Get the free BOE-401 - boe ca

Show details

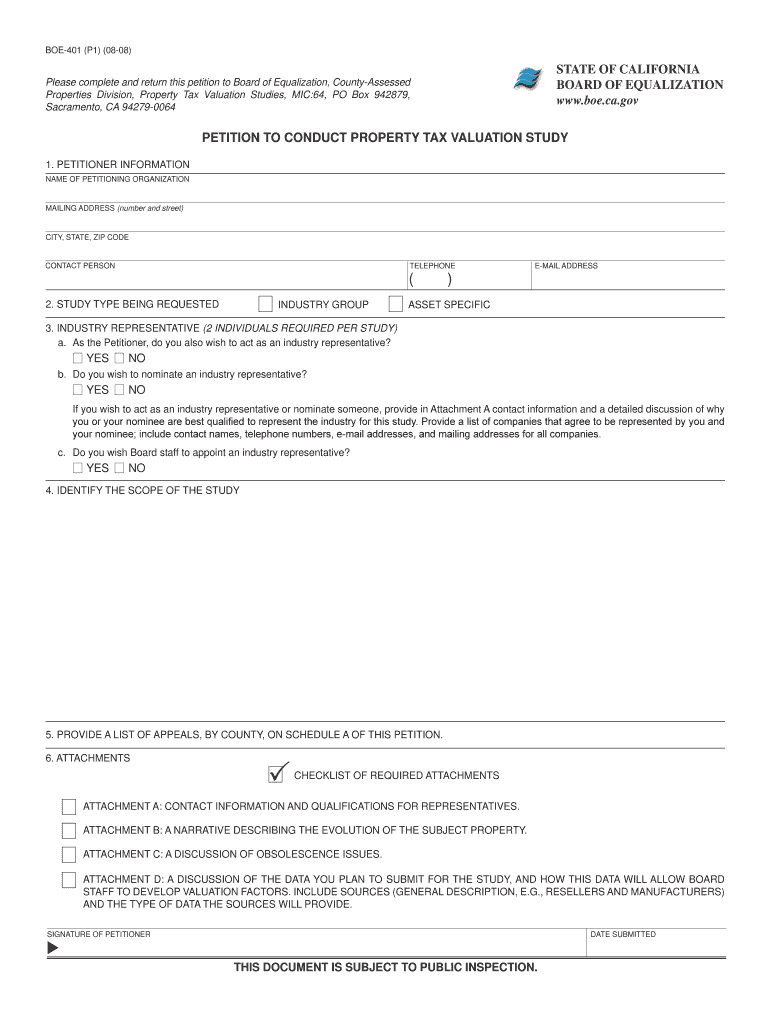

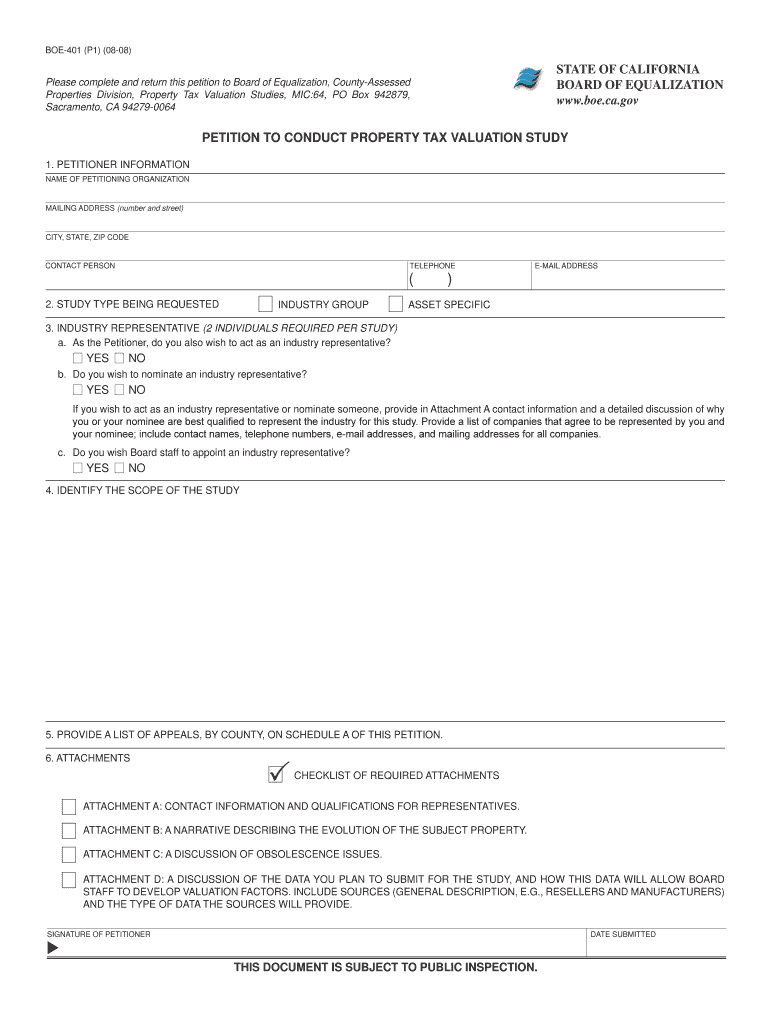

This document serves as a petition for conducting a property tax valuation study in California, providing necessary information about the petitioner, industry representatives, the scope of the study,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign boe-401 - boe ca

