Get the free Accelerated Death Benefit Rider - insurance arkansas

Show details

This document outlines the terms and conditions of the Accelerated Death Benefit Rider provided by Monumental Life Insurance Company. It details the benefit amount, eligibility requirements, and conditions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accelerated death benefit rider

Edit your accelerated death benefit rider form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accelerated death benefit rider form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing accelerated death benefit rider online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit accelerated death benefit rider. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

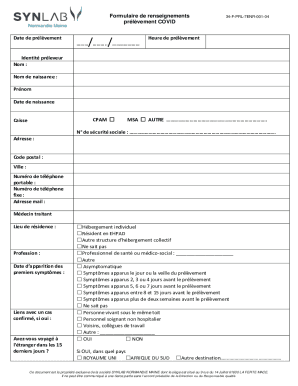

How to fill out accelerated death benefit rider

How to fill out Accelerated Death Benefit Rider

01

Review your life insurance policy to confirm that it includes an Accelerated Death Benefit Rider.

02

Obtain the necessary forms from your insurance provider for the Accelerated Death Benefit Rider.

03

Fill out the application form with your personal information and policy details.

04

Provide documentation of your qualifying medical condition as required by the insurer.

05

Submit the completed application and documentation to your insurance company.

06

Await approval from the insurance provider, which may involve an evaluation of your health status.

07

Once approved, review the terms and conditions related to the access of funds.

08

Decide how much of the benefit you wish to accelerate based on your needs.

Who needs Accelerated Death Benefit Rider?

01

Individuals diagnosed with terminal illnesses who need financial support for medical expenses.

02

Policyholders wishing to alleviate financial burdens on their families before death.

03

People who want to use a portion of their life insurance for care or treatment costs while still alive.

04

Those looking for options to access funds without taking out loans against their policy.

Fill

form

: Try Risk Free

People Also Ask about

What are the disadvantages of accelerated death benefit?

Its biggest limitation is that policyholders are required to be terminally ill, or in some cases, chronically ill. There are other options for policyholders who require care.

What qualifies for an accelerated death benefit?

An accelerated death benefit is usually a lump-sum payment you can use in any way you'd like to help alleviate financial stress during your final years. In many cases, you must have a terminal illness to qualify for this benefit. Many people use the funds for: Hospital bills.

What triggers the payment of accelerated death benefits?

Terminal illness, with death expected within a specified period, usually six months to one year. The occurrence of a specified catastrophic illness or the need for extraordinary medical intervention, such as an organ transplant, or the need for continuous life support.

What is an accelerated death benefit rider?

A: The accelerated benefits option or rider in a life insurance policy provides that all -- or a portion of -- the policy's proceeds will be paid to the insured upon the occurrence of specified events.

What is acceleration of benefits for a rider?

When you die, the Combination Enhanced Death Benefit Rider gives your beneficiaries whichever is more: The contract value on the date we receive all required paperwork in good order. The total for all purchase payments made to your annuity, minus any surrendered amounts.

What is an enhanced death benefit rider?

Cons You must be terminally ill, or in some cases chronically ill, to qualify for accelerated death benefits. Generating a lump sum of cash with accelerated death benefits could change your financial status, possibly making you ineligible for Medicaid, Supplemental Social Security, or other benefits.

Why would an insurer pay accelerated benefits?

The Accelerated Benefits Option is a part of your life insurance coverage that allows you to receive a portion of your group life benefit before death if you've been diagnosed as having a terminal illness with a limited life expectancy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Accelerated Death Benefit Rider?

An Accelerated Death Benefit Rider is a provision in a life insurance policy that allows the policyholder to access a portion of the death benefit while they are still alive under certain circumstances, typically in the event of a terminal illness.

Who is required to file Accelerated Death Benefit Rider?

The policyholder or the insured individual who wishes to utilize the benefit typically needs to file for the Accelerated Death Benefit Rider.

How to fill out Accelerated Death Benefit Rider?

To fill out the Accelerated Death Benefit Rider, the policyholder must complete the application form provided by the insurance company, which typically includes personal information, a declaration of the terminal illness, and any required medical documentation.

What is the purpose of Accelerated Death Benefit Rider?

The purpose of the Accelerated Death Benefit Rider is to provide financial support to insured individuals facing terminal illnesses, allowing them to access funds for medical expenses or to fulfill other needs while still alive.

What information must be reported on Accelerated Death Benefit Rider?

Information that must be reported can include the policy number, the insured individual's medical condition, details of the terminal illness, the amount of the benefit requested, and any relevant medical documentation.

Fill out your accelerated death benefit rider online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accelerated Death Benefit Rider is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.