Get the free NOTICE OF CIVIL PENALTIES DUE - cdss ca

Show details

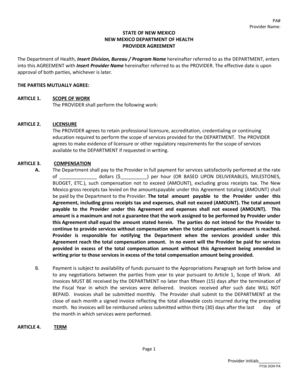

This document serves as a notification to facilities about civil penalties assessed for violations of the California Health and Safety Code, including details about payment and consequences for non-payment.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice of civil penalties

Edit your notice of civil penalties form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice of civil penalties form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit notice of civil penalties online

Follow the steps down below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit notice of civil penalties. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice of civil penalties

How to fill out NOTICE OF CIVIL PENALTIES DUE

01

Begin by obtaining the NOTICE OF CIVIL PENALTIES DUE form from the relevant authority.

02

Read the form carefully to understand the requirements and instructions.

03

Fill in your personal information at the top, including your name, address, and contact details.

04

Enter the relevant case or citation number associated with the penalties.

05

Provide details of the violations for which the penalties are assessed.

06

Indicate the amount of the civil penalties due.

07

Include any additional information or documentation as required by the form.

08

Review the completed form for accuracy and completeness.

09

Sign and date the form as required.

10

Submit the form according to the instructions, either by mail or online.

Who needs NOTICE OF CIVIL PENALTIES DUE?

01

Individuals or businesses that have received a notice for civil penalties from a governing authority.

02

Those who have been cited for violations of laws or regulations that carry financial penalties.

Fill

form

: Try Risk Free

People Also Ask about

What happens when you get a civil penalty?

Civil penalties usually only include civil fines or other financial payments as a remedy for damages. An action seeking a civil penalty can be brought by the government, or by a private party in the shoes of the government.

Why would the IRS charge a civil penalty?

Failure to comply with filing, reporting and payment requirements may result in civil penalties or, in some cases, criminal investigation. IRS's Collection function collects Federal taxes that have been reported or assessed but not paid and secures tax returns that have not been filed.

How serious is a civil penalty?

The civil fine is not considered to be a criminal punishment, because it is primarily sought in order to compensate the state for harm done to it, rather than to punish the wrongful conduct. As such, a civil penalty, in itself, will not carry a punishment of imprisonment or other legal penalties.

What is a civil penalty form?

IRS civil penalties are fees issued because of civil offenses, like failing to file your tax return on time or failing to pay the tax you owe. Six common civil penalties include: Penalty for underpayment of estimated tax. Failure to file/late filing penalty.

What is an example of a civil penalty?

An example of a civil penalty clause Here's how a civil penalty clause might appear in a legal agreement or regulation: “Any party found in violation of this agreement's terms shall be subject to a civil penalty of up to $10,000 for each violation.

What is a CivPen form?

IRC 6672 Civil Penalty Prior to being assessed to the Responsible Individual(s) of the delinquent business, this tax is often referred to simply as the Trust Fund. Once the TFRP is assessed to the individual(s), it is called a Civil Penalty. It is often abbreviated on IRS notices as CivPen.

What does civil penalty mean for IRS?

IRS civil penalties are fees issued because of civil offenses, like failing to file your tax return on time or failing to pay the tax you owe. Six common civil penalties include: Penalty for underpayment of estimated tax. Failure to file/late filing penalty. Failure to pay/late payment penalty.

What is a civil penalty on Good To Go?

If you fail to pay your toll within 80 days, you will be issued a notice of civil penalty for $40 for each unpaid toll. If a vehicle owner does not resolve a civil penalty within 20 days, the Department of Licensing may place a hold on the vehicle registration. $5 late fee for an unpaid bill.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NOTICE OF CIVIL PENALTIES DUE?

A NOTICE OF CIVIL PENALTIES DUE is a formal document that informs an individual or entity of the civil penalties that are owed due to violations of regulations or laws.

Who is required to file NOTICE OF CIVIL PENALTIES DUE?

Individuals or entities that have been assessed civil penalties for violations of laws, regulations, or rules are required to file a NOTICE OF CIVIL PENALTIES DUE.

How to fill out NOTICE OF CIVIL PENALTIES DUE?

To fill out a NOTICE OF CIVIL PENALTIES DUE, individuals must provide their contact information, details of the penalties being assessed, and any relevant case or violation numbers, along with any supporting documentation as required.

What is the purpose of NOTICE OF CIVIL PENALTIES DUE?

The purpose of a NOTICE OF CIVIL PENALTIES DUE is to formally notify the affected party of the penalties owed and to initiate the process for collection of those penalties.

What information must be reported on NOTICE OF CIVIL PENALTIES DUE?

The information that must be reported on a NOTICE OF CIVIL PENALTIES DUE includes the name and contact information of the violator, the type and amount of penalties owed, the date of the violation, and any associated case numbers.

Fill out your notice of civil penalties online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice Of Civil Penalties is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.