Get the free Stop Loss Filing - insurance arkansas

Show details

This document outlines the filing for excess/stop loss insurance by Standard Security Life Insurance Company of New York, including details on the coverage, application procedures, exclusions, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign stop loss filing

Edit your stop loss filing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your stop loss filing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

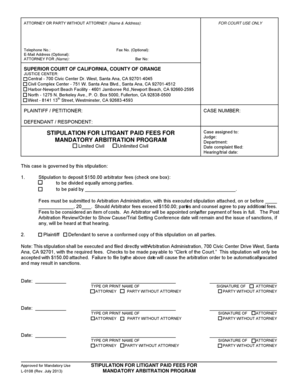

How to edit stop loss filing online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit stop loss filing. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

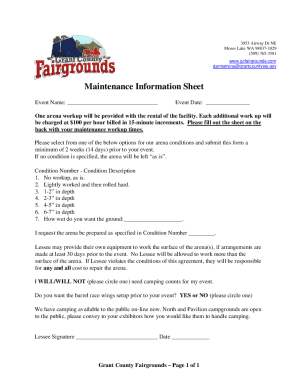

How to fill out stop loss filing

How to fill out Stop Loss Filing

01

Obtain the appropriate Stop Loss Filing form from your insurance regulatory authority.

02

Gather all necessary financial information, including claims history and policy details.

03

Complete the form with accurate and up-to-date information.

04

Calculate the stop-loss attachment point based on your risk tolerance and funding.

05

Include any required documentation or supporting information.

06

Review the form for completeness and accuracy.

07

Submit the filing to the relevant regulatory authority by the specified deadline.

Who needs Stop Loss Filing?

01

Employers offering self-funded health plans.

02

Insurance companies providing stop-loss coverage.

03

Healthcare organizations managing risk exposure in employee health benefits.

Fill

form

: Try Risk Free

People Also Ask about

What if an insured has a stop-loss limit of $5 000?

Stop-loss insurance doesn't pay bills directly. Instead, it reimburses the employer for costs that exceed the stop-loss limit. For instance, if an insured has a stop-loss limit of $5000, once the employer has paid $5000 in claims, the insurance kicks in to cover any additional eligible costs.

What is stop-loss with example?

A stoploss order is a buy/sell order placed to limit losses when there is a concern that prices may move against the trade. For instance, if a stock is purchased at ₹100 and the loss is to be limited at ₹95, an order can be placed to sell the stock as soon as its price reaches ₹95.

What is the purpose of a stop-loss?

A stop-loss order is a tool used by traders and investors to limit losses and reduce risk exposure. With a stop-loss order, an investor enters an order to exit a trading position that he holds if the price of his investment moves to a certain level that represents a specified amount of loss in the trade.

What is an example of a stop-loss claim?

For example, if an employer elects that their maximum liability per person on their benefits plan for that policy year be $100,000, and a specific claimant exceeds that liability and their total claims are $102,000, the stop-loss policy will reimburse them for claims in excess of that amount, the $2,000.

What if an insured has a stop loss limit of $5 000?

Stop-loss insurance doesn't pay bills directly. Instead, it reimburses the employer for costs that exceed the stop-loss limit. For instance, if an insured has a stop-loss limit of $5000, once the employer has paid $5000 in claims, the insurance kicks in to cover any additional eligible costs.

What is stop loss reporting?

Specific Stop-Loss is the form of excess risk coverage that provides protection for the employer against a high claim on any one individual. This is protection against abnormal severity of a single claim rather than abnormal frequency of claims in total. Specific stop-loss is also known as individual stop-loss.

What is an example of a stop loss claim?

For example, if an employer elects that their maximum liability per person on their benefits plan for that policy year be $100,000, and a specific claimant exceeds that liability and their total claims are $102,000, the stop-loss policy will reimburse them for claims in excess of that amount, the $2,000.

Is stop-loss insurance worth it?

What are the advantages of self-funding with stop-loss insurance? Self-funding with stop-loss insurance gives employers greater control and security over their health benefits. This can save your company money long term since you only pay for the healthcare services your employees actually use.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

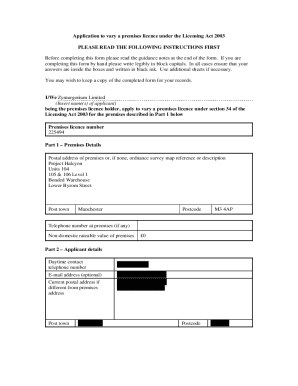

What is Stop Loss Filing?

Stop Loss Filing is a regulatory requirement where insurers report specific information about stop-loss insurance policies, which protect self-insured employers from high claims costs.

Who is required to file Stop Loss Filing?

Insurers that offer stop-loss insurance policies are required to file Stop Loss Filing.

How to fill out Stop Loss Filing?

To fill out Stop Loss Filing, insurers need to complete specific forms provided by the regulatory authority, including details about the policies, coverage amounts, and premiums.

What is the purpose of Stop Loss Filing?

The purpose of Stop Loss Filing is to ensure transparency in the insurance market and to protect consumers by ensuring that insurers adhere to regulatory standards.

What information must be reported on Stop Loss Filing?

Information that must be reported includes policyholder details, coverage limits, the effective date of the policy, premium amounts, and claims experience.

Fill out your stop loss filing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Stop Loss Filing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.