Get the free BOE-514-DI (12-10) - boe ca

Show details

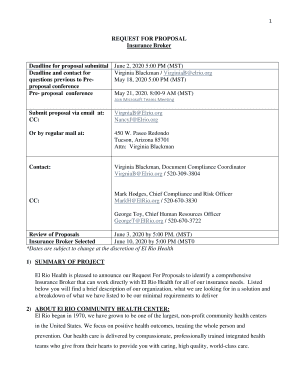

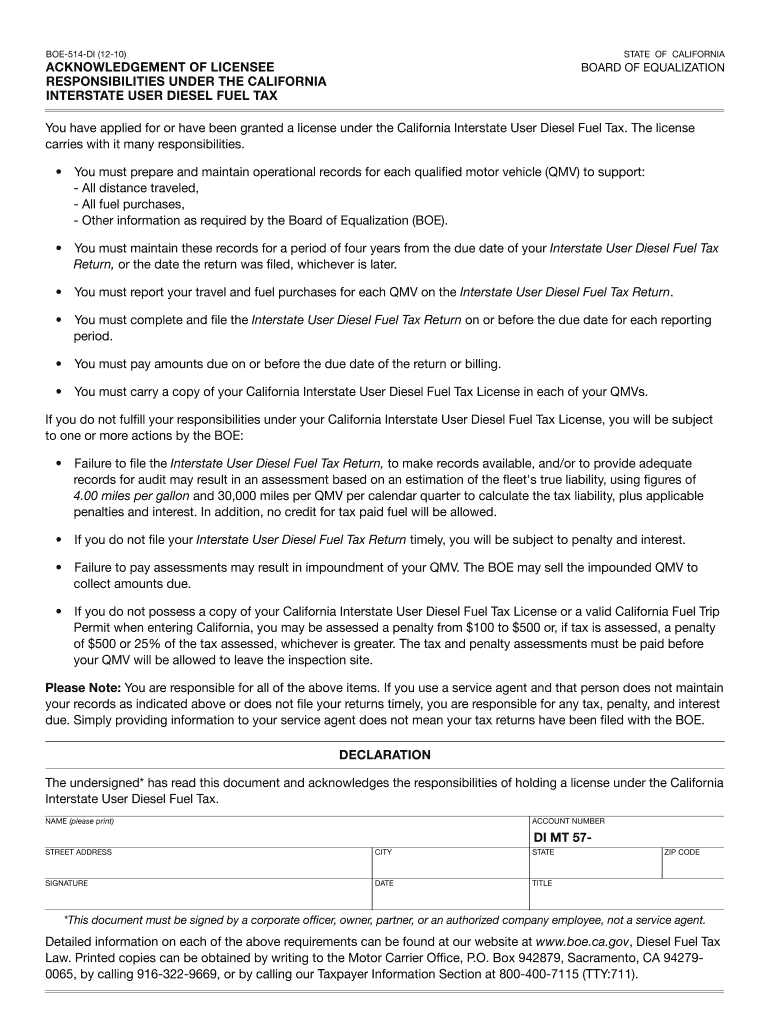

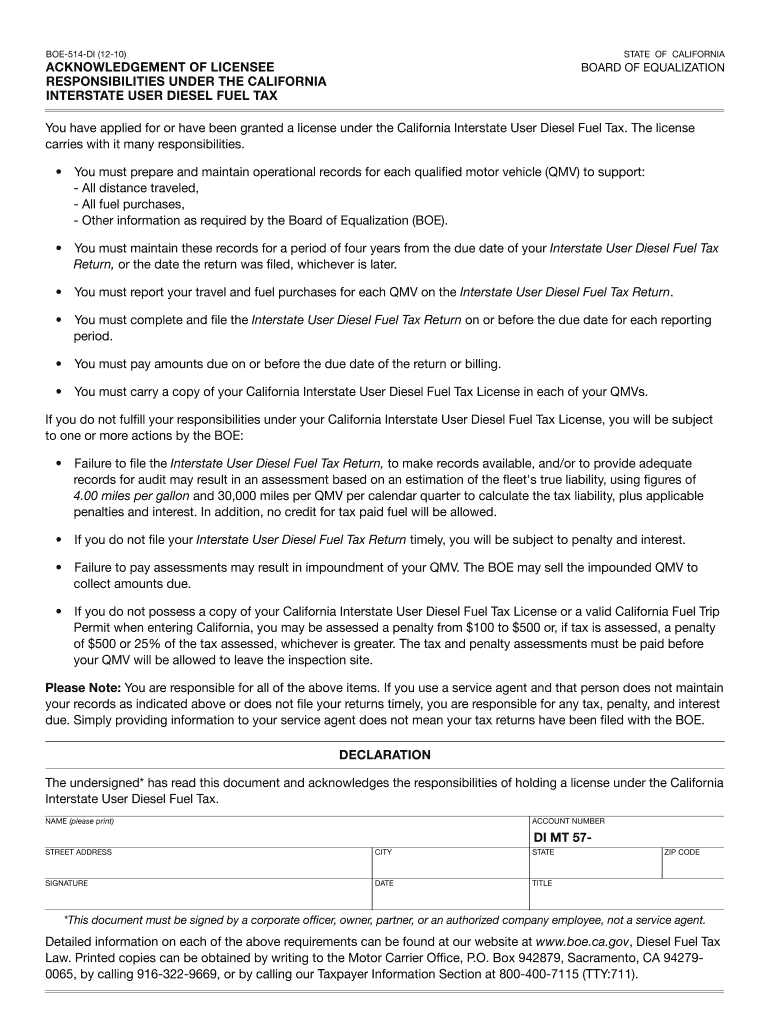

This document outlines the responsibilities and requirements of individuals or entities licensed under the California Interstate User Diesel Fuel Tax.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign boe-514-di 12-10 - boe

Edit your boe-514-di 12-10 - boe form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your boe-514-di 12-10 - boe form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit boe-514-di 12-10 - boe online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit boe-514-di 12-10 - boe. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out boe-514-di 12-10 - boe

How to fill out BOE-514-DI (12-10)

01

Download the BOE-514-DI (12-10) form from the California Department of Tax and Fee Administration website.

02

Fill out your personal information, including your name, address, and contact number at the top of the form.

03

Indicate the tax period for which you are filing the declaration.

04

Provide the details related to your business, including your seller's permit number and the type of business you operate.

05

Complete the sales and use tax information section as required.

06

Sign and date the form at the bottom to certify that the information provided is accurate.

07

Submit the completed form to the relevant tax authority by the specified deadline.

Who needs BOE-514-DI (12-10)?

01

Businesses and individuals who are engaged in selling tangible goods in California.

02

Taxpayers who need to report sales and use tax information for the specific period.

03

Individuals or businesses that are required to pay taxes on purchased goods.

Fill

form

: Try Risk Free

People Also Ask about

What is Romans 12:10 in marriage?

10 Love one another with brotherly affection. Outdo one another in showing honor. 10 Love each other with genuine affection, and take delight in honoring each other.

What does Romans Chapter 12 verse 10 mean?

They should go before each other in giving honour, and showing respect, as the word (prohgoumenov) , signifies: they should set each other an example; and which also may be taken into the sense of the word, should prevent one another, not waiting until respect is shown on one side to return it again.

What does "devoted" mean in Romans 12:10?

Some translations say, “Be devoted to one another in brotherly love” or “with genuine affection.” The bottom line is that we are called to a deep, caring love for others--toward fellow Christians, in particular. The word devoted here can also mean constant, loyal, or faithful.

