Get the free WAGES NOTICE REQUEST - edd ca

Show details

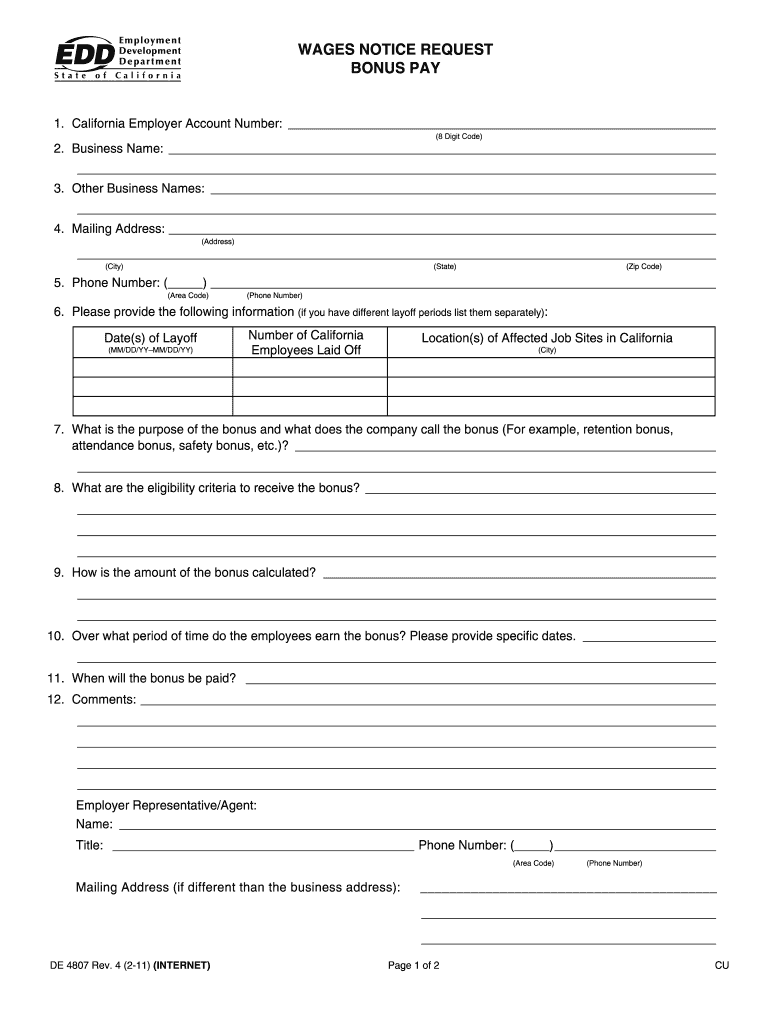

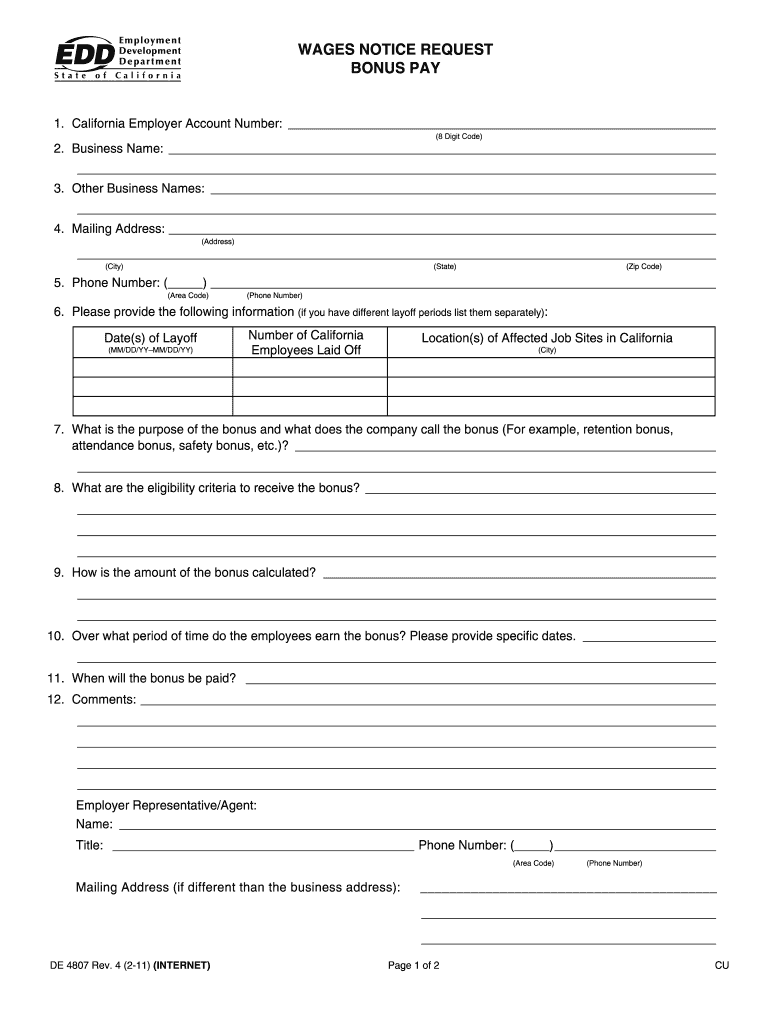

This document is a Wages Notice Request form designed for California employers to provide information about bonus payments and layoffs, assisting the Employment Development Department in determining

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wages notice request

Edit your wages notice request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wages notice request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wages notice request online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit wages notice request. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wages notice request

How to fill out WAGES NOTICE REQUEST

01

Gather necessary employee information including name, Social Security number, and employment dates.

02

Identify the specific wages or compensation for which you are requesting a notice.

03

Complete the WAGES NOTICE REQUEST form, ensuring all sections are filled out accurately.

04

Include any supporting documentation that may be required to process your request.

05

Review the completed form for any errors or missing information.

06

Submit the form to the appropriate payroll or human resources department.

Who needs WAGES NOTICE REQUEST?

01

Employees seeking clarification or details about their wages.

02

Employers who are required to provide wage notices to their employees.

03

Individuals involved in wage disputes or inquiries.

Fill

form

: Try Risk Free

People Also Ask about

Do employers need to respond to unemployment claims?

The determination means that they determined you probably earned too much that week and you didn't report it correctly or you didn't report it at all. What you need to do is figure out how much you earned at work during that week and if what they claim is not correct then show them.

What is a notice of wages used for unemployment insurance claim de 1545?

A: Workers have to receive the required notice containing specific information at the time of hire: (A) the rate or rates of pay and basis thereof, whether paid by the hour, shift, day, week, salary, piece, commission, or otherwise, including any rates for overtime, as applicable; (B) allowances, if any, claimed as

