Get the free SOC 822 - dss cahwnet

Show details

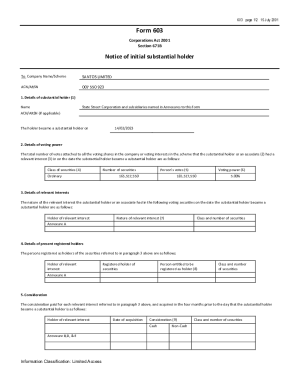

This document serves as a notification form for the inter-county transfer of participants in the Cash Assistance Program for Immigrants (CAPI) in California.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign soc 822 - dss

Edit your soc 822 - dss form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your soc 822 - dss form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing soc 822 - dss online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit soc 822 - dss. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out soc 822 - dss

How to fill out SOC 822

01

Gather all necessary personal information, including your name, address, and Social Security number.

02

Provide details about your employment or other relevant income sources.

03

Complete sections related to your household composition, including the number of people living with you.

04

Fill out the section concerning your assets and liabilities, including bank accounts and debts.

05

Review all entered information for accuracy before submission.

06

Submit the form through the specified method (online, mail, etc.) as outlined in the instructions.

Who needs SOC 822?

01

Individuals applying for social services or benefits that require income verification.

02

Anyone needing to report changes in their financial or household situation for assistance programs.

03

Applicants for certain government funding or aid programs that require completion of financial disclosure forms.

Fill

form

: Try Risk Free

People Also Ask about

What qualifies you for IHSS?

Fill out SOC 295 – “Application for In-Home Supportive Services”. The form is available in three languages. Submit the application to your county IHSS office.

What disqualifies you for IHSS?

Ineligibility Due to Criminal Background The IHSS program conducts background checks, which may result in disqualification if an applicant has: Been convicted of certain serious offenses, such as violent crimes or crimes against children. A history of abuse, neglect, or exploitation of vulnerable individuals.

What is an SOC 295 form for?

Common IHSS Application Procedure Fill out SOC 295 – “Application for In-Home Supportive Services”. The form is available in three languages. Submit the application to your county IHSS office.

Who fills out the IHSS form?

You (or your authorized representative) must complete PART A of this form to let the county know who you have chosen to provide your authorized services. If you have multiple providers, you must fill out a separate form for each person who will be providing authorized services for you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SOC 822?

SOC 822 is a reporting form used for the assessment of service and operational compliance related to certain financial transactions.

Who is required to file SOC 822?

Entities involved in specific financial operations or those that meet certain regulatory criteria are required to file SOC 822.

How to fill out SOC 822?

To fill out SOC 822, organizations must provide relevant information regarding their compliance processes, operational integrity, and any required financial data as per the guidelines.

What is the purpose of SOC 822?

The purpose of SOC 822 is to ensure transparency and accountability in financial reporting, helping regulators and stakeholders assess compliance and operational effectiveness.

What information must be reported on SOC 822?

SOC 822 must report specific information such as financial transaction details, compliance metrics, operational procedures, and any discrepancies noted during the assessment period.

Fill out your soc 822 - dss online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Soc 822 - Dss is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.