Where in the Bible does it say love one another with brotherly affection?

Romans 12:10 ESV Love one another with brotherly affection. Outdo one another in showing honor.

What does honor mean in Romans 12:10?

Honor is an important concept in the scriptures. Honor means to estimate with value, recognition, and show appreciation. The command, therefore, is that we would show genuine appreciation and admiration for others.

What kind of love is Romans 12:10?

We must love each other with a brotherly affection. The Greek word used here inspired the name of a city in the United States: Philadelphia, self-described as the city of brotherly love. Those in Christ are truly brothers and sisters. God adopts us as His children, welcoming us into His family.

How do you apply Romans 12 10 to marriage?

So, Romans 12:9-10 reads: Let love be genuine; hate what is evil, hold fast to what is good; love one another with mutual affection; outdo one another in showing honor. Do not lag in zeal, be ardent in spirit, serve the Lord. This communicates a lot about what I hope for a couple.

What is Paul saying in Romans 12:10?

He writes: “Be devoted to one another in brotherly love; give preference to one another in honor, not lagging in diligence, fervent in spirit, serving the Lord.” The element of emotion in being fervent stands out. In this verse, Paul gives part of his commentary on the gifts of the Spirit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is BOE-514-DI (12-10)?

BOE-514-DI (12-10) is a form used by businesses in California to report their use tax liability for the specific period covered by the form.

Who is required to file BOE-514-DI (12-10)?

Businesses and individuals who are responsible for paying use tax in California on purchases made from out-of-state sellers are required to file BOE-514-DI (12-10).

How to fill out BOE-514-DI (12-10)?

To fill out BOE-514-DI (12-10), obtain the form from the California Department of Tax and Fee Administration (CDTFA) website, provide the requested information regarding purchases, calculate the use tax, and submit the form by the specified deadline.

What is the purpose of BOE-514-DI (12-10)?

The purpose of BOE-514-DI (12-10) is to facilitate the reporting and payment of use tax owed by California residents and businesses on out-of-state purchases.

What information must be reported on BOE-514-DI (12-10)?

The information required includes details about the purchaser, vendor information, date of purchase, items purchased, and the calculated amount of use tax due.

Fill out your boe-514-di 12-10 - boe online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Boe-514-Di 12-10 - Boe is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.