What is a wage notice?

Wage notice requirements are legal mandates issued by each state that detail the information an employer or payroll company is obligated to provide with an employee's pay statement. This information might include: Gross wages. List of itemized deductions.

What is a DE 1545 form?

What is a DE 1545? The DE 1545, Notice of Wages Used for Unemployment Insurance (UI) Claim, is sent to all employers who reported wages within the past 19 months for any employee who has filed a claim for UI benefits.

Does notice of unemployment insurance award mean I am approved to receive payments?

Once an employee has submitted an unemployment claim, the employer will receive notice of the claim and have a chance to respond. The state will likely reach out to the employee for further details on the claim, depending on the employer's response.

Does EDD actually contact your employer?

Notice of Wages Used For Unemployment Insurance Claim (DE 1545) This notice is sent to all base period employers, including the most recent one, after the first UI payment is made. It tells employers the percentage of benefits charged to their employer reserve account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is WAGES NOTICE REQUEST?

WAGES NOTICE REQUEST is a formal request submitted to report employee wages and related information to regulatory authorities.

Who is required to file WAGES NOTICE REQUEST?

Employers who have employees subject to wage reporting laws are required to file a WAGES NOTICE REQUEST.

How to fill out WAGES NOTICE REQUEST?

To fill out a WAGES NOTICE REQUEST, employers must provide employee details including names, Social Security numbers, wages earned, and any other required information as specified by the regulatory authority.

What is the purpose of WAGES NOTICE REQUEST?

The purpose of WAGES NOTICE REQUEST is to ensure compliance with wage reporting laws and to provide accurate information for tax and benefit calculations.

What information must be reported on WAGES NOTICE REQUEST?

Information that must be reported includes employee names, Social Security numbers, total wages paid, hours worked, and any deductions applicable.

Fill out your wages notice request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wages Notice Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.