Get the free APERS MONTHLY RECONCILIATION - apers

Show details

This form is used for reporting the reconciliation of employee and employer contributions to the Arkansas Public Employees Retirement System (APERS) on a monthly basis.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign apers monthly reconciliation

Edit your apers monthly reconciliation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your apers monthly reconciliation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit apers monthly reconciliation online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit apers monthly reconciliation. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out apers monthly reconciliation

How to fill out APERS MONTHLY RECONCILIATION

01

Gather all necessary payroll and accounting documents.

02

Access the APERS (Arkansas Public Employees Retirement System) reporting platform.

03

Navigate to the Monthly Reconciliation section.

04

Enter the total contributions for the month from payroll records.

05

Verify employee and employer contribution amounts.

06

Check for any adjustments or corrections from previous months.

07

Include any additional contributions or deductions that apply.

08

Review all entries for accuracy before final submission.

09

Save and submit the reconciliation for processing.

Who needs APERS MONTHLY RECONCILIATION?

01

Employers who sponsor retirement plans for their employees.

02

Payroll departments in organizations with APERS-affiliated employees.

03

Human resources personnel managing employee benefits.

04

Financial personnel handling record-keeping and compliance.

Fill

form

: Try Risk Free

People Also Ask about

How long do you have to work for the state of Arkansas to retire?

If you are vested for an APERS benefit (you have five years of actual service), you are entitled to a retirement annuity upon meeting eligibility criteria. For most individuals, applying for normal retirement without any reduction for age or service is possible at age 65 or at any age with 28 years of actual service.

How long do you have to work for the state to retire with benefits?

Service retirement is a lifetime benefit. In general, you can retire at age 50 with five years of service credit unless all service was earned on or after January 1, 2013. After that, you must be at least 52 to retire.

How do you calculate apers?

Your straight life annuity benefit is calculated by multiplying your Final Average Compensation (FAC) by 1.66% and your years of credited service. It is then adjusted downward if you choose an annuity option other than straight life or if you are retiring early.

Can you retire from a government job after 10 years?

US federal jobs have a vesting period of 5 years, not 10. You would be able to start drawing from it at age 62. However, I agree with everyone else on here saying that it's a risky move to give up a state job and switch to federal in the current political climate.

How many years do you have to work for the state of Arkansas to retire?

ELIGIBILITY/QUALIFICATIONS Any active or inactive member who attains age 60 and has five (5) or more years of actual and reciprocal service may voluntarily retire upon written application filed with the System. B.

What is the retirement age for Apers in Arkansas?

For most individuals, applying for normal retirement without any reduction for age or service is possible at age 65 or at any age with 28 years of actual service.

How to withdraw money from Apers?

Members frequently ask if they can withdraw from, add to, or borrow against their retirement accounts. The answer to all of these is “no.” The only way you can get money from APERS is to retire or to terminate your covered employment.

What is the minimum working years for retirement?

Social Security and Medicare in Retirement The Social Security system is set up to start providing monthly benefits as early as age 62. If you start working at age 18, you'll be eligible after working for 44 years.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APERS MONTHLY RECONCILIATION?

APERS MONTHLY RECONCILIATION is a financial report that helps reconcile monthly contributions and deductions related to the Arkansas Public Employees Retirement System (APERS). It ensures that all transactions are accurately accounted for and reflects the financial status of retirement contributions for a specific period.

Who is required to file APERS MONTHLY RECONCILIATION?

Employers who have employees participating in the Arkansas Public Employees Retirement System (APERS) are required to file the APERS MONTHLY RECONCILIATION. This includes state agencies, municipalities, and other organizations that employ public workers covered by APERS.

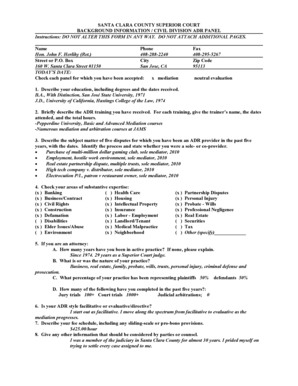

How to fill out APERS MONTHLY RECONCILIATION?

To fill out the APERS MONTHLY RECONCILIATION, employers must complete a designated reconciliation form, providing necessary details such as the total contributions made, employee information, and any adjustments for the month. It is important to ensure that all figures are accurate and all required fields are filled out correctly before submission.

What is the purpose of APERS MONTHLY RECONCILIATION?

The purpose of the APERS MONTHLY RECONCILIATION is to ensure accurate tracking of retirement contributions and to verify that all amounts owed to APERS are correct. It helps maintain the integrity of the retirement system and ensures that employees' retirement benefits are funded appropriately.

What information must be reported on APERS MONTHLY RECONCILIATION?

The APERS MONTHLY RECONCILIATION must report information such as total employee contributions, total employer contributions, total deductions, adjustments for previous errors, and detailed employee records including names, identification numbers, and contribution amounts for the reporting month.

Fill out your apers monthly reconciliation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Apers Monthly Reconciliation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.