Get the free Order Revoking Investment Adviser Certificate - corp ca

Show details

This document outlines the order issued by the California Department of Corporations to revoke the investment adviser certificate of Easy Equity Management, L.P. due to violations associated with

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign order revoking investment adviser

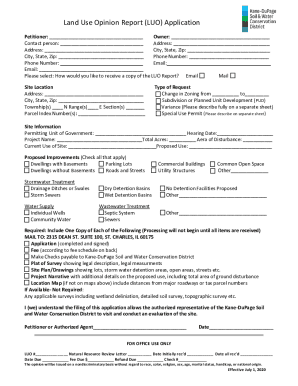

Edit your order revoking investment adviser form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your order revoking investment adviser form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit order revoking investment adviser online

Follow the steps down below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit order revoking investment adviser. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

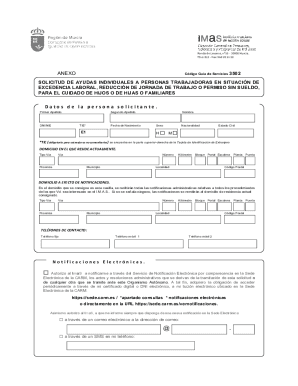

How to fill out order revoking investment adviser

How to fill out Order Revoking Investment Adviser Certificate

01

Obtain the Order Revoking Investment Adviser Certificate form from your applicable regulatory authority.

02

Fill in the basic information such as your name, business address, and contact details.

03

Provide the details of the investment adviser certificate you are revoking, including the certificate number.

04

State the reason for revocation clearly and concisely.

05

Include any supporting documentation as required by your regulatory authority.

06

Sign and date the form, ensuring all information provided is accurate and complete.

07

Submit the completed form along with any required fees to the appropriate office or regulatory body.

Who needs Order Revoking Investment Adviser Certificate?

01

Investment advisers who wish to cease their advisory business and formally revoke their certification.

02

Individuals or firms that no longer manage client assets or provide investment advice.

03

Investment professionals who need to comply with regulatory requirements in order to close their business.

Fill

form

: Try Risk Free

People Also Ask about

What is Section 260.236 of the California Code of Regulations?

Section 215 of the Advisers Act , which also predates Dodd-Frank, provides that: “(a) Any condition, stipulation, or provision binding any person to waive compliance with any provision of this title or with any rule, regulation, or order thereunder shall be void.

What are the changes to Rule 206 4 7?

What amendments did the Commission make to the Advisers Act compliance rule? The amendments to rule 206(4)-7 require that all advisers registered with the Commission, including those that do not advise private funds, document in writing the annual review of their compliance policies and procedures.

What are the requirements for Rule 206 4 7?

Rule 206(4)-7 requires each registered adviser to review its policies and procedures annually to determine their adequacy and the effectiveness of their implementation.

How much does it cost to file ADV?

10, § 260.236 - Qualifications of Investment Advisers and Investment Adviser Representatives. References to an investment adviser representative shall mean both an investment adviser representative and an associated person of an investment adviser, as those terms are defined in Section 25009.5(a) and (b) of the Code.

What is the Rule 206 4 7 of the Investment Advisers Act?

The application for an investment adviser certificate consists of Form ADV and additional documentation based on your responses to the questions in Form ADV. Form ADV (Parts 1 and 2) and the $125 application fee should be filed directly with the Investment Adviser Registration Depository (“IARD”).

What is Rule 206 4 of the investment adviser Act?

Rule 206(4)-4 under the Advisers Act requires all advisers to disclose certain material financial and disciplinary information to their clients, such as a financial condition of the adviser that is reasonably likely to impair the adviser's ability to meet its contractual commitments to clients, or any legal or

What is Rule 206 4 6 Advisers Act?

Under rule 206(4)-6, an investment adviser that exercises voting authority over clients' securities must adopt written proxy voting policies and procedures, describe the procedures to clients, make them available to clients upon request, and inform clients how they can obtain information about how their securities were

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

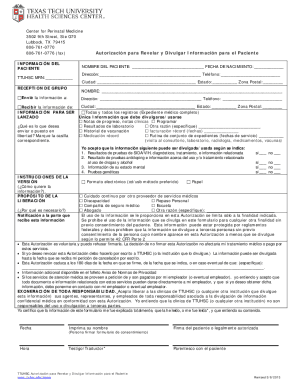

What is Order Revoking Investment Adviser Certificate?

Order Revoking Investment Adviser Certificate is a formal directive issued by regulatory authorities that cancels the registration of an investment adviser, often due to violations of laws or regulations.

Who is required to file Order Revoking Investment Adviser Certificate?

Investment advisers whose certificates have been suspended or whose registration is being revoked are required to file an Order Revoking Investment Adviser Certificate.

How to fill out Order Revoking Investment Adviser Certificate?

To fill out the Order Revoking Investment Adviser Certificate, follow the specific instructions provided by the regulatory authority, ensuring all required fields such as the adviser’s name, registration number, and reason for revocation are included.

What is the purpose of Order Revoking Investment Adviser Certificate?

The purpose of the Order Revoking Investment Adviser Certificate is to officially notify the public and relevant parties that an investment adviser's ability to operate has been terminated, often for compliance failures.

What information must be reported on Order Revoking Investment Adviser Certificate?

The Order Revoking Investment Adviser Certificate must report information including the adviser’s name, registration details, the basis for revocation, and any pertinent findings or violations.

Fill out your order revoking investment adviser online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Order Revoking Investment Adviser is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.