Get the free Terrorism Disclosure - insurance arkansas

Show details

This document serves as a notice to policyholders regarding the inclusion of terrorism coverage in their workers' compensation policy, in compliance with the Terrorism Risk Insurance Act of 2007.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign terrorism disclosure - insurance

Edit your terrorism disclosure - insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your terrorism disclosure - insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing terrorism disclosure - insurance online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit terrorism disclosure - insurance. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

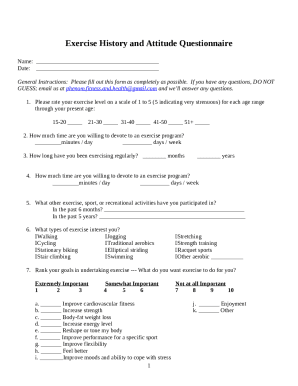

How to fill out terrorism disclosure - insurance

How to fill out Terrorism Disclosure

01

Obtain the Terrorism Disclosure form from the relevant authority or agency.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal information, including name, address, and contact details.

04

Specify the nature of your business or organization.

05

Provide details regarding any past incidents of terrorism related to your entity, if applicable.

06

Disclose any relevant information about your operations that may be impacted by terrorism risk.

07

Review all the information for accuracy and completeness.

08

Sign and date the form as required.

09

Submit the form to the designated authority by the specified deadline.

Who needs Terrorism Disclosure?

01

Organizations that are involved in sectors at higher risk of terrorism, such as insurance, finance, transportation, and large public gatherings.

02

Businesses that require insurance coverage for terrorism-related risks.

03

Entities seeking government contracts or funding that mandate a terrorism disclosure.

04

Any other organizations operating in environments susceptible to terrorist activities.

Fill

form

: Try Risk Free

People Also Ask about

What is the deductible for terrorism insurance?

Terrorism cover within Fire Insurance Policies, often referred to as “Terrorism Risk Insurance,” is designed to address losses incurred due to acts of terrorism. Terrorism cover in a Fire Insurance Policy typically includes coverage for a range of potential losses and damages caused by acts of terrorism.

What is terrorism passage in English?

The term “terrorism” was initially coined to describe the Reign of Terror, the period of the French Revolution from 5 September 1793 to 27 July 1794, during which the Revolutionary Government directed violence and harsh measures against citizens suspected of being enemies of the Revolution.

What is the Disclosure of the Terrorism Risk Insurance Act?

The Terrorism Risk Insurance Act, as amended, contains a $100 billion cap that limits U.S. Government reimbursement as well as insurers' liability for losses resulting from certified acts of terrorism when the amount of such losses exceeds $100 billion in any one calendar year.

What is the terrorism clause in insurance?

For the purpose of this cover, an act of terrorism means an act or series of acts, including but not limited to the use of force or violence and/or the threat thereof, of any person or group(s) of persons, whether acting alone or on behalf of or in connection with any organisation (s) or government(s),or unlawful

What is the terrorism coverage in insurance?

After these industry-wide thresholds are met, each individual insurer is responsible for a deductible equal to 20% of its premiums on TRIA-eligible lines of insurance. The Treasury would then reimburse the insurers 80% of their losses from the terrorist attack above this deductible.

What is covered under TRIA?

TRIA is limited to commercial property and casualty insurance. It does not cover losses in health or life insurance, nor does it is cover losses in personal property lines, such as homeowners insurance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Terrorism Disclosure?

Terrorism Disclosure is a reporting requirement designed to inform relevant authorities about any activities or transactions that may relate to terrorism or terrorist organizations.

Who is required to file Terrorism Disclosure?

Individuals and entities that engage in certain financial transactions or activities that could potentially be linked to terrorism are required to file Terrorism Disclosure.

How to fill out Terrorism Disclosure?

To fill out Terrorism Disclosure, one must provide detailed information about the transaction or activity, including the parties involved, the nature of the transaction, and any relevant dates.

What is the purpose of Terrorism Disclosure?

The purpose of Terrorism Disclosure is to enhance national security by preventing and detecting financing related to terrorism and to ensure compliance with regulatory requirements.

What information must be reported on Terrorism Disclosure?

Information that must be reported includes identifying details of the parties involved, transaction amounts, descriptions of the activities, and any other relevant data that would assist authorities in their investigations.

Fill out your terrorism disclosure - insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Terrorism Disclosure - Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.