Get the free GENERAL PREVAILING WAGE DETERMINATION MADE BY THE DIRECTOR OF INDUSTRIAL RELATIONS P...

Show details

This document outlines the prevailing wage determination for various crafts and classifications applicable to public works in California, detailing rates, classifications, and provisions for payment.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign general prevailing wage determination

Edit your general prevailing wage determination form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your general prevailing wage determination form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit general prevailing wage determination online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit general prevailing wage determination. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out general prevailing wage determination

How to fill out GENERAL PREVAILING WAGE DETERMINATION MADE BY THE DIRECTOR OF INDUSTRIAL RELATIONS PURSUANT TO CALIFORNIA LABOR CODE PART 7, CHAPTER 1, ARTICLE 2, SECTIONS 1770, 1773 AND 1773.1 FOR COMMERCIAL BUILDING, HIGHWAY, HEAVY CONSTRUCTION AND DREDGING PROJECTS

01

Obtain the General Prevailing Wage Determination form from the California Department of Industrial Relations website.

02

Review the current prevailing wage rates for the specific type of work (commercial building, highway, heavy construction, dredging) found in the form.

03

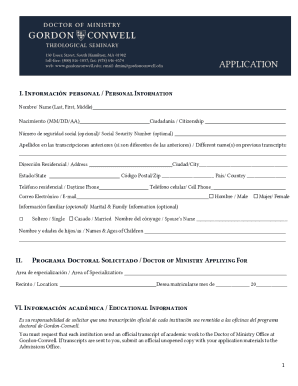

Fill out the form with the necessary information including project name, location, and type of work being performed.

04

Attach any necessary documentation or additional information required by the form, such as contractor details and the scope of work.

05

Submit the filled form to the Director of Industrial Relations along with any required fees or supporting documentation.

06

Wait for the response from the Director of Industrial Relations regarding the prevailing wage determination.

Who needs GENERAL PREVAILING WAGE DETERMINATION MADE BY THE DIRECTOR OF INDUSTRIAL RELATIONS PURSUANT TO CALIFORNIA LABOR CODE PART 7, CHAPTER 1, ARTICLE 2, SECTIONS 1770, 1773 AND 1773.1 FOR COMMERCIAL BUILDING, HIGHWAY, HEAVY CONSTRUCTION AND DREDGING PROJECTS?

01

Contractors bidding on public works projects that fall under the specified categories.

02

Subcontractors who need to comply with prevailing wage laws on public works projects.

03

Employers in the construction industry who must adhere to California Labor Code regulations.

04

Workers seeking protection under prevailing wage laws to ensure fair compensation.

Fill

form

: Try Risk Free

People Also Ask about

What is Section 1773 of the California Labor Code?

The body awarding any contract for public work, or otherwise undertaking any public work, shall obtain the general prevailing rate of per diem wages and the general prevailing rate for holiday and overtime work in the locality in which the public work is to be performed for each craft, classification, or type of worker

Who is exempt from prevailing wages in California?

How Are Prevailing Wages Determined? Employers can obtain this wage rate by submitting a request to the National Prevailing Wage Center (NPWC), or by accessing other legitimate sources of information such as the Online Wage Library, available for use in some programs.

What is the penalty for violating a pay statement in California?

Civil penalties from a pay stub violation amount to $50 for the initial pay period and $100 per employee for each violation in a subsequent pay period. The maximum award available to an employee is $4,000.

How do you prove prevailing wage?

When an employee is paid the prevailing wage, their travel time is paid at the same rate as their job requires. If an employer attempts to pay a per diem rate, they would be in violation of prevailing wage laws. Employees who travel straight from home to a job site do not qualify for travel pay.

What is the Labor Code 1773?

The body awarding any contract for public work, or otherwise undertaking any public work, shall obtain the general prevailing rate of per diem wages and the general prevailing rate for holiday and overtime work in the locality in which the public work is to be performed for each craft, classification, or type of worker

What is Section 1720 A )( 1 of the California Labor Code?

(1) Construction, alteration, demolition, installation, or repair work done under contract and paid for in whole or in part out of public funds, except work done directly by a public utility company pursuant to order of the Public Utilities Commission or other public authority.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is GENERAL PREVAILING WAGE DETERMINATION MADE BY THE DIRECTOR OF INDUSTRIAL RELATIONS PURSUANT TO CALIFORNIA LABOR CODE PART 7, CHAPTER 1, ARTICLE 2, SECTIONS 1770, 1773 AND 1773.1 FOR COMMERCIAL BUILDING, HIGHWAY, HEAVY CONSTRUCTION AND DREDGING PROJECTS?

The General Prevailing Wage Determination is a regulation that specifies the minimum wage rates that must be paid to workers on public works projects in California. It is established by the Director of Industrial Relations under specified sections of the California Labor Code, ensuring that workers receive fair wages based on the type of work and region.

Who is required to file GENERAL PREVAILING WAGE DETERMINATION MADE BY THE DIRECTOR OF INDUSTRIAL RELATIONS PURSUANT TO CALIFORNIA LABOR CODE PART 7, CHAPTER 1, ARTICLE 2, SECTIONS 1770, 1773 AND 1773.1 FOR COMMERCIAL BUILDING, HIGHWAY, HEAVY CONSTRUCTION AND DREDGING PROJECTS?

Employers engaged in public works construction projects, including general contractors and subcontractors, are required to file the General Prevailing Wage Determination. This includes any public agency that oversees these projects.

How to fill out GENERAL PREVAILING WAGE DETERMINATION MADE BY THE DIRECTOR OF INDUSTRIAL RELATIONS PURSUANT TO CALIFORNIA LABOR CODE PART 7, CHAPTER 1, ARTICLE 2, SECTIONS 1770, 1773 AND 1773.1 FOR COMMERCIAL BUILDING, HIGHWAY, HEAVY CONSTRUCTION AND DREDGING PROJECTS?

To fill out the General Prevailing Wage Determination, employers must provide detailed information about the project, including the type of work to be performed and the location. They should reference the applicable wage determinations and ensure compliance with reporting requirements to the Department of Industrial Relations.

What is the purpose of GENERAL PREVAILING WAGE DETERMINATION MADE BY THE DIRECTOR OF INDUSTRIAL RELATIONS PURSUANT TO CALIFORNIA LABOR CODE PART 7, CHAPTER 1, ARTICLE 2, SECTIONS 1770, 1773 AND 1773.1 FOR COMMERCIAL BUILDING, HIGHWAY, HEAVY CONSTRUCTION AND DREDGING PROJECTS?

The purpose of the General Prevailing Wage Determination is to establish fair labor standards and wage rates for workers involved in public works projects, thereby promoting economic justice and preventing the underbidding of contracts that can lead to poor working conditions.

What information must be reported on GENERAL PREVAILING WAGE DETERMINATION MADE BY THE DIRECTOR OF INDUSTRIAL RELATIONS PURSUANT TO CALIFORNIA LABOR CODE PART 7, CHAPTER 1, ARTICLE 2, SECTIONS 1770, 1773 AND 1773.1 FOR COMMERCIAL BUILDING, HIGHWAY, HEAVY CONSTRUCTION AND DREDGING PROJECTS?

Reported information must include the type of work, wage rates for each classification of worker, job site locations, and any applicable apprenticeship requirements. Additional details on the compliance with local ordinances or federal guidelines may also be included.

Fill out your general prevailing wage determination online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

General Prevailing Wage Determination is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.