Get the free FIA510 Fixed Indexed Annuity - insurance arkansas

Show details

This document outlines the terms and conditions of the FIA510 Fixed Indexed Annuity, including details about the policy, benefits, withdrawal options, and death benefits.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fia510 fixed indexed annuity

Edit your fia510 fixed indexed annuity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fia510 fixed indexed annuity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fia510 fixed indexed annuity online

Follow the steps below to benefit from a competent PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit fia510 fixed indexed annuity. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

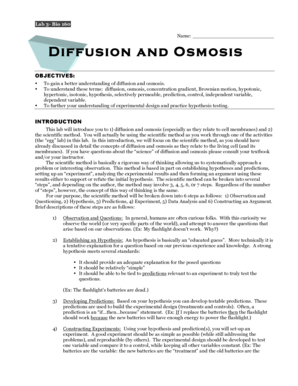

How to fill out fia510 fixed indexed annuity

How to fill out FIA510 Fixed Indexed Annuity

01

Gather necessary personal information, including your full name, date of birth, and Social Security number.

02

Determine your financial goals and investment needs to assess if FIA510 is suitable for you.

03

Review the product details and benefits outlined in the FIA510 brochure.

04

Complete the application form, ensuring all sections are filled out accurately.

05

Select the allocation options for your premium payments, considering your risk tolerance and market preferences.

06

Choose any optional riders or features that enhance the annuity, if applicable.

07

Sign and date the application form to confirm your agreement with the terms.

08

Submit the completed application to the issuing insurance company along with your initial premium payment.

Who needs FIA510 Fixed Indexed Annuity?

01

Individuals looking for a stable investment with potential for growth tied to a market index.

02

Those seeking a retirement income solution with guaranteed minimum returns.

03

Investors who want to protect their principal while benefiting from market upsides.

04

People concerned about outliving their savings and interested in longevity insurance.

05

Anyone who desires a predictable income stream in retirement while maintaining some level of market exposure.

Fill

form

: Try Risk Free

People Also Ask about

What is a FiA annuity?

Pfau's findings suggest that a fixed annuity calculated to cover minimum living expenses early in retirement is a good idea. It lets the retiree take a bit more risk with investment portfolio, investing more in stocks than they would be willing to do if they were depending completely on portfolio to live.

How much does a $100,000 fixed annuity pay per month?

One such tool is a fixed indexed annuity (FIA). With a FIA, you earn interest based in part on the upward movement of a stock market index, but you're protected from loss if the market goes down. FIAs also give you the option to create a stream of guaranteed income that can help supplement your other income sources.

Are FIAs a good investment?

FIAs can be excellent investments for the right situation. If you are retired or about to retire and using a bucket strategy then the FIA can be excellent for your 2nd bucket assets.

How do Fia annuities work?

FIAs are a type of annuity that earn interest based in part on any upward movement in one or more reference stock market indices, such as the S&P 500®. If the net change in the index in a given crediting period is positive, then you could earn interest credits.

What is the downside of a fixed index annuity?

The bottom line A $100,000 annuity can provide you with a monthly income of between roughly $525 and just over $1,000, depending on your age, the payout structure and the features you select.

What are the downsides of FIA?

Fixed Index Annuity Disadvantages: Ordinary income tax owed on earnings during the withdrawal or income payout stage. LIFO: Last in first out tax requirement so earnings are taxed first, unless annuitization takes place, which then uses a tax exclusion ratio. Fixed index annuities are not FDIC insured.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FIA510 Fixed Indexed Annuity?

The FIA510 Fixed Indexed Annuity is a type of insurance product that offers a combination of investment features and a guaranteed minimum payout. It provides a way for individuals to invest their savings while also ensuring a certain level of income in retirement.

Who is required to file FIA510 Fixed Indexed Annuity?

Individuals or entities that sell or issue FIA510 Fixed Indexed Annuities are typically required to file it, including insurance companies and financial advisors who offer these products to clients.

How to fill out FIA510 Fixed Indexed Annuity?

To fill out the FIA510 Fixed Indexed Annuity, provide accurate personal information, details of the annuity being purchased, including terms, conditions and investment options, and ensure all signatures and required documentation are complete.

What is the purpose of FIA510 Fixed Indexed Annuity?

The purpose of the FIA510 Fixed Indexed Annuity is to provide a secure means of retirement savings with the potential for growth linked to a stock market index, while also protecting the principal from market losses.

What information must be reported on FIA510 Fixed Indexed Annuity?

The FIA510 must report information such as the contractholder's identity, the annuity's terms, initial investment amount, projected returns, and any fees or charges associated with the annuity.

Fill out your fia510 fixed indexed annuity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

fia510 Fixed Indexed Annuity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.