift.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Homeowners Program?

The Homeowners Program is a government initiative designed to provide financial assistance and support to homeowners for various purposes, such as home repairs, property tax relief, and mortgage assistance.

Who is required to file Homeowners Program?

Homeowners who meet specific eligibility criteria, such as income levels and property ownership status, are required to file for the Homeowners Program.

How to fill out Homeowners Program?

To fill out the Homeowners Program application, individuals must gather required documents, complete the application form accurately, and submit it to the relevant authorities, which can usually be done online or via mail.

What is the purpose of Homeowners Program?

The purpose of the Homeowners Program is to provide financial relief to homeowners, promote homeownership stability, and support community development.

What information must be reported on Homeowners Program?

Applicants must report personal information, property details, income levels, home equity, and any other relevant financial information as specified in the application guidelines.

Fill out your homeowners program - insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Homeowners Program - Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.