Edit your boe-401 - boe ca form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your boe-401 - boe ca form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing boe-401 - boe ca online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit boe-401 - boe ca. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out boe-401 - boe ca

How to fill out BOE-401

01

Obtain a copy of the BOE-401 form from the California State Board of Equalization's website or an authorized office.

02

Fill in the taxpayer's name, address, and account number at the top of the form.

03

Select the type of tax you are reporting by checking the appropriate box.

04

Report your total taxable sales or receipts in the designated section.

05

Calculate the tax due by applying the appropriate tax rate to your taxable sales.

06

Include any applicable deductions or exemptions in the specified area.

07

Complete any additional sections as required, such as reporting any credits or adjustments.

08

Double-check all calculations and ensure all information is accurate.

09

Sign and date the form to certify that the information provided is true and correct.

10

Submit the completed BOE-401 form by the due date, either by mail or electronically as instructed.

Who needs BOE-401?

01

Businesses and individuals who are required to report sales and use tax in California.

02

Taxpayers registered with the California State Board of Equalization for sales tax purposes.

03

Anyone who operates a business that sells tangible personal property in California.

Fill

form

: Try Risk Free

People Also Ask about

How to pay tax voucher online?

How to Pay IRS 1040-V Online? Pay Using IRS Direct Pay. IRS Direct Pay is a free and secure way to pay directly from your bank account, avoiding the need to mail a check or money order payable to the United States Treasury. Pay by Debit or Credit Card. Pay Using the Electronic Federal Tax Payment System (EFTPS)

How do I print a payment voucher in QuickBooks?

How do I print a voucher in QuickBooks? From the left menu, select Expenses. On the Expenses tab, select Print Checks. Select the check you'll need to print, then click the Print setup tab. Under the Select the type of checks you use section, choose Voucher. Once done, click the Yes, I'm finished with setup tab.

How do I request a payment plan from CDTFA?

To submit your request, on the Online Services Login page, under the Payments section, select Request a Payment Plan to begin your request. You will be prompted to enter the 10-digit Letter ID and the amount due shown on the Statement of Account or Payment Voucher. Visit our online services log in page to get started.

Who must file a California sales tax return?

Most retailers, even some occasional sellers of tangible goods, are required to register to collect sales or use tax in California. CDTFA issues seller's permits to business owners and allows them to collect tax from customers, file returns, and pay sales taxes to the state.

What is the form CDTFA 146 res?

CDTFA-146-RES, Exemption Certificate and Statement of Delivery in Indian Country, is used to document exempt sales of property, vehicles, vessels, and aircraft for delivery on a reservation to a Native American purchaser.

What purchases are subject to California use tax?

What items are subject to use tax. Generally, if the item would have been taxable if purchased from a California retailer, it is subject to use tax. For example, purchases of clothing, appliances, toys, books, furniture, or CDs would be subject to use tax.

How to print a payment voucher from CDTFA?

Prepayment vouchers can also be printed through our online services system by clicking the “Make a Payment” button on our Online Services Login Page, then choosing “Print a Prepayment Voucher.” We will process your check the same day it is received.

How do I print my sellers permit from CDTFA?

How do I print a seller's permit? Visit the CDTFA's Online Services page and log in to your online services profile using your username and password. Select the appropriate account. Select the Locations tab. Click the Print Permit button. Select the location to print. Click the Print button.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is BOE-401?

BOE-401 is the California Sales and Use Tax Return form used by businesses to report sales and use tax transactions.

Who is required to file BOE-401?

Businesses that have a sales tax permit and have taxable sales or use tax liabilities in California must file BOE-401.

How to fill out BOE-401?

BOE-401 can be filled out by entering total sales, taxable sales, and any deductions, along with the applicable tax rate to calculate the tax due.

What is the purpose of BOE-401?

The purpose of BOE-401 is to collect sales and use tax from businesses and ensure compliance with California tax laws.

What information must be reported on BOE-401?

Information that must be reported on BOE-401 includes total sales, taxable sales, deductions, and the amount of sales and use tax owed.

Fill out your boe-401 - boe ca online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Boe-401 - Boe Ca is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.