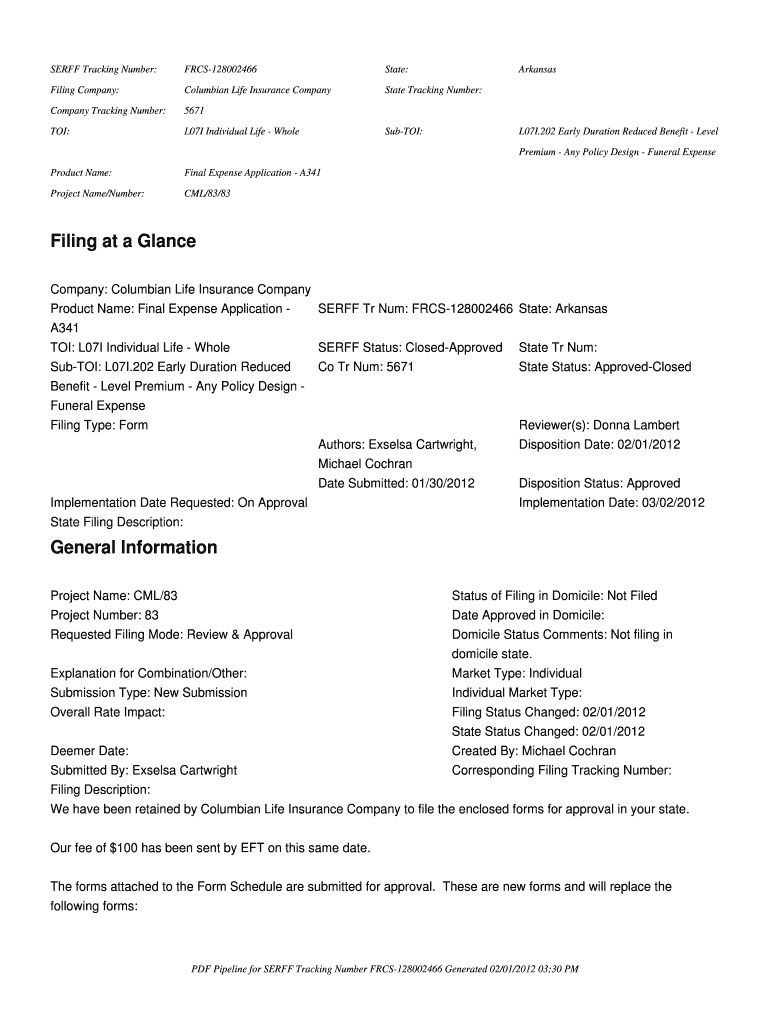

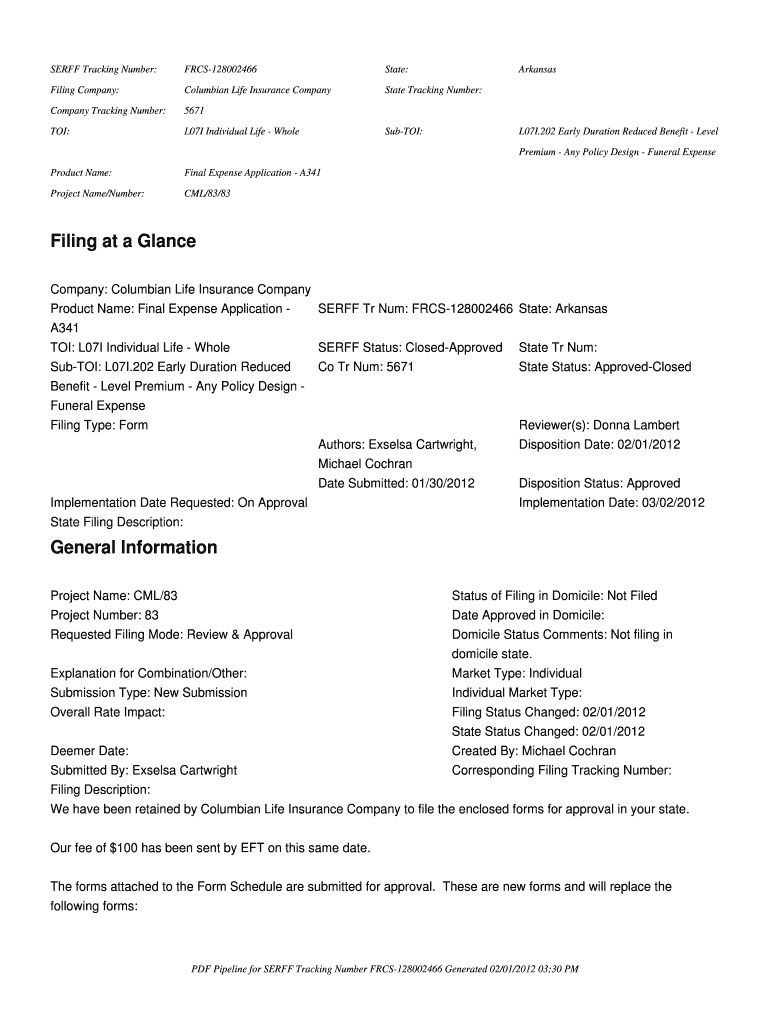

Get the free Final Expense Application - A341 - insurance arkansas

Show details

This document serves as an application for whole life insurance and reinstatement. It includes medical questions, terms, and conditions related to life insurance and compliance certifications.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign final expense application

