Get the free Group Limited Payment Whole Life Insurance Certificate - insurance arkansas

Show details

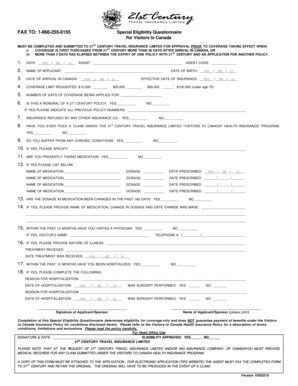

Este documento describe un certificado de seguro de vida a plazo limitado para grupos, emitido por Unity Financial Life Insurance Company, con detalles sobre beneficios, primas, y condiciones generales.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign group limited payment whole

Edit your group limited payment whole form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your group limited payment whole form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing group limited payment whole online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit group limited payment whole. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out group limited payment whole

How to fill out Group Limited Payment Whole Life Insurance Certificate

01

Obtain the Group Limited Payment Whole Life Insurance Certificate application form from your insurance provider.

02

Fill in the personal information sections including your name, address, and contact details.

03

Indicate the insurance coverage amount you wish to apply for.

04

Provide information about any other insurance policies you currently hold.

05

Designate beneficiaries by providing their names and relationships to you.

06

Carefully read the policy terms and conditions to understand the coverage and limitations.

07

Sign and date the application form to confirm the information is accurate.

08

Submit the completed application form to your insurance agent or the specified department.

Who needs Group Limited Payment Whole Life Insurance Certificate?

01

Individuals seeking financial security for their beneficiaries after passing.

02

Parents wanting to ensure their children's education and wellbeing are funded.

03

Business owners looking to provide benefits to key employees.

04

People who want to leave a legacy or make arrangements for funeral expenses.

05

Anyone interested in a life insurance policy that requires limited payments over a set period.

Fill

form

: Try Risk Free

People Also Ask about

What is a limited payment whole life insurance?

What is a limited payment life insurance policy? Limited payment life insurance is a form of whole life insurance that covers you for life, but only requires premium payments for a fixed policy term. As a result, it combines a fixed payment duration with the lifelong coverage and cash value of whole life insurance.

Until when will a limited pay policy provide coverage?

It offers coverage until death and builds tax-deferred cash value, usually at an accelerated rate.

How long does coverage continue on a limited pay whole life policy?

Key Features of Limited-Pay Life Insurance Fixed Premium Period: Payments are only required for a set duration, commonly 7, 10, 15, or 20 years. Lifelong Coverage: Coverage continues for the insured's lifetime, even after the premium payment period ends.

What is a certificate of insurance given to a group life policy?

Typically, each insured member of the group receives a certificate of insurance. This certificate states that the insured member of the group is covered under the master contract held by the employer. Also, the provisions of the group insurance are usually stated in the certificate of insurance.

How long does the coverage last on a limited pay life policy?

How it works. Premiums on limited payment life insurance are paid for a limited number of years, but the benefits last a lifetime. Premiums are payable for 10, 15 or 20 years depending on the policy selected. You can pay premiums monthly, quarterly, semi-annually or annually.

What does limited pay whole life insurance mean?

Limited pay life insurance is a type of whole life insurance. You pay premiums for a certain number of years, but the policy lasts your whole life. Although the yearly premiums for limited pay policies are higher than those for longer payment periods, the cash value of the policy may grow more quickly.

How long does the coverage normally remain on a limited?

The short answer to How Long Does the Coverage normally remain on a limited pay life policy is usually until age 100 or until death. However there is a more nuanced version of this.

Is there a certificate of insurance issued with a group policy?

In a group policy, a certificate of insurance is typically issued to an employer who then provides it to the employees to verify their coverage under the employer's group health plan. This certificate serves as evidence of insurance for the individuals covered under the policy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Group Limited Payment Whole Life Insurance Certificate?

Group Limited Payment Whole Life Insurance Certificate is a type of life insurance policy that provides coverage for a group where individuals pay premiums for a limited number of years, after which they receive lifelong protection without the need for further payments.

Who is required to file Group Limited Payment Whole Life Insurance Certificate?

Typically, the insurance provider or administrator of the group policy is required to file the Group Limited Payment Whole Life Insurance Certificate, ensuring compliance with insurance regulations and maintaining accurate records for the participating members.

How to fill out Group Limited Payment Whole Life Insurance Certificate?

To fill out the Group Limited Payment Whole Life Insurance Certificate, one must provide accurate personal information for each insured member, details about the coverage amount, premium payment schedules, and any other required declarations as stated by the insurance provider.

What is the purpose of Group Limited Payment Whole Life Insurance Certificate?

The purpose of the Group Limited Payment Whole Life Insurance Certificate is to offer financial protection to group members and their beneficiaries, ensuring that life insurance coverage is provided without the ongoing financial obligation of premium payments after a limited time.

What information must be reported on Group Limited Payment Whole Life Insurance Certificate?

The information that must be reported on the Group Limited Payment Whole Life Insurance Certificate includes the insured member's personal details (name, age, etc.), coverage amounts, premium payment instructions, beneficiary information, and any relevant policy terms or conditions.

Fill out your group limited payment whole online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Group Limited Payment Whole is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.