Get the free raymond james beneficiary change form

Get, Create, Make and Sign raymond james beneficiary change

Editing raymond james beneficiary change online

Uncompromising security for your PDF editing and eSignature needs

How to fill out raymond james beneficiary change

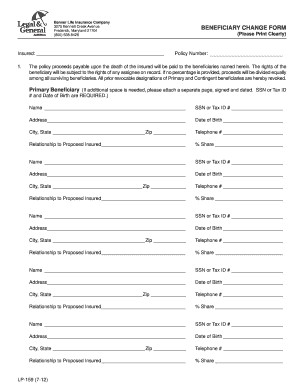

To fill out a Raymond James beneficiary change, follow these steps:

Who needs a Raymond James beneficiary change?

Video instructions and help with filling out and completing raymond james beneficiary change form

Instructions and Help about raymond james beneficiary change

Music if you have an IRA there's a lot of things that might be on your mind you might be thinking about how the investment portfolio is performing you might be concerned about how much risk you're taking or reexamining your investment objective there's a lot of things that go into IRAs but one thing that gets overlooked sometimes is the beneficiary designation portion of an IRA the beneficiary designation portion specifies who you want these funds to go to if something were to happen to you in this video we're going to discuss IRA beneficiary designations and what you need to know but first be sure to subscribe I want to make sure that you don't miss any of my future videos and your subscription to this channel really helps when you fill out an IRA beneficiary designation form there are several spots to fill in a person's information you want to make sure that you're paying attention to whether you're filling out the primary beneficiary designation or the contingent beneficiary designation the primary beneficiary designates who you want the funds to go to first think of it this way you put down a primary beneficiary you're telling the IRA custodian or your investment firm that that is the person that is first in line the contingent beneficiary is second in line after the primary beneficiary the reason why this is important is that it protects you in case something were to happen to a primary beneficiary if the primary beneficiary passes away before you the contingent beneficiary now moves in to the first spot in line and becomes the primary beneficiary before we go any further in this video we want to address why it's so important to designate a primary beneficiary for an IRA in the first place IRA s are powerful retirement savings tools they also allow you to pass your retirement funds to a beneficiary while avoiding the probate process well we don't have time in this video to discuss the probate process and why it's so important to avoid it we want to recognize that it is very important with IRAs to specify who you want your money to go to if you were to pass away if you don't your money will go through the probate process, and then you'll have people through the court system trying to make claims on your retirement funds now it is a very common process to go through, and I don't mean to alarm you that it's some kind of horrible process, but it can be very problematic so if you have the ability to do so it makes sense to specify designations on your IRAs naming minors as beneficiaries can be problematic minors aren't able to make their own investment in financial related decisions on their own courts will often appoint a custodian to handle those types of decisions until a child reaches the age of 18 if you have named minors as beneficiaries, and you pass away, and you haven't specified any other estate planning documents that indicate who the custodian should be for your minor children the courts will appoint one for you, and you may not like...

People Also Ask about

Do you need to fill out a beneficiary form?

Can you change beneficiary at any time?

Who has the authority to change the beneficiary?

How long does it take to change a beneficiary?

How do I fill out a beneficiary change form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify raymond james beneficiary change without leaving Google Drive?

How do I complete raymond james beneficiary change online?

How do I edit raymond james beneficiary change on an iOS device?

What is raymond james beneficiary change?

Who is required to file raymond james beneficiary change?

How to fill out raymond james beneficiary change?

What is the purpose of raymond james beneficiary change?

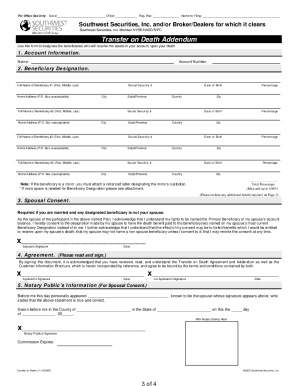

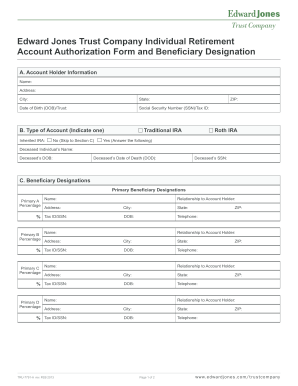

What information must be reported on raymond james beneficiary change?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.