Get the free Revised Audit Report - sco ca

Show details

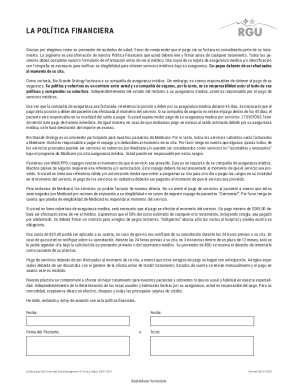

This document contains the revised audit report for the Riverside Unified School District regarding the Notification of Truancy Program, detailing the costs claimed, allowable and unallowable expenses,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revised audit report

Edit your revised audit report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revised audit report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing revised audit report online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit revised audit report. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out revised audit report

How to fill out Revised Audit Report

01

Begin by gathering all relevant financial data and documents.

02

Review the original audit findings and recommendations.

03

Prepare a clear outline of the revised audit report structure.

04

Fill in the executive summary with key changes and updates.

05

Update the findings section with any new information or corrections.

06

Adjust the recommendations section based on revised findings.

07

Include an updated conclusion reflecting the revised scope of the audit.

08

Ensure all data is accurate and cross-checked.

09

Format the report according to the required guidelines.

10

Review the document for clarity and cohesiveness before submission.

Who needs Revised Audit Report?

01

Auditing firms conducting follow-up audits.

02

Management teams that need to understand changes in the audit results.

03

Regulatory bodies requiring compliance documentation.

04

Stakeholders interested in updated financial practices.

05

Investors needing assurance on financial statements.

Fill

form

: Try Risk Free

People Also Ask about

What is the ISA 600 revised?

ISA 600 (Revised) introduces several changes that will reshape how auditors approach group audits. The standard places a stronger emphasis on assessing risks at both the group and component levels while improving communication and documentation.

What are the 5 C's of audit report writing?

As a guide for what details to include in the audit report, use the five “C's” of recording observations: criteria, condition, cause, consequence, and corrective action plans (or recommendations).

What is revised audit report?

A revision of the audit report may be warranted in several instances involving reasons such as apparent mistakes, wrong information about facts, subsequent discovery of facts existing at the date of the audit report, etc.

What is the penalty for a revised tax audit report?

An independent auditor may also be requested by his client to furnish additional copies of a previously issued report. Use of the original report date in a reissued report removes any implication that records, transactions, or events after that date have been examined or reviewed.

What are the 4 types of audit reports?

For non-compliance with section 44AB, you will be charged a penalty of 0.5% of total sales or turnover or gross receipts or Rs. 1.5 Lakh, whichever is less.

What is an audit report in English?

An audit report is a formal document that communicates an auditor's opinion (or probably your opinion, if you're reading this) on an organization's financial performance and concludes whether it complies with financial reporting regulations.

What is a revised audit report?

A revision of the audit report may be warranted in several instances involving reasons such as apparent mistakes, wrong information about facts, subsequent discovery of facts existing at the date of the audit report, etc.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Revised Audit Report?

A Revised Audit Report is a modified version of an initial audit report that incorporates corrections, amendments, or additional information that may have emerged after the original report was issued.

Who is required to file Revised Audit Report?

Entities or individuals who have previously submitted an audit report that needs adjustments or corrections are required to file a Revised Audit Report, typically if errors were found or new data was relevant.

How to fill out Revised Audit Report?

To fill out a Revised Audit Report, one should provide accurate corrections to the original report, update any relevant financial information, include all necessary disclosures, and ensure it is properly signed and dated.

What is the purpose of Revised Audit Report?

The purpose of a Revised Audit Report is to ensure the accuracy and reliability of the information provided in the original audit report, to maintain transparency, and to comply with regulatory standards.

What information must be reported on Revised Audit Report?

The Revised Audit Report must include the corrected financial statements, the reasons for the revisions, any new findings, and the signatures of authorized individuals confirming the accuracy of the updates.

Fill out your revised audit report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Revised Audit Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.