Edit your final expense application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your final expense application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing final expense application online

Follow the steps down below to take advantage of the professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit final expense application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

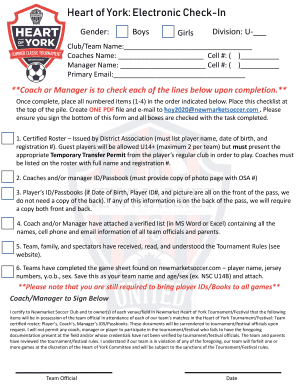

How to fill out final expense application

How to fill out Final Expense Application - A341

01

Begin by gathering personal information, such as the applicant's full name, address, and Social Security number.

02

Provide details about the applicant's date of birth and gender.

03

Specify the type of coverage desired, along with the coverage amount.

04

Fill out the beneficiary information, including the name and relationship to the applicant.

05

Answer health-related questions honestly regarding any pre-existing conditions or medications.

06

Review the application for completeness and accuracy before submission.

07

Sign and date the application where required.

Who needs Final Expense Application - A341?

01

Individuals who want to ensure their final expenses are covered after their passing.

02

Those looking for an affordable life insurance option to alleviate financial burdens on loved ones.

03

People with limited savings or resources who wish to secure funding for funeral and burial costs.

Fill

form

: Try Risk Free

People Also Ask about

At what age should you buy final expense insurance?

At what age should you buy final expense insurance? You can buy a final expense insurance policy at any age. However, these policies are often designed for adults who are 50 to 85 years old.

Is final expense worth it?

Final expense insurance can be a great way to help protect your loved ones with a small payout upon your death. They can use the funds to pay for any final costs and other expenses while they grieve.

How much does a final expense policy cost?

The Cost Of Final Expense Insurance. The average cost for a burial insurance policy is approximately $50-$100 monthly for roughly $10,000 in coverage. Multiple factors determine the net price, including your exact age, health, tobacco usage (if any), the type of policy, state of residence, and how much coverage you buy

What is the best funeral plan company?

A comparison of funeral plans from leading providers Funeral plan providerSingle payment starts fromFeefo or Trustpilot rating Golden Charter £3,730 4.6 Golden Leaves £3,769 4.7 Open Prepaid Funerals £3,350 NK With Grace £3,475 4.96 more rows

What is the best company to get whole life insurance from?

Best Whole Life Insurance Companies of 2025 Best Whole Life Insurance Companies. Best Overall: USAA. Best for Policy Options: MassMutual. Best for Coverage Amounts: Protective. Best for Benefits: Nationwide. Best for No-Exam Policies: Mutual of Omaha. Best for Age Range: State Farm.

Who is the #1 final expense insurance company?

State Farm, AARP and Mutual of Omaha are among our top picks for final expense policies. Burial insurance, also known as final expense or end-of-life insurance, can be a more affordable alternative to traditional life insurance.

What is the best final expense company?

State Farm, AARP and Mutual of Omaha are among our top picks for final expense policies. Burial insurance, also known as final expense or end-of-life insurance, can be a more affordable alternative to traditional life insurance.

What is the best life insurance for final expenses?

Best burial life insurance policies for March 2025 State Farm burial insurance policy details. Policy name: Guaranteed Issue Final Expense Life Insurance (known as $10,000 Whole Life in New York). AARP burial insurance policy details. American Family burial insurance policy details. Ethos burial insurance policy details.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Final Expense Application - A341?

Final Expense Application - A341 is a form used to apply for final expense insurance, which helps cover funeral and burial costs.

Who is required to file Final Expense Application - A341?

Individuals seeking coverage for final expenses, such as funeral costs, are required to file Final Expense Application - A341.

How to fill out Final Expense Application - A341?

To fill out Final Expense Application - A341, provide personal information, select desired coverage amounts, and include any necessary beneficiary details.

What is the purpose of Final Expense Application - A341?

The purpose of Final Expense Application - A341 is to formally request insurance coverage for final expenses, ensuring financial support for end-of-life costs.

What information must be reported on Final Expense Application - A341?

Information that must be reported includes the applicant's personal details, desired coverage amount, beneficiary information, and any health-related questions.

Fill out your final expense application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Final Expense Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.