Get the free AB 32 Cost of Implementation Fee and Proposed Amendments to the Mandatory Reporting ...

Show details

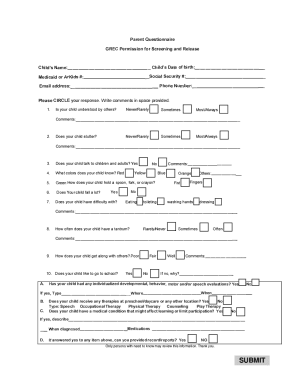

This document outlines the proposed regulations concerning the AB 32 Cost of Implementation Fee, including details on applicability, definitions, fee calculations, reporting requirements, and enforcement

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ab 32 cost of

Edit your ab 32 cost of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ab 32 cost of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ab 32 cost of online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ab 32 cost of. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ab 32 cost of

How to fill out AB 32 Cost of Implementation Fee and Proposed Amendments to the Mandatory Reporting of Greenhouse Gas Emissions Regulations

01

Review the AB 32 guidelines and prepare any necessary supporting documents.

02

Identify the applicable business operations subject to the cost of implementation fee.

03

Calculate the emissions and associated fees based on the reporting period.

04

Complete the AB 32 Cost of Implementation Fee form accurately, ensuring all required fields are filled.

05

Submit the completed form along with any required payments by the specified deadline.

Who needs AB 32 Cost of Implementation Fee and Proposed Amendments to the Mandatory Reporting of Greenhouse Gas Emissions Regulations?

01

Businesses and organizations that emit greenhouse gases and are subject to California's AB 32 regulations.

02

Entities seeking to comply with the Mandatory Reporting of Greenhouse Gas Emissions Regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is the ab 32 cost of implementation fee regulation?

The AB 32 Cost of Implementation Fee Regulation applies to Natural gas entities (gas utilities, pipeline owners and operators, and end users receiving natural gas from an interstate pipeline); Producers and importers of California gasoline, California Reformulated Gasoline Blendstock (CARBOB), and California diesel;

What is the California Assembly Bill 32?

AB 32 requires the California Air Resources Board (CARB or ARB) to create regulations and market mechanisms to reduce the state's greenhouse gas emissions to 1990 levels by 2020, a 30% statewide reduction, with mandatory caps beginning in 2012 for significant emissions sources.

What is the SB 32 greenhouse gas emissions Reduction Act?

SB-32 requires CARB to reduce greenhouse gas emissions to 40% below the 1990 levels by 2030. This bill gives CARB the authority to adopt regulations in order to achieve the maximum technology feasible to be the most cost-efficient way to reduce greenhouse gas emissions.

What are the implementation debates around AB 32?

The implementation debates around AB 32 highlighted conflicts over d) Regulatory Science vs. Local Knowledge. This issue underscores the tension between centralized regulatory approaches and the need for local context in developing climate policies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is AB 32 Cost of Implementation Fee and Proposed Amendments to the Mandatory Reporting of Greenhouse Gas Emissions Regulations?

AB 32, also known as the Global Warming Solutions Act of 2006, authorizes the California Air Resources Board to implement regulations to reduce greenhouse gas emissions. The Cost of Implementation Fee is a fee established to support the costs related to the implementation of the CAP and the proposed amendments seek to update the reporting requirements for greenhouse gas emissions.

Who is required to file AB 32 Cost of Implementation Fee and Proposed Amendments to the Mandatory Reporting of Greenhouse Gas Emissions Regulations?

Entities that are subject to California's greenhouse gas cap-and-trade regulations, as well as those that are required to report their greenhouse gas emissions under the mandatory reporting regulations, are required to file the AB 32 Cost of Implementation Fee.

How to fill out AB 32 Cost of Implementation Fee and Proposed Amendments to the Mandatory Reporting of Greenhouse Gas Emissions Regulations?

To fill out the filing, entities must provide accurate and complete data regarding their greenhouse gas emissions. This typically includes reporting their total emissions, calculating the associated fee based on their emissions levels, and submitting the necessary forms to the California Air Resources Board by the specified deadlines.

What is the purpose of AB 32 Cost of Implementation Fee and Proposed Amendments to the Mandatory Reporting of Greenhouse Gas Emissions Regulations?

The purpose of the AB 32 Cost of Implementation Fee and the proposed amendments is to ensure that California's greenhouse gas emissions are accurately quantified and reported. This helps to support the state's efforts in regulating emissions and implementing climate change policies effectively.

What information must be reported on AB 32 Cost of Implementation Fee and Proposed Amendments to the Mandatory Reporting of Greenhouse Gas Emissions Regulations?

The information that must be reported includes the total greenhouse gas emissions produced by the entity, calculations of emissions reductions, compliance data, and any relevant operational information required to assess compliance with the regulations.

Fill out your ab 32 cost of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ab 32 Cost Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.